Mission-Driven Bank Fund will offer corporates a way to infuse equity capital in banks serving minority communities.

Corporations looking to make impactful investments in minority communities, but not through bank deposits, may want to consider a new partner: the Federal Deposit Insurance Corporation (FDIC)—the federal agency that insures deposits.

- Representatives from the FDIC and a large asset manager that is acting in an advisory role described what’s being called the Mission-Driven Bank Fund (MDBF) at a recent meeting of NeuGroup’s diversity and inclusion (D&I) working group.

- The fund, slated to launch later this year, will offer corporates a path to provide equity capital to minority depository institutions (MDIs) and community development financial institutions (CDFIs) that serve low- and moderate-income communities at higher rates than mainstream banks, the FDIC said.

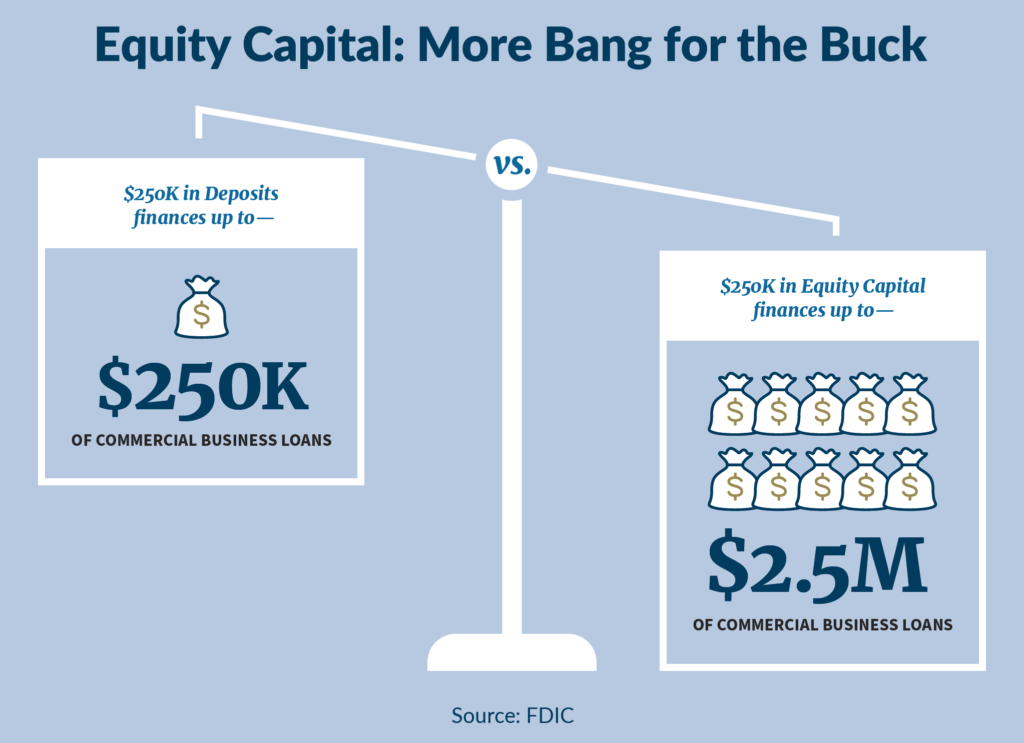

Equity capital’s multiplier effect. One advantage of infusing equity capital into MDIs and CDFIs is that an equity investment “helps mission-driven banks far more than deposits,” according to an FDIC slide (see chart, below).

- Every dollar of equity capital invested, the FDIC says, can increase lending by a multiple of the original investment, while every dollar of deposits can only increase lending up to the amount of the deposit.

- The treasurer of a large technology company that is an anchor investor in the fund said, “We’ve looked at a lot of different ways [to invest], we looked at deposits, but we wanted impact. We feel like we’ve moved up.”

- Because of regulatory requirements governing capital ratios, many MDIs and CDFIs need equity far more than deposits so they can increase the amount of loans they make to borrowers.

Facts and figures. Once the MDBF launches, the FDIC says, it will be run by an independent fund manager selected by the fund’s founding investors. The FDIC will not be an investor and will play no role in fund management.

- The FDIC’s goals for the MDBF are initial capital commitments in the range of $100 million to $250 million and a target of $500 million to $1 billion when fully established.

- Once selected, the fund manager will work with an investment committee to hear quarterly proposals from MDIs and CDFIs for potential investments. Those could include:

- Direct equity

- Structured transactions

- Funding commitments

- Loss-share arrangements

- The FDIC says it is targeting “a minimal rate of return to investors, who can reinvest any returns in the fund or in aligned non-profit enterprises that support mission-driven banks.”

Investment policy changes? One NeuGroup member from a corporate that worked with the FDIC said the fund meets the company’s priorities. “Our primary focuses are risk, then impact, and then return, in that order,” he said. “The beauty is you get to do it all in one product. They do all the work for you instead of needing to hire a team.”

- The company did have to change its investment policy to accommodate investment of equity capital. “Lots of corporations are unable to do equity, but it’s an important part of [our] portfolio,” the member said.

- Another member said that as long as the investment aligns with the company’s stated values and mission, this kind of change isn’t too difficult.

- But in a survey at the meeting, half the members responding said it would be either somewhat or very difficult to change investment guidelines to allow or create exceptions to make investments in MDIs or CDFIs in the form of equity capital.