Few corporate investment managers plan to make meaningful changes to their cash investment strategies, despite an unexpectedly hawkish Fed and continued war in Ukraine.

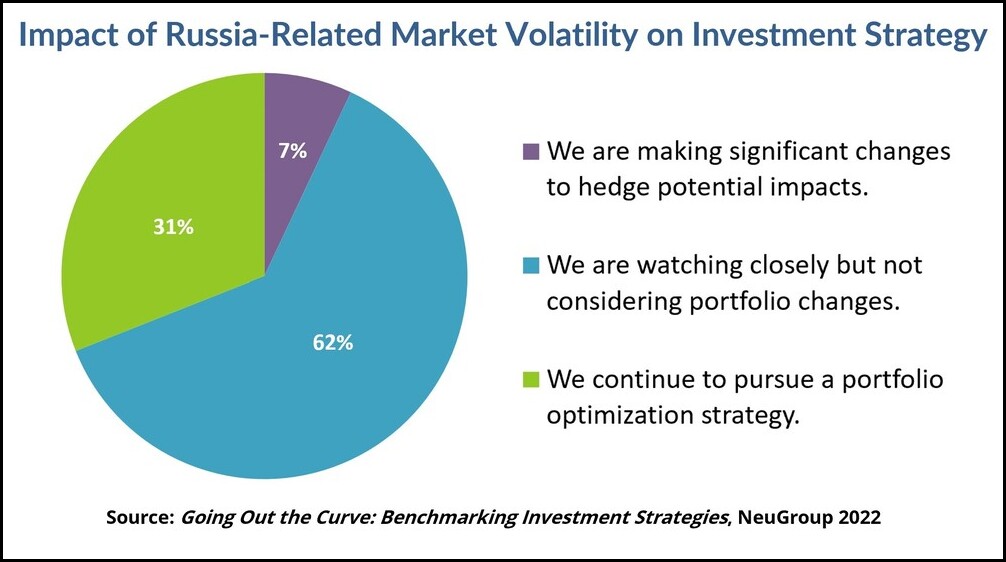

A just-completed NeuGroup survey sponsored by Clearwater Analytics, Going Out the Curve: Benchmarking Investment Strategies, reveals most corporate investment managers have made no significant changes to their portfolios in response to recent market shocks. As the chart below shows, only 7% of respondents say they are making significant changes. Some, though, are going further out on the yield curve to take advantage of rising rates.

“We know that corporate treasury is conservative and focused on driving corporations,” said Cody Lott, director of corporate treasury solutions at Clearwater Analytics. “Historically, we have seen that our clients do not move out of deposits until money market fund yields are noticeably higher, but once they are, they make the transition quickly. We also know that deposit yields trail MMF yields through hikes, so it would appear that this crossover could happen sooner rather than later.”

Monitoring the situation. “With the situation in Europe, we basically put a pause on new investments,” said a member of NeuGroup for Cash Investment at a focus session held to discuss preliminary findings. “We didn’t unwind anything, but we are doing more due diligence and keeping a closer eye on our allocations and our different partners,” he said. “We don’t have any long positions that we had to be super concerned about because our average duration is pretty short.”

- For most of the survey participants, the outbreak of the war had little direct impact on their holdings. “As we have done with other market shocks, when the conflict started, we went to our external investment managers and asked them to take a look at our portfolio and assess what impact there could be from the Russia-Ukraine war,” another member said.

- “We have a very conservative portfolio, and our holdings didn’t have much direct exposure, maybe secondary, but it wasn’t enough that we were all that concerned and would take much action.”

- One member said his company had some holdings in one of the aircraft leasing companies that may incur significant losses stemming from leases to Russian airlines. But beyond that, “We’re really looking at what the knock-on effects are going to be.”

It’s a localized shock—for now. Most members view the crisis in Europe primarily as a localized event, versus, for example, the wider market shocks of the pandemic. “With the pandemic, there was a lot more impact and exposure to our portfolio in general, and we took a lot more action, because it was so broad to the market,” one said.

- After the coronavirus outbreak, another member said, “We asked our portfolio managers to stop all investments and just allow securities to mature and cash to build up and sold off some assets, for example some [mortgage-backed securities]. We actually took cash back because we were concerned about liquidity.”

An ops story. Instead, with Russia, the primary impact is operational. “We have operations in-country. So we have had to make some adjustments of how our cash operations take place; we’ve publicly announced that we’re going to put a halt on manufacturing operations in the country. As far as investments, I do not have any specific investments that are impacted by the Russian sanctions.”

The uncertainty spectrum. The war in Europe added another element of uncertainty, especially after the Fed came out with a surprisingly hawkish announcement on March 16. The 25 basis point hike was not a surprise; however, Fed chair Jerome Powell’s tone and promise of seven more potential rate hikes was. “It is a very aggressive path of rate hikes that we are not used to, at least in the last two decades,” Subadra Rajappa, head of US rates strategy at Societe Generale, told NeuGroup Insights days after the announcement.

- “The question here is whether this Fed will be a Fed that moves rates, or a Fed that signals hawkishly to provoke the market to price in higher rates,” Mr. Lott commented. “As we saw with the last hike, and through the last hike cycle, most Fed decisions lose sting because markets move yields before meetings. We have to remember why rate movements matter, and with the term ‘recession’ back in the vocabulary of most, the next few months will be critical.”

- Speaking with members of NeuGroup for Tech Treasurers on March 17, Tom Porcelli, RBC’s chief US economist, said “monetary policy is a blunt tool, and core inflation is driven by forces that are outside the Fed’s control; so why so aggressive?” He added, “It’s about expected versus actual inflation, and expectations are showing signs of becoming somewhat unhinged. The Fed is playing catch up. The problem is there are already challenges dotting the landscape. The decision this week adds on another layer of risk. “

- Mr. Porcelli also noted that “The median number of rate hikes in ’22 went from three to seven, when there weren’t really indications that the Fed would be this aggressive. It drives home the fact that they want to crush inflation as much as they can. Powell’s narrative is that they are going to do whatever it takes, even if it means growth falters.”

- “Going back a month or so, I think there was some more certainty about how many hikes at and what levels we will see them happening, in response to inflation,” said one member. “But I think the war in Ukraine throws in some more uncertainty around that. The impact of all these unprecedented economic sanctions is still unknown. Prior to the war, there was a pretty clear path, but now I think it’s a little bit cloudy.”

- Will the Fed deliver on its promise? At the March 16 session of the cash investment group, one member said he doubts there will be more than four hikes. “At the expense of growth does not mean at the expense of a recession.” He added, “The volatility following the announcement signaled fears of an overzealous Fed.”

Extending duration. Prospects of faster-rising rates, however, are convincing some members to push out maturities to benefit from the yield pick-up. “We’ve been busy buying bonds for the last month-and-a-half, as we expected, but I’m actually looking at extending it a little bit further,” one survey respondent shared. “Most of my duration is kept under two years. So, I won’t pick up 100% as we’re going along, but a lot of that expectation is already priced in the issuances today.”

- The cash investment manager at another organization said he doesn’t view all cash as likely to be redeemed within in a one-year time frame. So, “depending on the purpose, we’re able to go longer.” This manager is looking to do that by buying floating-rate securities to both benefit from rising rates to avoid some of the mark-to-market volatility.

- Floaters were popular with another company. “We’ve also been increasing our allocation to floating rate notes,” the investment manager said. “Some of the feedback we’ve gotten is that the pricing on those can be pretty rich right now as a lot of people look to get into them. So, where we find value and it makes sense, we are increasing our allocation.”