Insights from HSBC on CBDCs, as China’s tests of a government-backed digital currency, dubbed e-CNY, grow larger.

Most multinationals in the NeuGroup Network do business in China, just one reason finance teams need to stay on top of the country’s expanding tests of a digital version of the yuan known as the e-CNY, a so-called central bank digital currency or CBDC.

- HSBC’s global head of FX research, Paul Mackel, spoke at a NeuGroup virtual interactive session sponsored by the bank this spring to help treasurers get up to speed on CBDCs and China’s e-CNY trials, as interest in these topics grows.

- “I first started talking about this with my team a year ago, and now we’re getting requests from clients daily, from many different types of clients on our spectrum, to have discussions about what’s happening,” Mr. Mackel said.

An e-CNY for an e-China. China’s crackdown on cryptocurrencies like Bitcoin, as well as its embrace of non-bank payment methods, increases the potential impact and implications of a CBDC in the country.

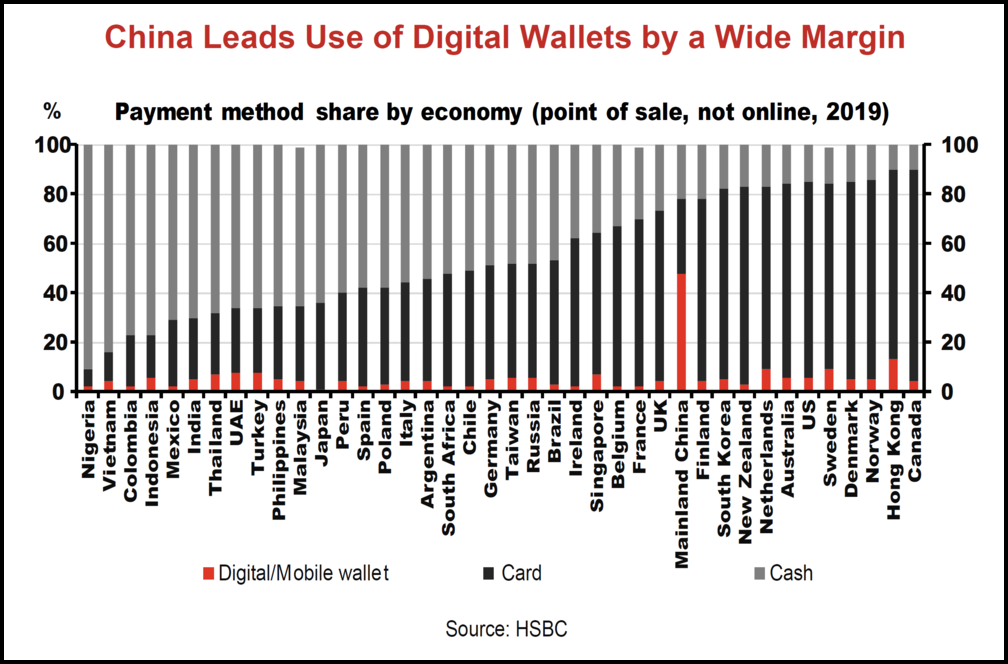

- Due to the proliferation of app-based payments like WeChat and AliPay, Chinese citizens currently far outpace any other nation’s use of digital or mobile wallets (see chart below), with over 800 million payments by mobile phones.

- China has publicly addressed the inherent risk of a population that heavily relies on these types of non-bank payments. If one of these apps ran into an obstacle, “that could be a source of concern,” Mr. Mackel said.

- He said “the line of thinking from the PBOC is that the e-CNY is going to complement what Alipay and WeChat pay already do” for consumers, while also offering an alternative and a way to hedge internal risk from the PBOC’s side.

- On the other hand, amid China’s increasingly strict regulation on cryptocurrency, Mr. Mackel believes the e-CNY could be an attempt to alleviate the curiosity around digital or crypto currencies.

A broader impact? In terms of the impact in other markets, it may be limited—for now. In the US, the Fed recently started to research the topic with MIT and the European Central Bank has published a number of whitepapers on what an e-Euro may look like, but for now it’s all theoretical.

- “What China has done, given their apparent success, is they’re making other central banks look far behind the curve,” Mr. Mackel said

- “Over next two to three quarters, I think that the information transfer between central banks and [other companies] will only steepen the learning curve.”

CBDC pros and cons. Central banks cite many reasons for exploring CBDCs, including improving the safety, robustness and efficiency of the payments system as well as its use as a monetary policy tool to spur financial inclusion.

- In the meeting, HSBC said the primary benefits of central bank digital currencies are:

- Lower transaction costs.

- Easier transaction processing for less developed banking systems (if CBDCs are enabled for cross-border transactions).

- Real-time indications of consumption.

- Useful for policy setting or combating inflation.

- Among the drawbacks:

- Russia’s central bank identified a CBDC as a potential tool to combat sanctions.

- A digital currency would make it far easier for a central government to track users based on ID.

- In a time of crisis, a run on a central bank digital currency could have a widespread impact on bank funding.