On Dec. 1 and 3, NeuGroup hosted the inaugural gathering of the AsiaTech20 Treasurers’ Peer Group, involving over 50 treasury professionals from more than 20 leading technology companies in Asia Pacific as well as the US. The attendees, representing influential treasurers in the e-commerce, electronics and semiconductor sectors included these companies:

- Alibaba

- Ant Financial

- ASMPT

- Carsales.com

- CK Hutchinson Holdings

- Flex

- Foxconn

- Infineon

- Ingram Micro

- Intel

- Iress

- KLA

- KNS

- Lenovo

- MediaTek

- Qorvo

- QuEST Global

- SEEK

- SoftBank

- Traveloka

- UTAC Group

- WPI

- Xiaomi

- Alibaba

- Ant Financial

- ASMPT

- Carsales.com

- CK Hutchinson Holdings

- Flex

- Foxconn

- Infineon

- Ingram Micro

- Intel

- Iress

- KLA

- KNS

- Lenovo

- MediaTek

- Qorvo

- QuEST Global

- SEEK

- SoftBank

- Traveloka

- UTAC Group

- WPI

- Xiaomi

The groundbreaking event was conducted in partnership with MUFG and was hosted virtually after being rescheduled due to global events including the Covid-19 virus. AsiaTech20 aims to keep Asia-based tech company treasurers connected with each other and to their US peers for knowledge exchange. AsiaTech20 will be the sister group to NeuGroup’s premier technology treasurers’ peer group, Tech20, whose long-standing members include Adobe, Amazon, Apple, Microsoft, HP, Intel, Oracle, Salesforce and many more.

Overall Key Takeaways

The exchanges came amid geopolitical tension, a potentially game-changing US election and economic competition between the US and China. NeuGroup and MUFG initiated this effort to keep the bridge open between the world’s leading tech sectors (those of the US and Asia) to maintain treasury and finance cooperation on integrated ecosystems, best practices and innovation sharing.

Overall themes of the two days:

- Be prepared for global optimism in 2021: More companies (with treasury strategies supporting them) are expected to be going on offense and their treasury and finance teams are putting the financial resources in place to do so.

- Growth dynamics in Asia capital markets: Bank lending continues to be strong, yielding favorable impacts for tech company treasurers, plus bond issuances are drawing greater interest from US investors as well as those in Asia.

- AsiaTech20 treasurers accelerating digitalization efforts: Covid created a unique opportunity to standardize processes, accelerate digitization, experiment with remote strategies and take on technology issues internally that TMS (Treasury Management Systems), ERP and bank platforms have been slow to move on.

Day One Summary

Day one’s agenda consisted of three keynote discussions led by subject matter experts from MUFG:

| Session One | US election implications for policy, markets & the US-China relationship |

| Session Two | Covid outlook and potential impact on 2021 |

| Session Three | Tariffs, trade and decoupling— the treasury and finance implications of supply-chain and manufacturing model shifts |

High-level takeaways from Session one’s market overview and insights from MUFG subject matter experts:

The global economic outlook is overwhelmingly positive with the Covid-19 vaccines approaching distribution. Efficacy and speed of the vaccines is the main driver of economic optimism, and a live, in-session poll of pilot members confirmed this view.

Expectation that new US administration favors economic growth on a more global scope, with Asia expected to outperform.

- Uncertainty around the US election is subsiding, leading to positive market sentiment

- A Biden win puts a broader global spin on the bullish market impact

- A few outstanding topics remain (Georgia runoff, expiring executive powers, including on Trade Promotion Authority), which treasury professionals should be tracking for impact on capital requirements and trade implications

Tech treasurers in Asia have pivoted from stockpiling capital and liquidity to going on offense during the recovery and improving their standing in the market.

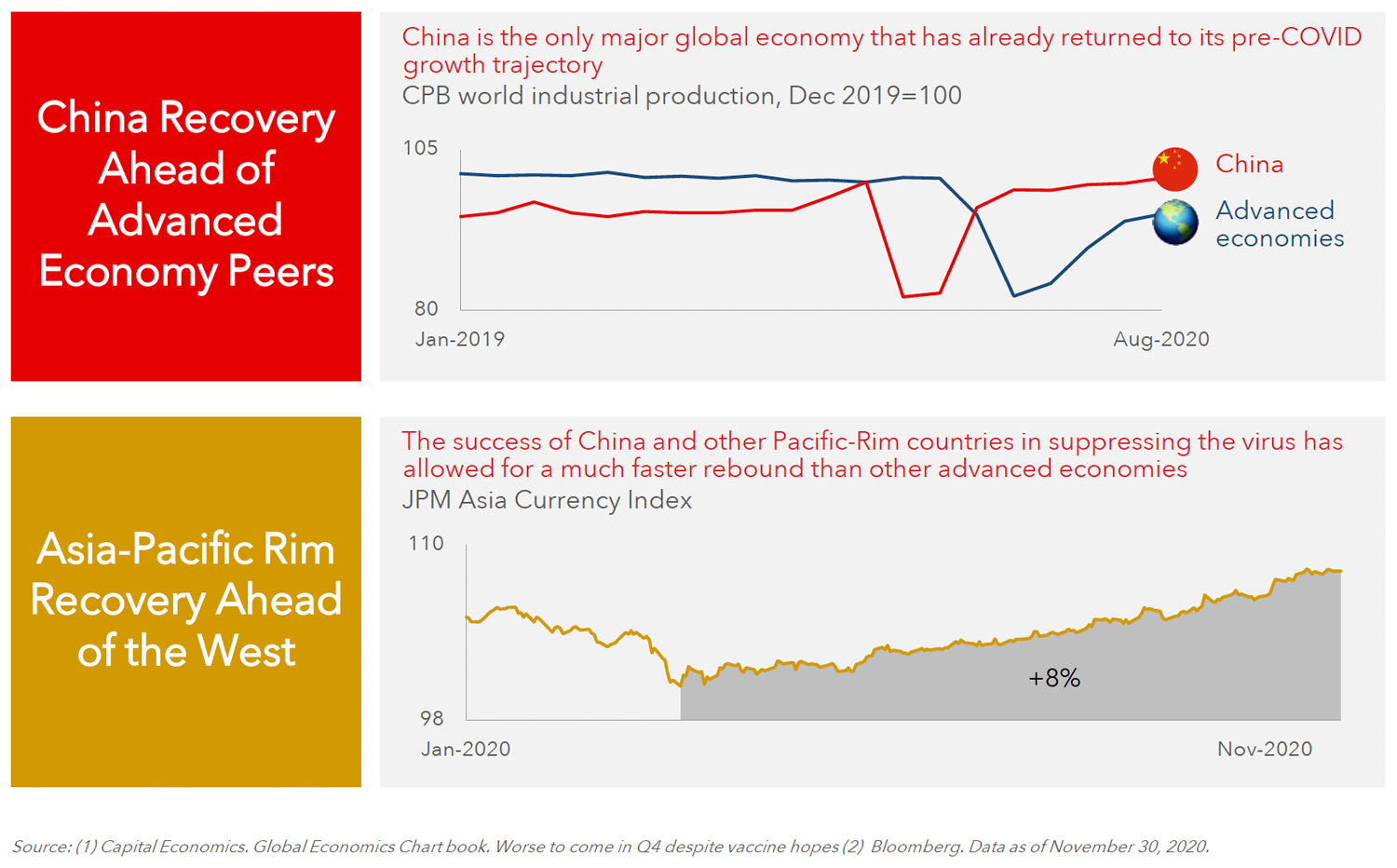

Asia Pacific-Rim Recovery Ahead of the West

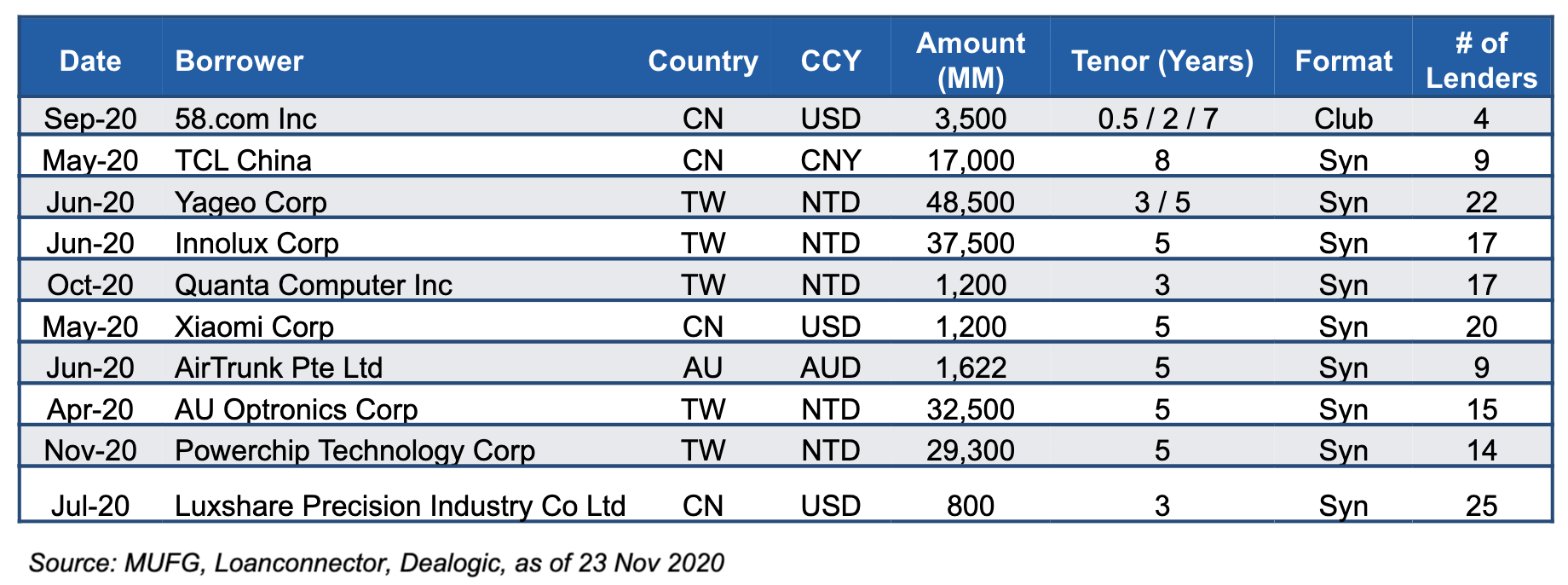

The traditional strength of bank lending to tech in Asia remains (particularly in Taiwan, China and Australia), with tech treasurers reporting success in renewing credit facilities, upsizing or adding new loans, and amending covenants favorably.

YTD 2020 Largest Technology Loan Deals

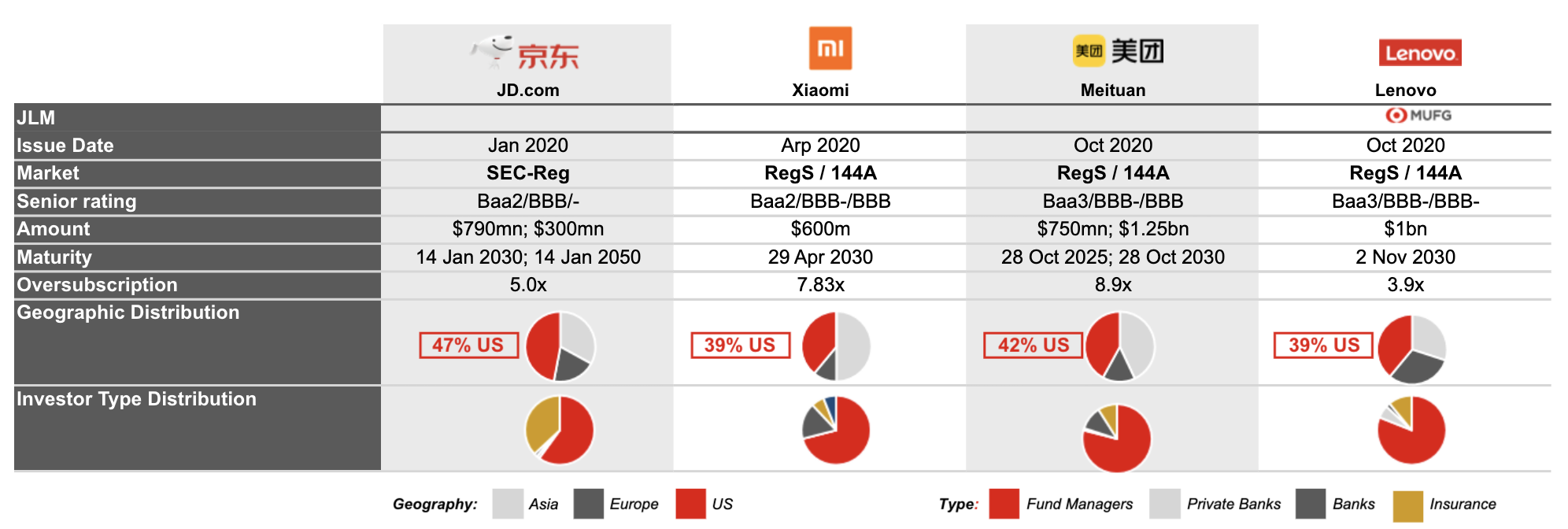

- Bond issuance by tech firms in Asia has grown as firms find receptive investors in the US, especially if they get a rating in the US in addition to their Asia rating.

- The depth in debt capital markets continues to grow—issuers seen as investment grade looking to raise $300 million and even $500 million can get deals done in Asia.

- Two drivers of recent M&A capital sourcing are Chinese tech manufacturers selling mainland Chinese assets to fund new assets offshore, and Chinese tech firms funding “take private” deals as US and other offshore listings are drawing more scrutiny.

- Growth optimism and positive sector tailwinds will likely drive broader acquisition financing demand, as well as increasing capex to lean into post-Covid demand.

- Treasury opportunities are there for firms with capital access and knowledge to grow through acquisition, take better care of existing and new customers, plus support suppliers who are transitioning with you.

Increasing US Investor Participation in Recent APAC Technology Bond Issuances

- Virus policy matters more than monetary/fiscal policy. Due to the shortfall of virus policy, the US economy has been battered by the virus. US may still take two to three years to recover to pre-Covid levels, and three to five years to get back to the pre-Covid growth pattern; China, by contrast, is there now.

- With the new administration, we can expect continued disentangling between US and China economies and currencies.

- Common treasury issues include addressing liquidity concerns, supply chain financing, working capital challenges and volatile FX markets.

- Subsectors are on a continuum in terms of Covid impact—and knowing where your firm is on that continuum and its place in the ecosystem will help you manage the challenges facing you in these businesses (many with heavy Asia Pacific-US interaction).

- Collaboration and building relationships within the tech sector across global markets will become even more critical as US-China trade relations evolve.

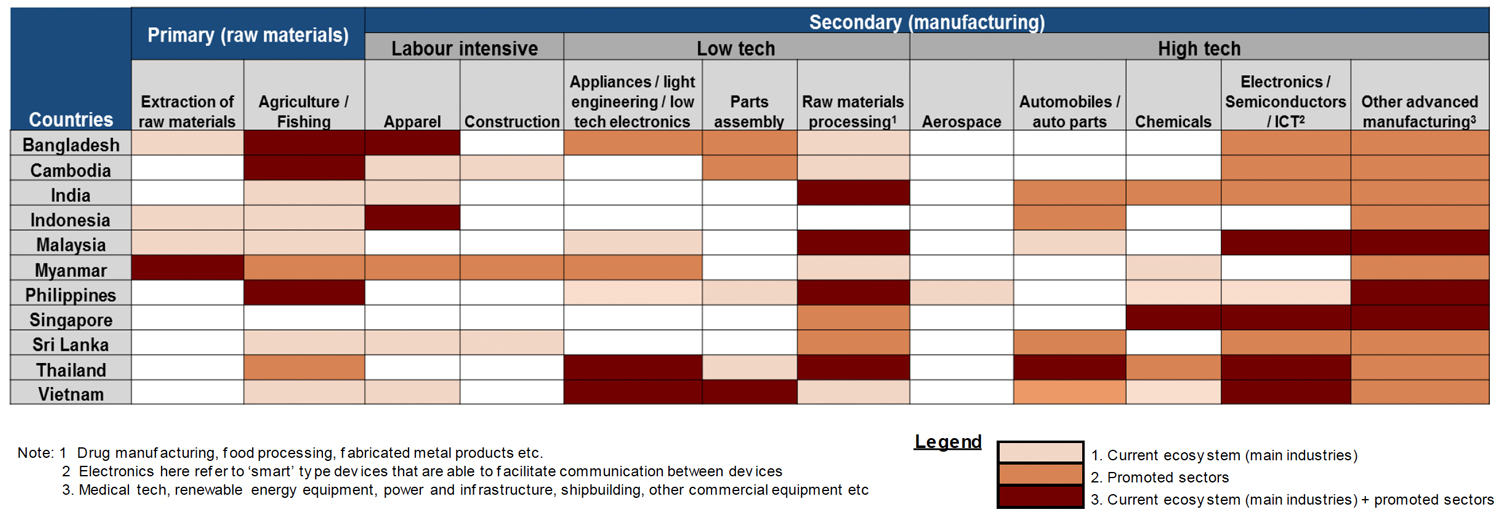

- A “China plus” strategy of building up new supply, distribution and sales channels for ex-China Asia and the US, while diverting China channels to fuel domestic growth in China is increasingly common.

- Beneficiary markets in the rest of Asia are looking to accelerate investment with special economic zones and other investment incentives along with physical and financial infrastructure improvements.

- Banks are in a position to help clients by understanding the regulations and changes as well as passing along what peers are doing.

- Tech firms that have managed their financial position well through the crisis are able to help customers, suppliers and distributors deemed acceptable credit risks or strategic partners. That helps attract new customers, suppliers and distributors that have not been treated as well.

- APAC may be doing a better job at controlling COVID due to geographic isolation, culture, and geopolitics. This tale of two worlds is likely to continue into 2021.

- Focusing on mortality is just the tip of the iceberg, minimizing several other factors.

- Most experts think a vaccine is likely to become widely available by mid-2021; about 12‒18 months after the virus first emerged. Distribution is not easily achievable.

- TMT sector – Most negative impacts may be a temporary phenomenon (smartphone & advertising are set for a strong rebound) while there may be select positive impacts set to become long-term trends (like WFH & E-commerce preference).

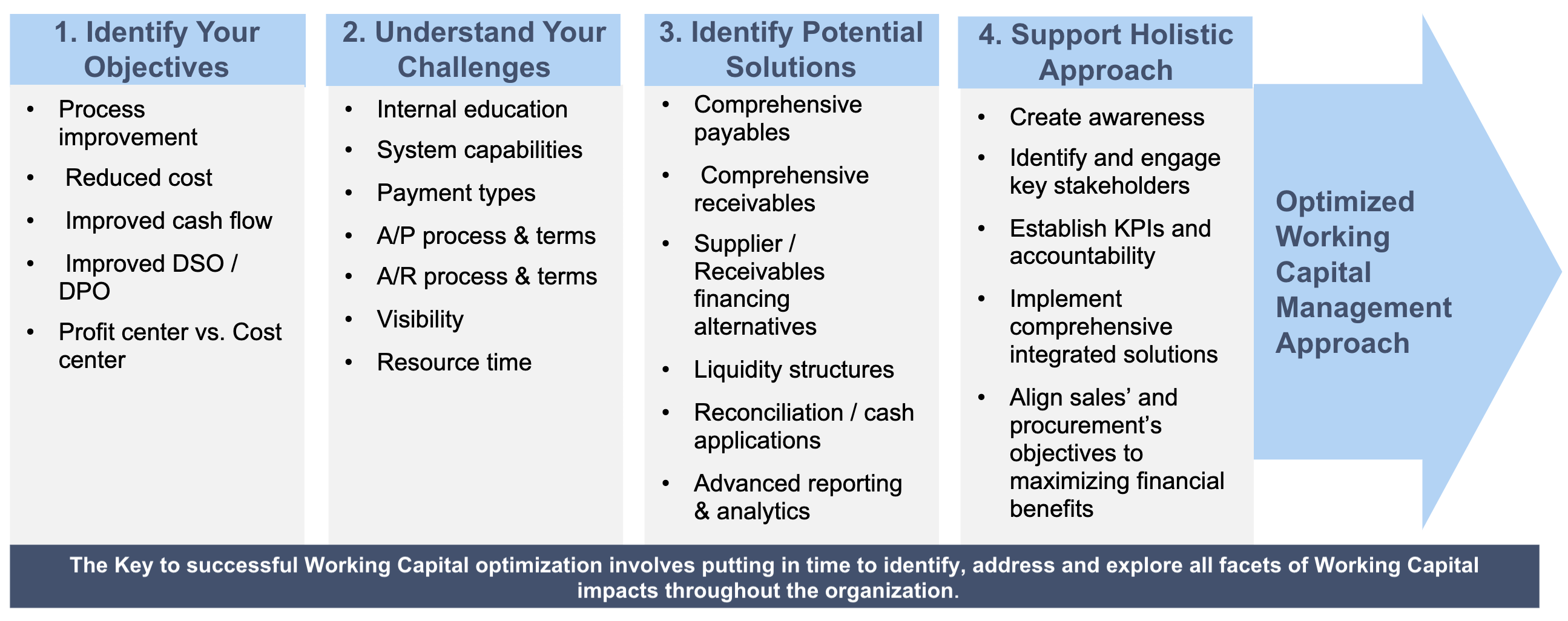

- Supply Chain Finance – Using working capital management can benefit companies during the pandemic. Many companies have been taking a fresh look at working capital and developing KPIs around working capital.

Current industry ecosystems and promoted sectors of selected Asian countries

Day Two Summary

Day two represented a shift from the presentation/keynote structure to greater opportunities for attendee interaction and relationship building. The schedule included four separate opportunities to meet in smaller groups, share personal experiences and develop camaraderie:

| Session Kick-off | Individual member introductions via multiple, small breakout groups. |

| Session Four | Technology Peer Company Benchmarking - Capital Allocation and Capital Raising Strategies Since The Covid Pandemic (Panel discussion followed by breakout sessions) |

| Session Five | Tech Treasury Organization Benchmarking: Similarities and Differences in Approach Across Asia, US and Subsectors. |

| Working Session | (Treasury and finance practitioners only) |

High-level takeaways from group discussions:

Tech treasurers in Asia have benefited from projects to standardize treasury processes ahead of the crises with the overall goal of being able to scale support for rapid tech growth without having to increase headcount.

Member anecdotes:

- Using proximity to a shared service center to help drive standardization across multiple business units and working capital management.

- Pushing treasury staffs to educate themselves on data analysis techniques and automation tools to make cash forecasting easier.

- Relying less on TMSs and bank systems that have been slower to keep up with needed changes and are not as open.

- More companies using APIs and robotic process automation (RPA) to do their own data integrations.

- Using software engineers to develop a mobile treasury app that provides three-click access to real-time cash and debt levels on team mobile devices.

Path to Optimizing Working Capital Management

Senior Attention:

- Working Capital improvement is an ongoing process led by the most senior stakeholders within the company.

- Holistic organizational transformation requiring close cross-functional coordination.

- Change in culture and organizational buy-in by all stakeholders.

Organizational Change Management:

- Buy-in is needed across various departments of the organization including treasury, sales, and procurement teams.

- Working Capital Solutions require a deep understanding of systems and internal processes supporting the company, legal contracts and payment terms affecting Working Capital, and financial tools employed to improve and gain further efficiency.

- Liquidity differences across multiple geographies (most notably China and India) make this business ecosystem different, and more dramatic than those firms in Europe and the US face.

- More advanced recovery in China and RMB strength is resulting in “window guidance” favoring outbound flows. However, continued uncertainty around changes in guidance have treasurers creating contingency liquidity facilities involving local Chinese banks or cross-border LCs.

- More pressure is being put on banks to try to adopt solutions more quickly, and be willing to invest alongside customers to drive automation.

- Firms are trying to reduce the number of banks and bank accounts due to increased risks, especially with growth (increased during Covid) of remote banking needs. This includes pursuing process that require as few signatories as possible.

- KYC (know your customer) efforts continue to be cumbersome, with high demand for a technology solution and coordination of differing standards across multiple geographies. AsiaTech20 members are keen to push for regulators to help them see banks and other vendors step up with solutions.

- Heavy interest in blockchain as a potential solution to challenges, especially in trade and supply chain finance areas.

Next steps

Based on the positive feedback from attendees, NeuGroup plans to continue managing this group as a pilot, and schedule additional sessions 2021, looking for further opportunities to connect this influential group with the now 20-year-old Tech20 NeuGroup Peer Group in the US.

If you would like more information on how to remain or get involved, read our post Asia Tech Companies Optimistic for Post-Covid Growth, or contact [email protected].