One company has fewer than 10 banks in its revolving credit facility while the other has more than two dozen.

How many banks does a corporation need or want in its revolving credit facility? The answer, no surprise, is that it depends on the company, a point driven home at a recent meeting of NeuGroup for Mega-Cap Assistant Treasurers.

- During the session, two members discussed how they arrived at very different answers based on the particulars of their companies.

Less is more. For one company, the answer is fewer than 10 banks, with each committing the same amount of capital. It’s a five-year revolver that is in excess of $3 billon.

- This structure came about after extensive analysis and discussion at the company following a strategic acquisition that left it with about two dozen banks combined, which it reduced by about 30% initially.

- Later, the question arose in treasury, “how few [banks] could we have and support the business we operate,” the member said. It also needed to know the approximate revenue each bank would need to earn on an annual basis to achieve its return targets, and whether the company’s recurring business would generate sufficient fee revenue for its banking partners over time.

- The company first and foremost wanted to ensure it had a bank group that could provide investment and commercial banking services on a global basis. The results have been good, with the company being more able to award additional business and shift ongoing business based on value-added ideas and execution expertise.

Benefits from bigger. The second company has roughly three times the number of banks in its revolver as the first (but fewer than 30), with four tiers of commitment amounts. The revolver is less than $10 billion in total across one-year, four-year and five-year tranches.

- This long-established structure provides ample liquidity to support the credit rating and commercial paper program related to its captive finance company which has $50 billion in assets. Some of the banks in this facility have relationships with the company spanning multiple decades.

- For this member, whose company has a strong risk management culture, the banks provide a wide range of services including medium-term notes, commercial paper, asset-backed securities, foreign exchange, interest rate derivatives and cash management.

- Like the other member, this company keeps close track of fees paid to its banks.

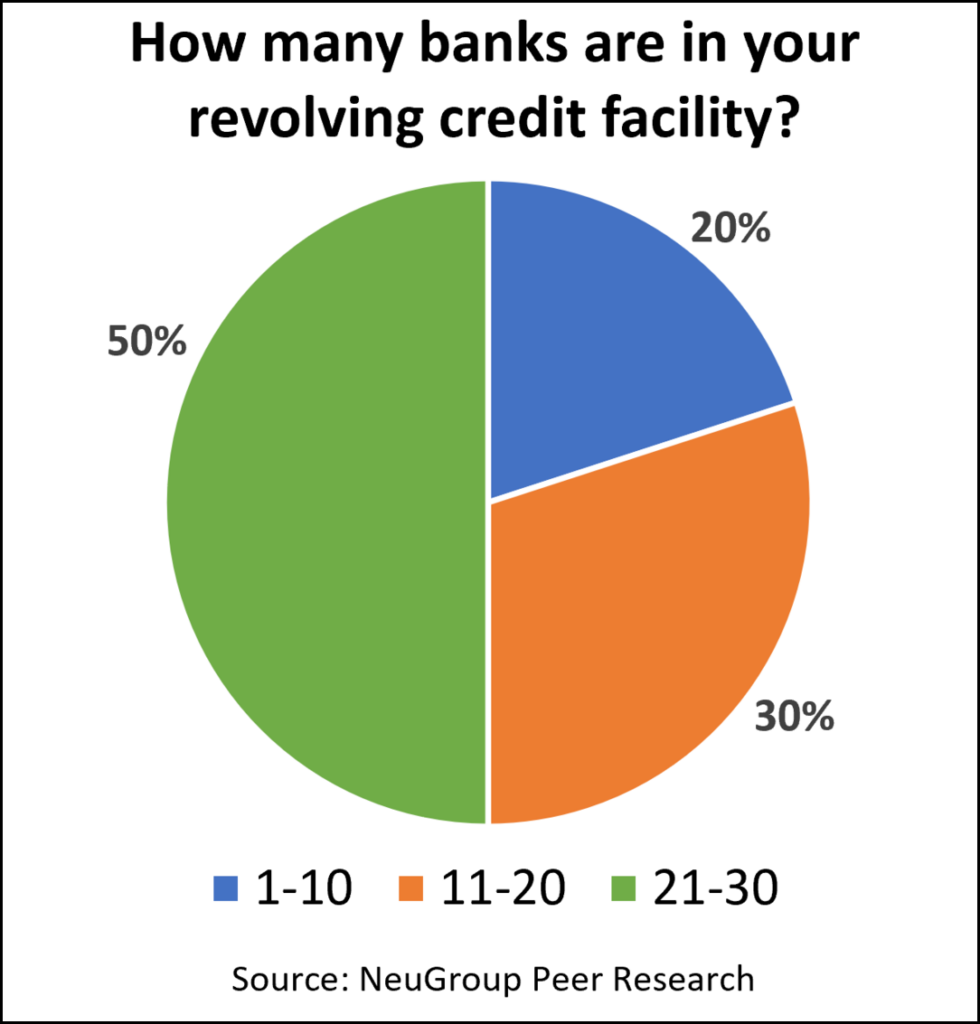

Big Picture. A poll during the session (see chart) revealed the member with fewer than 10 banks is in the minority of the corporates at the meeting. As the chart below shows, 20% have 10 or fewer banks in their revolvers, 30% have between 11 and 20 banks, and half have between 21 and 30.

- In terms of dollar amount, the poll showed that half the group have revolvers between $3 billon and $5 billion; another 30% have revolvers between $1 billion and $3 billion.

- Both members and other ATs who joined the discussion noted that the number of banks in a revolver means committing time and attention to coverage efforts by the bank group. Also, most members said the trend was to have fewer as opposed to more banks in their revolvers relative to where they are now.