April 8, 2021

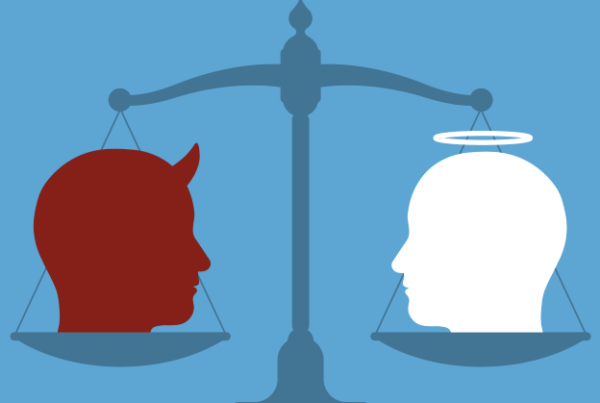

Making the Devil’s Advocate an Angel on Your Shoulder

NeuGroup risk managers make space for contrarians to question decisions and combat overconfidence.Rather than shunning contrarians for challenging conventional thinking, corporates need to make sure their decision-making processes always include a constructive devil’s advocate—someone who forces teams to consider all the ramifications of whatever action—or inaction—a company is contemplating. This was among the key pieces of advice given by Michael Zuraw, head of enterprise risk management at ON Semiconductor, during a presentation on decision-making at a recent ERM-focused NeuGroup meeting.…