An FX risk manager faces hedging and forecasting challenges amid changes made in response to BEPS regulations.

It’s no surprise that the 15-point action plan announced by the OECD in 2015 to address base erosion and profit shifting (BEPS) would create various headaches for finance teams at multinational corporations.

- But a member presentation at a recent meeting of NeuGroup FX risk managers provided a fuller picture of some specific challenges facing companies as they comply with the new regulations.

- At issue for the member: Transfer pricing and the ripple effects on hedging and forecasting following a necessary entity restructuring.

Transfer pricing dynamics. At one end of the spectrum is the relatively straightforward setting of interest rates on intercompany loans: They must be priced as if the two entities are independent, operating at arm’s length.

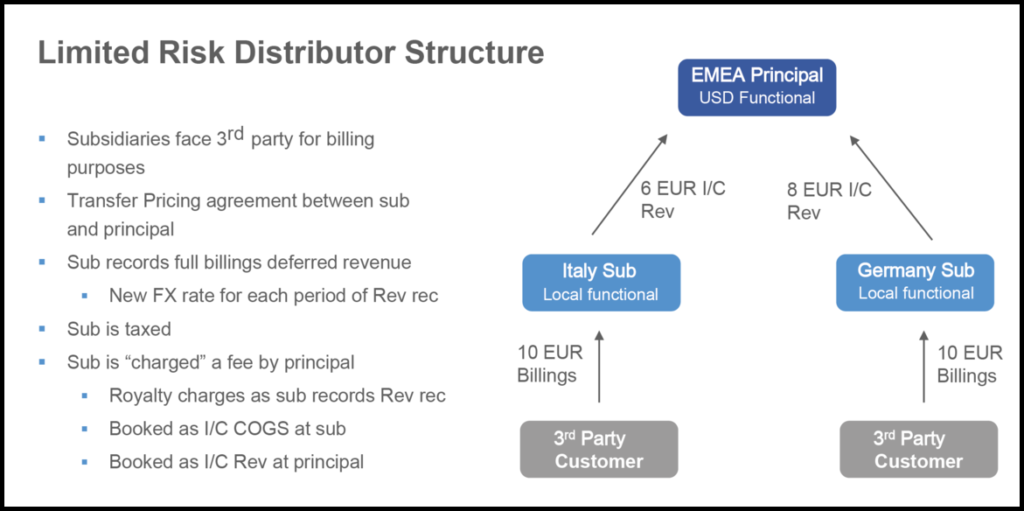

- At the other end, the member described a much larger undertaking: Changing from a so-called commissionaire business entity structure to a buy-sell or limited risk distributorships (LRD) structure.

- The member gave an overview of the change so far and what it has meant to the management of FX risk.

- The short version: It went from relatively simple and convenient to more complex and cumbersome.

Before: simplicity. In a commissionaire structure, a foreign subsidiary faces the third party (customer) for billing purposes, but really acts as a pass-through for the transfer of foreign billings to the principal, which is an entity in a low-tax jurisdiction.

- The subsidiary gets a commission on the billings but the structure is designed to minimize gains and consequently taxes in countries in which its products are sold.

- The principal records the full amount of the billings as deferred revenue, which enables the company to hedge the revenue and lock in one FX rate for the entire period of the deferred revenue.

- For example, an annual contract will have the revenue recognized monthly over the whole period.

- This makes it simple to hedge the exposure at one time at the principal entity level; one FX rate applies to the entire contract period, and it’s smooth and easy to forecast USD revenues (a key performance metric) for the principal entity.

After: forecasting complexity. In the LRD structure, a taxable local-currency functional subsidiary is now the seller to the third-party customer. The billed amount is booked as deferred revenue at the subsidiary level instead, and local currency-denominated royalties are intercompany cost of goods sold (COGS) for the sub (see graphic).

- For the principal, the forecasted intercompany royalty revenues in foreign currency—also recognized monthly—is now the recognizable exposure that can be hedged, using third-party transactions as proxy for hedge designation.

- To hedge, treasury uses monthly layered cash-flow hedging with forwards, resulting in a smoothing effect from the different effective FX rates; but the monthly revenue recognition still means a new FX rate for each of the periods in the contract period, making for a nightmare to forecast the key performance measures for management.

- That’s a problem because some of the most important management KPIs for the member’s company are revenues and free cash flows on a USD basis, making the ability to forecast them crucial. “Fun times,” the member joked.

- Overall objectives for the conversion project include minimizing FX risk from foreign billings and revenues, protecting foreign cash flows and maintain hedge accounting.

Starting small. The company started in Asia Pacific, which represents a relatively smaller part of overall revenues, before moving on to EMEA, which represents the vast majority of global turnover. “It will become much more material as we convert more entities,” the member said.

Is there a deadline? The deadline for conversion may vary based on requirements by the different tax authorities and jurisdictions. Having a plan and being seen as making the required changes matter, so there are opportunities for deadline extensions on a case-by-case basis.

- If you don’t have agreement with local tax authorities on your conversion timeline, you risk owing the taxes, so you want to convert or get out of higher-tax jurisdictions sooner than later.