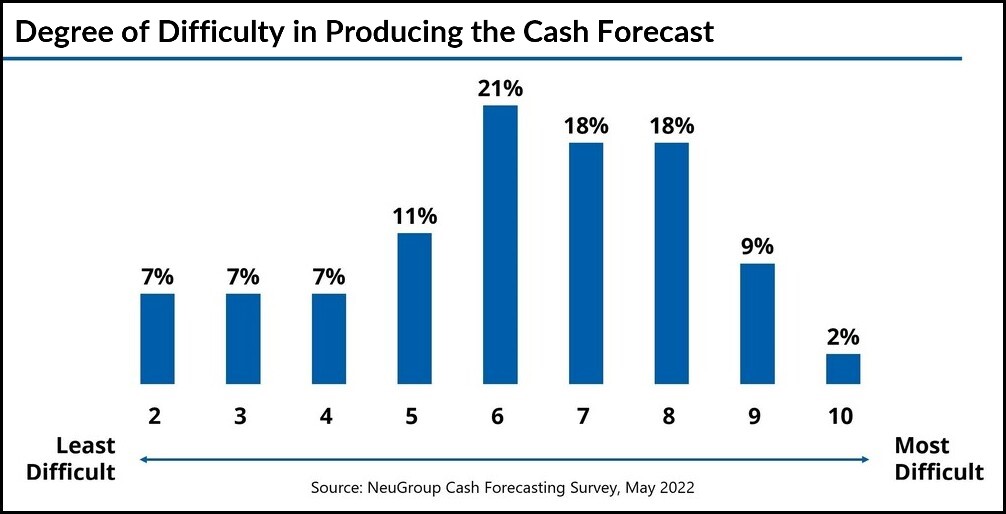

More than two-thirds of respondents to a NeuGroup survey ranked the difficulty of producing the cash flow forecast at 6 or above on a scale of 1-10.

Rising rates and a slower economy present treasury with a challenge and an opportunity. The challenge is safeguarding the company’s liquidity. The opportunity is investing excess cash to earn higher yields. In both cases, treasury teams must have a line of sight into how much cash is on hand, and how much more (or less) is in the pipeline.

- With a recession looming, it’s critical to get a handle on current and future cash flows, yet most treasuries still find producing the forecast difficult or very difficult, according to the results of NeuGroup’s May 2022 Cash Forecasting Benchmarking Survey (see chart below).

- A major source of difficulty: the data treasury collects from scattered sources to tell the cash story doesn’t always tell the whole truth.

Treasurers as chief liquidity officers. After a decade of abundant liquidity and frenzied debt issuance, cash and working capital are again front and center in CFOs’ minds. Access to external funding may dwindle as borrowing becomes more expensive. Meanwhile, zero or negative growth will put a squeeze on earnings. Producing a reliable forecast is essential for companies’ financial resilience during hard economic times, as we learned during the 2008-09 recession.

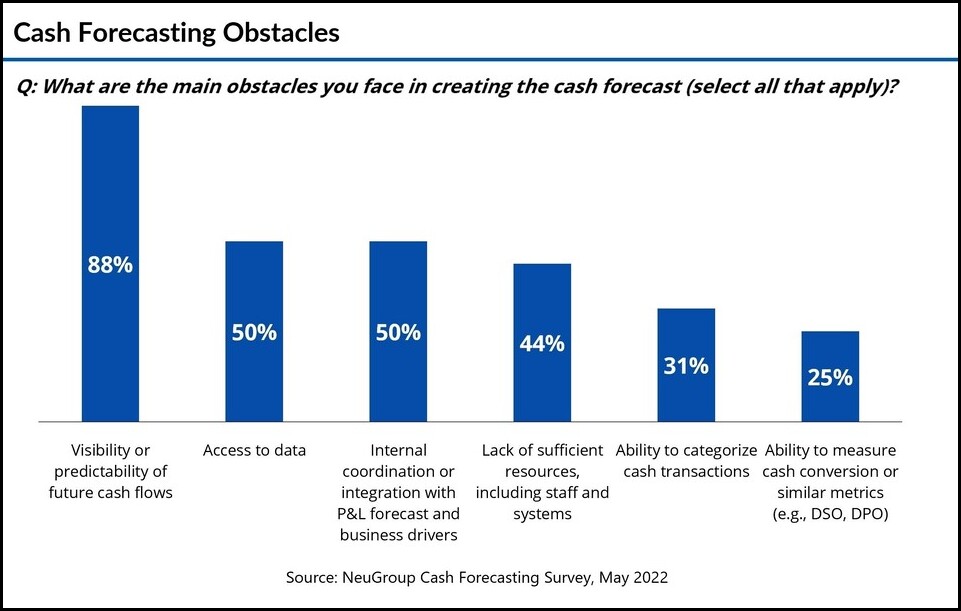

Obstructed view. The survey found that the most-cited impediment to generating the forecast is lack of visibility and the unpredictability of cash flows (see chart below). Tied for second: access to data. The two are interrelated and impact treasury’s ability to see cash as it flows across the customer-to-cash process.

An archipelago of systems. Getting access to bank balances is the smaller problem, although in some cases, accounts are outside the purview of the TMS or the cash pool. The larger problem is collecting data about cash, because the data sits in disparate source systems. Pulling that information is often manual and always time consuming. While a TMS automates some of the work, participants in post-survey focus groups say they have not yet found a system that provides comprehensive cash forecasting functionality. That’s why 93% of treasuries are still using Excel, often in combination with the TMS. Only 53% said they are using their TMS for cash forecasting. Even fewer, 18%, are using ML/AI tools.

The impact on reliability. The upshot is that cash forecasts are often inaccurate, undermining their role in supporting liquidity management decisions. In our survey, only 41% of organizations achieved a forecast-to-actuals variance within +/- 5%. The majority were +/- 10% or above. Additional analysis of the practices of the most accurate cash forecasters (those that scored accuracy at +/- 5% or better) revealed that accurate forecasts are not necessarily harder to produce: 56% of the accurate forecasters ranked the degree of difficulty at six or above, compared to 67% for the overall sample.

Solutions—now and later. Cash forecasting has been a perennial challenge for treasury teams and remains so, despite the technological advances of the past decade. The longer-term solution is to overhaul the finance technology architecture, decommission legacy applications and integrate data sources into a single location, i.e., a data lake. That is the goal of the extensive transformation work NeuGroup sees among finance organizations. And it goes beyond treasury. In the short term, treasury teams may need to become more active users of RPA and AI/ML solutions that can scour the tech ecosystem for data, cleanse it and assume some elements of the predictive process.

To learn more about the survey results, join us on August 3 at 12:00pm ET for a special debriefing session.