January 19, 2021

Sign of the Times: Retailers Say Coin Shortage Worries Persist

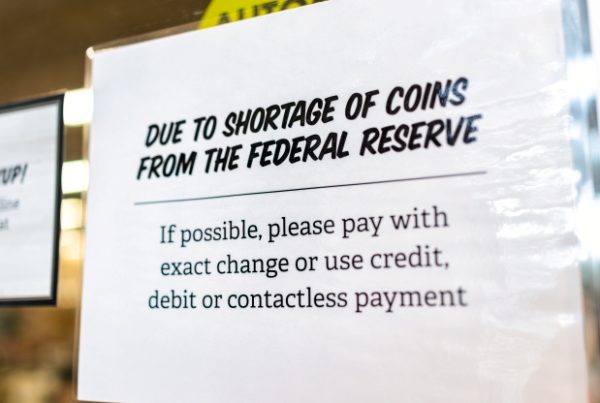

Burned by a dearth of coins during the pandemic, many retailers are cautious despite some signs of stability.“Cash-mageddon” is how one member at a recent meeting of NeuGroup for Retail Treasury described the havoc wreaked by the coin shortage that made life hellish for many retailers last year. And despite signs of normalization and increased production by the US Mint (see below), some members remain unconvinced that the coin supply disruption caused by the pandemic is truly over. Cautious about…