BNP Paribas shares a guide for corporates looking into carbon emission markets.

A NeuGroup member at a large technology company recently asked peers on an online forum, “Does anyone have experience in purchasing carbon credits in voluntary markets?”

- For guidance, NeuGroup Insights reached out to BNP Paribas, which has a long-standing presence in this area and is committed to developing origination capabilities in carbon offset markets.

- The bank shared a presentation to help clients better understand the dynamics of the voluntary emission reduction (VER) market.

- Understanding carbon markets can only help corporates ramping up their efforts to address environmental, social and governance (ESG) issues as pressures to embrace sustainability grow even stronger.

Three carbon pricing mechanisms. The BNP Paribas presentation describes three main ways carbon is priced. Governments have been using the first two to reach carbon reduction goals.

- Carbon taxes. Applying a flat and predefined rate on all carbon usage.

- Cap and trade. Regulated entities are subject to an emission cap and can freely buy and sell carbon allowances, which are rights to emit carbon. BNP Paribas says that to some extent these entities can also use carbon offsets if deemed compliant by the regulator.

- Voluntary markets. At the same time, BNP Paribas explains, the creation of so-called voluntary markets has allowed companies to buy on a voluntary basis a certain type of carbon credits or offsets and redeem them to offset their emissions. The goal is to demonstrate the corporate’s business activity is carbon neutral.

- “By buying carbon offsets, a company could voluntarily compensate for its residual emissions and support the transition to a low-carbon economy,” the presentation states.

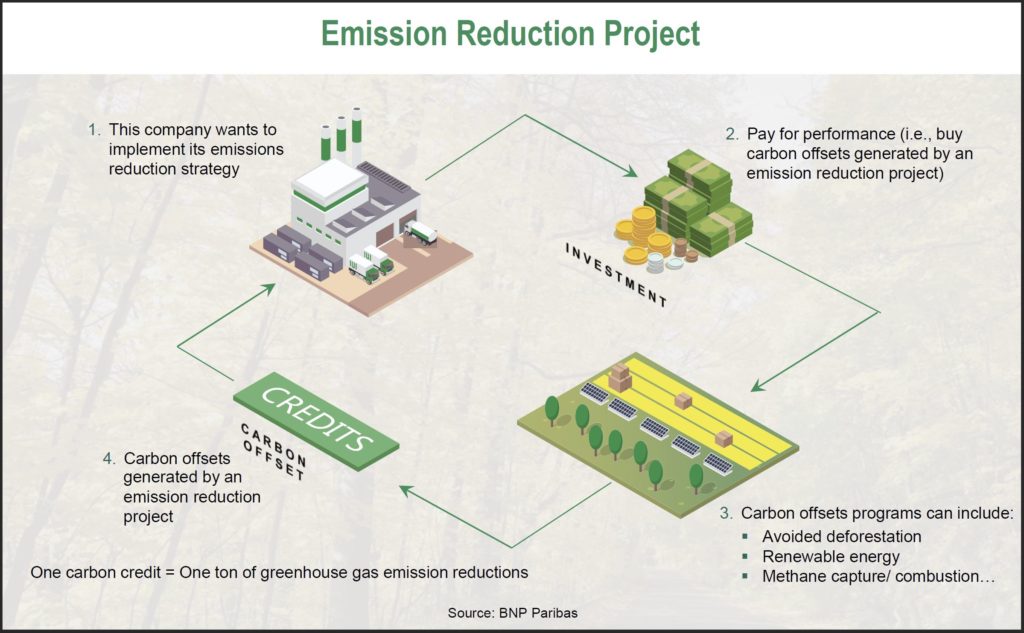

- Carbon offsets are units of carbon dioxide-equivalent that are reduced, avoided or sequestered to compensate for emissions occurring elsewhere through emission reduction projects (see below).

- BNP Paribas channels money to the emission reduction project developer to operate, perform and generate emissions reductions.

How to use VERs. The presentation explains that the first step is for a company to measure its carbon emissions and define reduction targets as part of its commitment to corporate social responsibility (CSR). VERs are one of the instruments of a comprehensive carbon offset strategy. The other steps include:

- Reducing greenhouse gas emissions as much as possible as part of the CSR strategy.

- Reporting on greenhouse gas emissions.

- Compensating for emissions that cannot be avoided with carbon offsets and through verified emission reduction.

Carbon footprint offsetting process. The presentation notes that BNP Paribas holds carbon offset certificates and provides liquidity to this market, offering “a simple and cost-efficient setup to its clients to buy the necessary offsets to it remaining emissions.”

- “VER is paying for past performance,” the presentation states. “A VER certificate is only issued when the carbon avoidance has already been achieved.”

- Clients buy selected carbon offsets (spot and forward) from BNP Paribas via ad hoc negotiated documentation.

- Each VER has a unique serial number with the objective to mitigate the risk of fraud and double counting.

- At the time of the purchase the client can request BNP Paribas cancel the VERs on its behalf directly from the BNP Paribas registry. A certificate of cancellation is issued by the registry (Markit) and provided to the client.

- Or the VERs can be transferred to and retained on the client’s registry, which needs to be set up.