Many treasuries have grown complacent about cash levels, but concerns about a recession are triggering a renewed focus on optimizing the management of working capital.

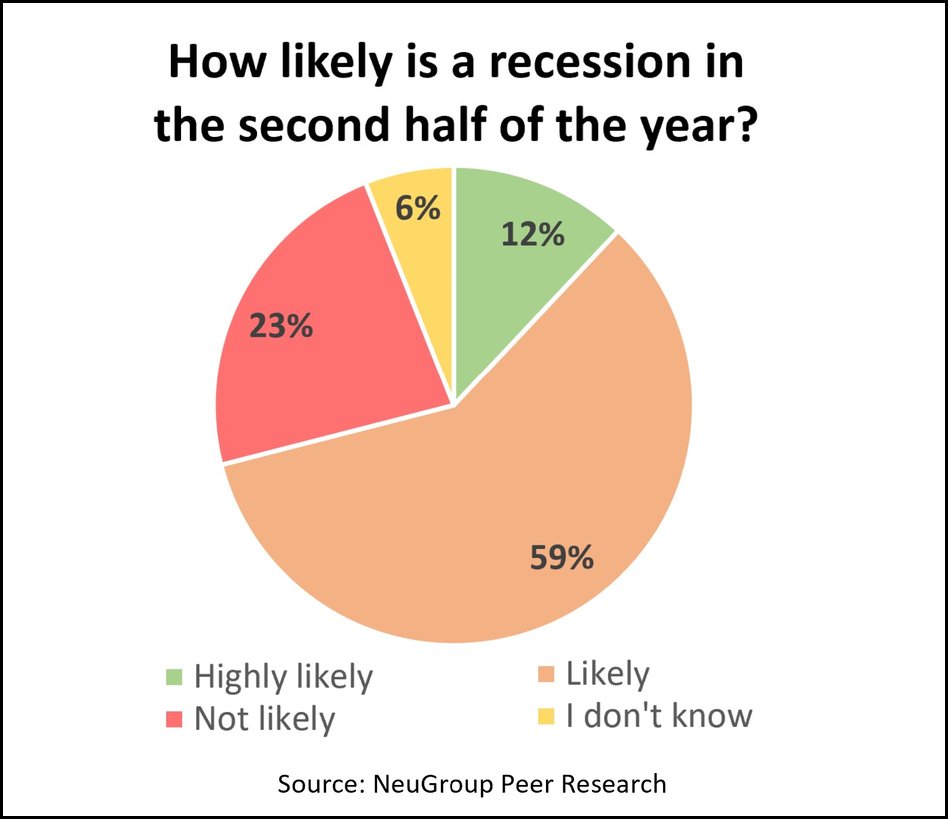

The debate about whether the US economy is headed into a recession because of higher interest rates and the Fed reducing its balance sheet is heating up. While some economists are bullish, many corporate treasuries are not: In a poll last week, 71% of members of NeuGroup for Global Cash and Banking said a recession is likely or highly likely in the second half of this year (see chart.)

This sentiment was echoed in a NeuGroup Peer Research survey, Going Out the Curve: Benchmarking Investment Strategies. In follow-up conversations with respondents, NeuGroup found that not only are companies rolling off longer duration assets, but some are reallocating strategic cash into their operational and reserve cash “buckets.”

- “Because this cash is so short-term, we are pulling money out of externally managed portfolios,” one NeuGroup for Cash Investment member explained. “We feel we have the expertise to manage this cash internally.”

- In addition, NeuGroup has observed a growing interest among cash investment managers in investing in money market funds (MMFs) and setting up connectivity with MMF portals to facilitate the process.

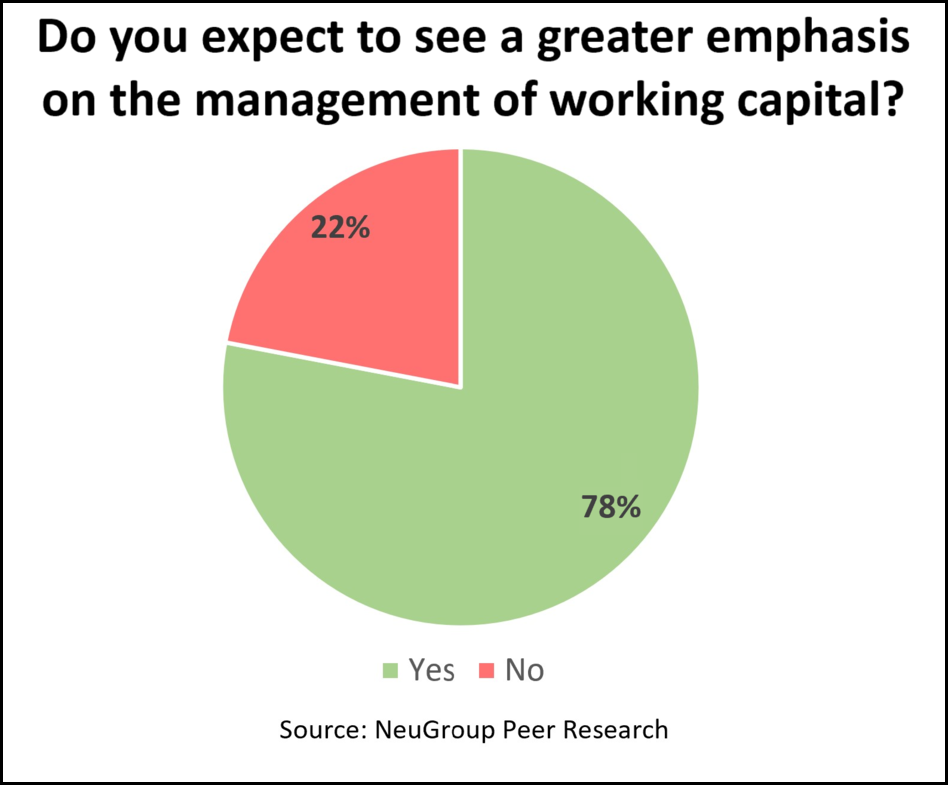

Return to discipline. Significant corporate expectations of higher rates and a recession later this year is—or should be—a red flag for treasuries, especially at companies that issued or refinanced debt in the past few years. That’s because lower earnings can deplete liquidity buffers, and higher rates would make additional borrowing more expensive. That’s why 78% of participants in the global cash and banking group poll said they expect greater emphasis on working capital (see chart).

In NeuGroup’s 2022 Member Agenda Survey earlier this year, working capital ranked fourth in the list of priorities, after business partnering, capital structure and digital transformation. If we asked members now, would the survey results be different? To find out, we asked this very question during a research-debrief session at the H1 semi-annual meeting of the NeuGroup for Mid-Cap Treasurers.

- “Working capital would rank higher,” one of the members said. At his company, optimization of working capital is now a big focus area for treasury.

Getting closer to the sources of cash. At the same mid-cap treasurers meeting, members reported that their role, and treasury’s scope, are expanding rapidly, e.g., to include credit cards, AP and parts or all of FP&A. On one side, the broader role is stretching some members’ capacity; however, on the other, it is elevating treasury’s profile and increasing engagement with the business.

- Managing working capital requires getting into the weeds of incoming and outgoing cash by looking at customer-to-cash metrics such as days sales outstanding (DSO) and days payable outstanding (DPO) and the health of the AR portfolio. These metrics are important in two ways:

- They allow treasury to get involved in managing customer credit and payment terms, e.g., come up with strategies to hasten collections and delay payments, calculate the cash impact of offering early-payment discounts, etc.

- Also, the closer treasury is to cash, the more accurate its cash forecast, which takes on greater urgency during times of tight liquidity. For example, a deeper dive provides visibility to DSOs and thus a slowdown in incoming cash, which can be built into hedging ratios and duration.