ION’s plans to tap machine learning, deep learning and neural networks to help treasurers.

Making better use of technology to improve cash flow forecasting (and cash visibility) has taken on greater importance during the pandemic for many companies where it was already a high priority. That was among the key takeaways at the spring virtual meeting of the Global Cash and Banking Group, sponsored by ION Treasury.

- ION sells seven different treasury management systems (TMSs), including Reval and Wallstreet Suite.

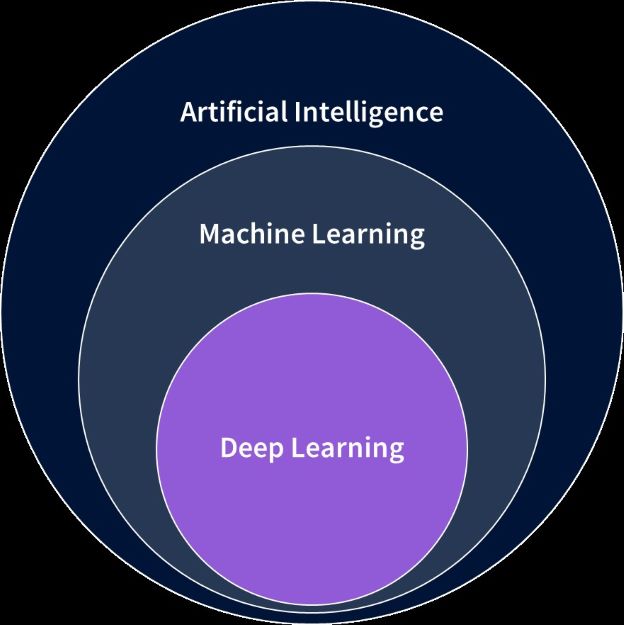

- Among the cross-product solutions ION is focused on is a cash forecasting tool leveraging artificial intelligence (AI), mostly in the form of machine learning (ML) and deep learning neural networks.

- One of the ION presenters said advances in AI and ML have produced an “opportunity to reimagine how cash forecasting can be done,” noting something treasurers know too well—that no one yet has truly “solved in a great way” one of the top challenges facing finance teams.

Define your terms. Another ION presenter explained that AI is any intelligence demonstrated by a machine.

- ML—a subset of AI—involves the ability to learn without being explicitly programmed.

- Deep learning (DL) is a subset of ML and includes so-called neural networks inspired by the human brain. The algorithms powering neural networks need “training data” to learn, enabling them to recognize patterns.

- The ION presenter gave the example of a neural network within a self-driving vehicle that processes images “seen” by the car.

Building on data and business knowledge. For cash forecasting, the learning process starts with entering historical data into the model that is “cleaned” by tagging the inflows and outflows appropriately and removing outliers that would significantly skew trends. Models are trained via algorithms that apply rules and matching inputs with expected outputs.

Validation required. Like many learning curves, it takes time for the model to reach a high level of performance and requires treasury professionals to validate that the algo knows what it is doing by comparing the forecast to actual variances.

- Similarly, people—not machines—will have insider knowledge of significant changes within the organization and must make tweaks to the model where appropriate.

Measuring the models. Various statistical approaches feed neural networks’ underlying algorithms. When building their AI cash forecasting solution, ION tested everything from simple linear regression to multivariable linear regression to the Autoregressive Integrated Moving Average (ARIMA) model, which adds layers to the neural network and process non-linear activities.

- ION’s research suggests that linear regression-based learning models perform well for businesses with stable, growing cash flows, but less well with cash flows subject to seasonal peaks.

- ARIMA models perform better, but need extra modeling for seasonality while neural networks require careful attention to training data to learn from, as well as supplemental intervention when non-repeating events occur—such as global pandemics.

- Still, you can get 90%-95% accuracy most of the time, in seconds vs a day or more using manual methods. ML for cash forecasting has the potential to be 3,000 times faster than common manual processes companies employ, according to ION.

- Other benefits include improving accuracy, overcoming human biases, picking up anomalies that could mean fraudulent activity, and realizing monetary gains from more predictable cash positions.