Pinpointing where all your cash resides—and how much you have—depends on good technology.

The COVID-19 crisis has highlighted the value of technology that allows treasury to know—in real time—how much cash is available and where it is.

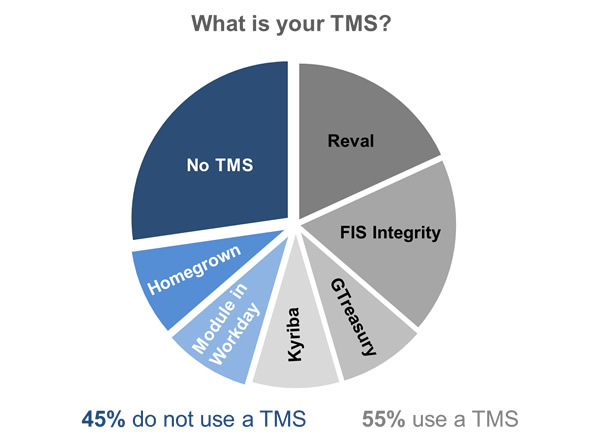

A recent virtual meeting of NeuGroup’s Tech20HG—for treasurers of high-growth tech companies—revealed that the technology that treasury teams use varies: The pre-meting survey of members showed that 45% of respondents do not have a treasury management system (TMS), compared to 55% that do.Those with a TMS use well-known vendors, but no clear winner emerged (see pie chart). With the relative youth of the companies in the group, their ERPs are of recent vintage and acquisitions haven’t yet resulted in the use of multiple ERPs and/or multiple instances of the ERPs in use. From that point of view, things are under control.

SaaS is where it’s at. Whether members choose to implement a TMS or special-purpose add-ons to existing systems, software-as-a-service, or SaaS, is what many consider the best way of availing themselves of new technology tools.

- SaaS doesn’t require nearly as many internal IT resources to implement and maintain as installed software, and security protocols have improved to the point where IT chiefs are satisfied.

- So, if your IT teams slow you down (when was the last time treasury was first in line for internal IT projects?), cloud solutions enable faster delivery of benefits, or “quick time to value,” according to Joerg Wiemer of bank connectivity and payments provider TIS, the meeting sponsor.

Too many bank accounts? Companies doing business in many countries across the globe are likely to have many bank accounts, too. Some companies have more than one per legal entity: One for collections, one for disbursements and local concentration accounts, and possibly single purpose accounts for local tax payments for example. In any event, the number of bank accounts usually exceeds what a treasurer wants to have.

Good bank account management is the foundation for good cash management. One advantage TIS says it has is that more than 10,000 banks are connected to its cloud platform.

- TIS’s customers can then access cash balance statement data into one centralized point more seamlessly than in a heterogeneous environment where the data needs to be accessed via proprietary e-banking tools and then consolidated and analyzed.

- TIS or not, the key is to have the capability to connect to both back-end systems and front-end banks to enable real-time data aggregation and accessibility.

And if you don’t? Whether because of poor bank connectivity or local banks’ inability to deliver statement information, a 2019 study of 172 companies by PwC reported that about a quarter of companies did not have daily visibility of all their cash. In addition, a JPMorgan study, also from 2019, concluded that cash forecasting beyond 90 days is still a challenge for many US companies. There are many contributing factors to poor cash visibility.

- Decentralization: A complex business ecosystem in different geographies with various payment methods and banking partners using inconsistent messaging may result in fragmented data landscape.

- Lack of systems integration exacerbates challenges stemming from multiple instances of different ERP systems, bank portals, additional TMSs and HR databases.

- Poor data quality from too many manual processes. A manual data process is prone to mistakes, time consuming and the data is already outdated by the time it reaches the HQ.

Consequences of poor cash visibility. These effects are interconnected and can result in inefficiency, which can be expensive in the long run. Consequences:

- No visibility over cash flows and no holistic view of actual cash position means outdated or missing cash information to guide business decisions.

- Difficulty calculating excess cash for investing or paying down debt means that inefficient use of cash and funding costs may increase, leading to unnecessarily large cash buffers.

- Inability to track foreign currency positions to hedge risks.

- Longer time frames for creating cash flow reporting for C-Level.

On the other hand, analysis instead of data gathering. With streamlined access to balance information, treasury team members can free up their time; rather than gathering data, they can turn their analytical eye toward answering questions like:

- Do we have enough cash even if the top line drops 30%?

- Where is our cash and what is our cash position and cash exposure with our different banks?

- What does our operating cash flow look like?

- Do we run into problems with financial covenants?

Faster and cheaper. Ultimately, a well-executed technology strategy that enables access to data more seamlessly will produce returns not only in time savings from consistent and more automated processes, but also reduced bank fees, funding costs and increased cash efficiency.