December 1, 2020

What an Extended Libor Deadline May Mean for Corporates

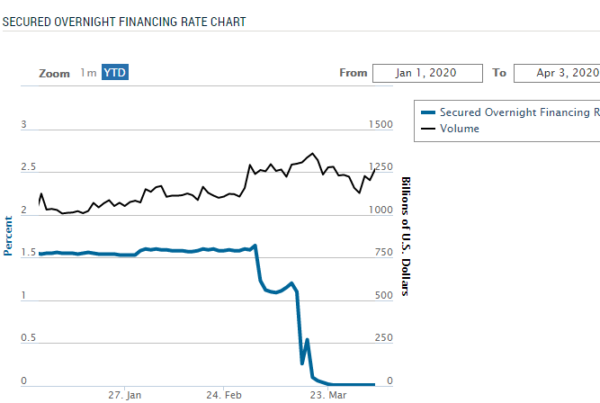

Takeaways on a proposal backed by the Fed that would allow more legacy Libor contracts to mature. Libor relief? Monday brought news that US regulators welcome a proposal by Libor’s administrator to offer an additional 18 months—until June 30, 2023—for legacy contracts to mature before Libor fully winds down. Reuters called the plan a “stay of execution.” What it means for corporates. We reached out to Amanda Breslin, managing director of treasury advisory at Chatham Financial, to get the significance of…