April 28, 2020

Funding Is Top Priority for Treasurers amid Pandemic: Poll

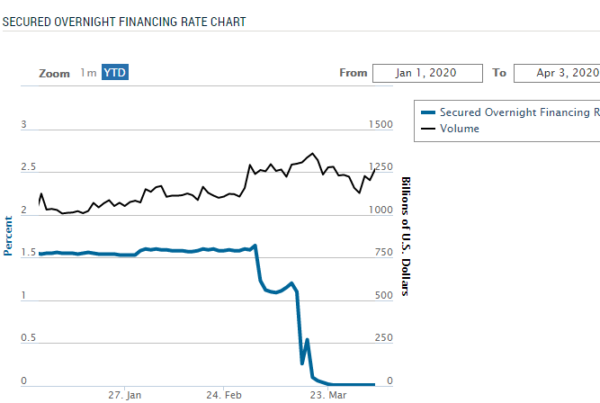

Treasurers have funding on their minds as they deal with COVID-19. BCP and supply chains also a concern.Securing funding is a top priority for corporate treasurers thrust into the role of organizing companies’ financial response amid the COVID-19 pandemic, according to a recent poll by Bloomberg and Greenwich Associates. Following funding, treasurers say their attention is also on business continuity plans and suppliers.Many treasurers have been tasked with making sure key suppliers have the resources to stay in business and…