Many NeuGroup members are shortening duration and some are avoiding maturities beyond six months.

“This is the most uncertain time I’ve ever seen,” said a representative of Allspring Global Investments at the fall meeting of NeuGroup for Cash Investment 2, aptly capturing the sentiment of many members. Uncertainty and a sense that interest rates will keep rising despite fears of recession are among the reasons many of them are keeping average portfolio duration short amid the extreme inversion of the yield curve. They’re viewing cash as a useful asset and steering clear of longer-term investments that—for now—aren’t worth the extra risk.

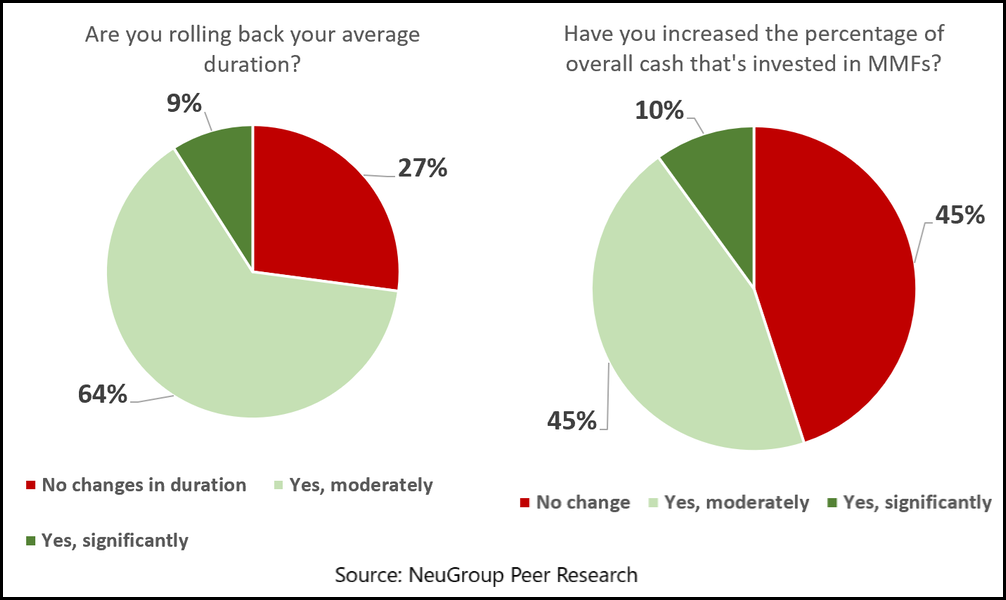

- This spring, a NeuGroup survey showed that 70% of members did not intend to extend duration. At the fall meeting sponsored by Allspring, a poll (results below) showed almost three-quarters are shortening duration and 55% are increasing the percentage of cash held in money market funds.

- Jeffrey Herzog, managing director and portfolio manager at Lord Abbett, sponsor of the NeuGroup for Cash Investment 1 meeting, said, “What we’re seeing from our larger institutional investors is they’re finding a lot of value in shorter-term fixed income. The risk-adjusted returns are really compelling relative to everything else.”

Six-month maximum. As capital preservation and liquidity are of heightened importance in uncertain times, the consensus among members was that six-month maturities are as far out as they’re willing to go.

- But one treasury director, who has had a one-to-three year short duration strategy since 2017, said he currently views even six months as “uninvestible,” which resonated with a number of his peers at the meeting.

- “We only invest in [investment-grade] corporate bonds, so interest rate risk is the biggest driver,” he said. “With the amount of volatility that’s going on right now, if for some reason I need that cash quickly, I’m not worried about liquidity, I’m worried about being in a marked-to-market loss position all of a sudden.”

Safety in money market funds. As they keep duration short, members are mostly investing in high-quality, low-risk investments like bank deposits, government money market funds and commercial paper.

- One investment manager said he’s used some demand deposit accounts, commercial paper and has a small corporate bond portfolio, but “we’re mostly sitting in the money market fund bucket.”

- A colleague of his added that, with where rates are, “Management is like, ‘I’m earning 4% on MMFs, is it worth taking additional risk to get 4.25%?’”

- Within that money market fund portfolio, the company exclusively invests in treasury and government funds. “When we looked into prime funds, the difference between government and prime just wasn’t attractive,” he said. “And it’s predominantly government because they have more repo.”

- One member said his stance is to stick to government money market funds “until we see repeated inflation prints that are going in the right direction consistent with what Jerome Powell was saying on his last call. We’re not trying to be heroes here for any reason.”

Risk vs. reward. One manager willing to test the waters in a hunt for yield found promise in offshore prime funds, but most members are lying in wait until rate hikes and inflation slow down.

- The member, a manager of capital markets at a US pharmaceutical company, said he found opportunities in offshore constant net asset value (CNAV) and low volatility net asset value (LVNAV) prime funds, which “have pretty decent yield.”

- Another member, still playing it safe, added that his team is taking time to “posture ourselves” to be ready to strike once the market starts to stabilize. The team is “working on how we identify risk on a macro level,” to optimize allocation when the time comes.

- The member who said he wouldn’t consider six-month investments currently is also planning for what comes next. “Our real goal is, once the Fed starts cutting, to go out further than we were before, four to five years,” he said.