An option for members of the Bank Treasurers’ Peer Group coping with excess liquidity amid rock-bottom rates.

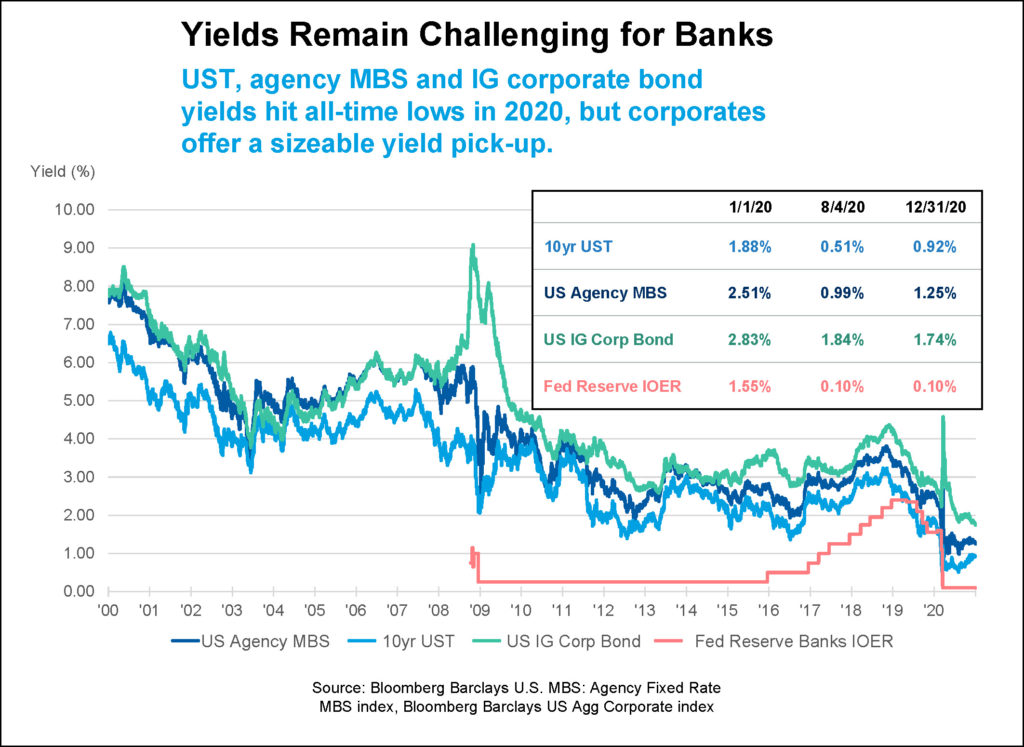

Many members of the Bank Treasurers’ Peer Group (BTPG) find themselves looking to their investment portfolios as they search for yield in a manner that complies with policy risk parameters—a theme heard at other NeuGroup meetings in the second half as interest rates fell.

- Banks face the added challenge of tepid loan growth amid a surge in deposits driven by a flight to safe havens and businesses parking cash received through the Paycheck Protection Program.

- “We have all this cash and nowhere to invest,” one bank treasurer said.

- One suggestion from the sponsor of the BTPG H2 meeting: Buy lightly structured investment-grade corporate bonds, in addition to US treasuries, federal agency debt, MBS, ABS and municipal bonds.

Structured notes. According to the sponsor, lightly structured bonds can offer a significant yield pickup and be customized to meet portfolio needs. Structured correctly, these securities can be a capital-efficient investment from a risk-weighting perspective. Structured notes issued by US depositary institutions or qualifying foreign banks can have the same risk-weighting as a federal agency or MBS investment.

- The sponsor was that clear structured notes, if appropriate, would still only comprise a relatively small percentage of a bank’s securities portfolio, primarily because they can be less liquid than other investments, especially during times of high volatility and stress in the financial markets.

- That said, these investments can be customized by issuer, tenor, rating, fixed versus variable interest payments and call feature.

- Additionally, more highly structured notes can allow the portfolio manager to express views on inflation or the shape of the yield curve, again, if appropriate.

Caveat emptor. The search for yield does not come without risk, of course. But for investment portfolios that have a buy and hold approach to at least a small portion of their holdings, they may have merit.