There’s still time for corporates to benefit from federal tax credits and reap attractive returns.

The final session of NeuGroup’s final H1 meeting featured a presentation on green and sustainability-linked finance by U.S. Bank, sponsor of the NeuGroup for Retail Treasury. Below are some key takeaways from the session as distilled by Joseph Neu, founder of NeuGroup and leader of the retail group.

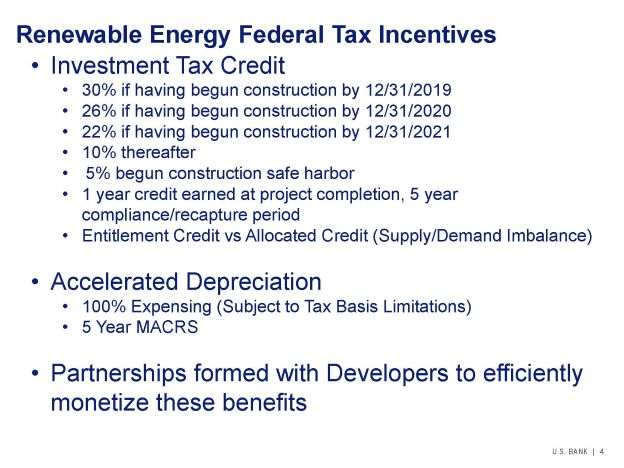

- Update your view on the ROI of tax equity structures. Commenting on the cash flows from a transaction presented by U.S. Bank, one member noted that they looked more sizable than he remembered when looking into tax equity structures several years ago. This shows how the economics have improved significantly with the greater investment tax credit available, so it pays to do the math again if you have not looked at these in a while. Members confirmed that the immediate (end of year one) tax credit payback and subsequent operational cash flows make it relatively easy to meet your hurdle and do something good with renewable energy (mainly solar) tax equity investments.

- It helps to work with a bank/broker with balance sheet. If you have your own source of funding it is easier to control the transaction while lining up investors and keeping the contractor and project moving. One member noted having a transaction fail with a broker that did not have its own funding and lost control of the project.

- Investors needed. U.S. Bank says that there are multiples more projects needing financing than current investors in tax equity structures, so it’s a bit of an investor’s market. Also, even if the tax credits on offer though 2023 are not renewed, there is still ample time to get on board—and there is good likelihood that they will be.

- PPAs and VPPAs. Power purchase agreements (PPAs) and virtual PPAs are also a way to support renewable energy, but come with a bit more risk due to potential price fluctuations and the need to actually use the energy procured or the counterparty risk with the VPPA. Tax equity structures tend to have a first loss guarantee by the bank to cushion performance risk.

- Do you have enough use of proceeds to issue in benchmark size? When the discussion turned to green bonds, the first question was to look at your use of proceeds, including with three or more-year look backs, to see if you can justify a benchmark size issuance of $500 million or more.

- If yes, then consider the fees/real asset economics. The second question asked was to what extent a green issuance can be justified based on the cost of issuance and pricing. All things point to the answer being yes— you can see a three to four basis point advantage to green bonds, as appetite by ESG investors and normal fixed income investors for ESG-friendly bonds is strong and growing stronger.

- The only way to prove it without extrapolation of different tranches (green and non-green) issued at once by an issuer or by backing out the new issue premium differential from how green bonds trade in the secondary markets is for someone to issue a 10-year green bond and 10-year non-green bond of the same amount simultaneously.

- One member said he would do that if bank underwriting fees were discounted to help him do it. These fees can be a bit higher because there is a bit more work on the part of the bank underwriter. There are also specialty accounting/audit fees to consider and those of a specialty ESG rater.