Splitting priorities into categories looking forward four years helps align treasury with finance and support business units.

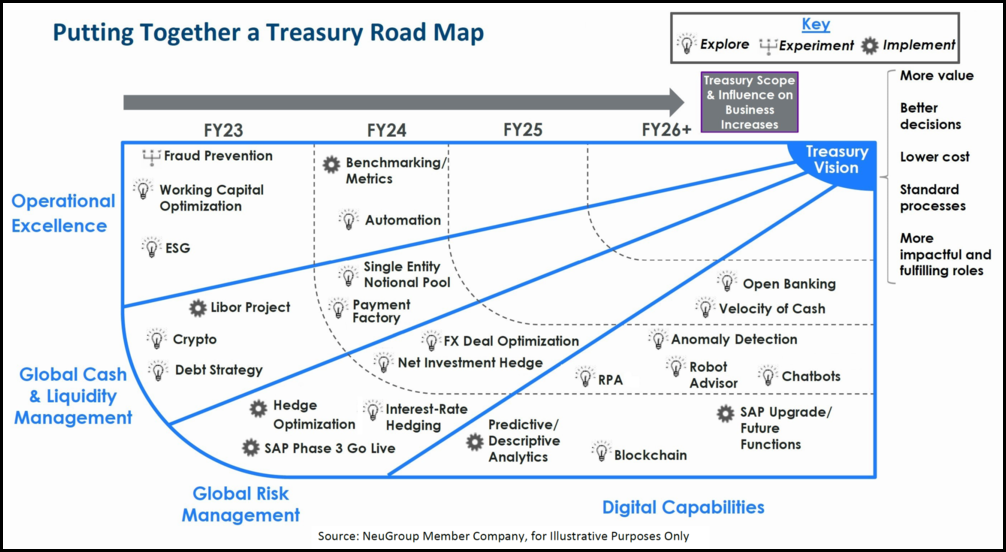

A picture of a treasury road map presented at a recent meeting of NeuGroup for Mega-Cap Assistant Treasurers was worth considerably more than a thousand words, drawing praise and insights from peers. To create it, the treasury team at the NeuGroup member company provided input about their priorities, helping create a vision and road map across four categories of goals:

- Operational excellence

- Global cash and liquidity management

- Global risk management

- Digital capabilities.

What’s in it. The document below illustrates dozens of initiatives, ranging from those being implemented, such as a Libor transition project, to those requiring experimentation, such as fraud prevention, to those in the exploration stage, including net investment hedging. The document looks ahead four years, starting in 2023.

Living and breathing. Far from static, the document can change throughout the year depending on changing priorities. For example, the company’s broad SAP implementation has pushed some other items further out.

- Treasury’s priorities must align with the greater finance department and company goals overall. Noting finance’s center-of-excellence goal to increase the use of analytical tools to replace manual processes, the AT said, “We have to make sure our priorities are using the same lens as the rest of finance.”

Support the business. Another member said her treasury team uses a similar approach that includes a fifth category of goals, business support. She said the treasury organization’s lean structure makes it essential for it to understand the business units’ initiatives early on—not after key decisions have been made.

- For example, a business may decide to change its multi-country credit card program, and treasury taking proactive measures to facilitate the change rather than reacting to it is more efficient, both for treasury but also for the business initiative.

- “How do we stay ahead of that and get pulled in early enough to help guide some of the choices so they’re less painful and inefficient in the long-run?” the AT said.

- The presenting member said she would follow suit: “I love adding the additional section to support the business.” Business support is already a treasury priority, the member said, and adding it to the chart will strengthen the document as a tool to help make the case for financing needs.

- Another member agreed that supporting the business is treasury’s top priority. His team also devotes significant resources to tax-related transactions, indicating tax could be an additional category of treasury goals. “Tax is another constant battle we face,” he said.

Understanding business priorities. To help align treasury’s priorities with those of the operating businesses, the presenting AT said, there are forums throughout the year when treasury members interact with investors to understand where they see the businesses focusing. And monthly and quarterly meetings are scheduled with business leaders to understand their priorities.

- A member from a company with multiple subsidiaries said his treasury takes a similar approach, determining its own priorities over the next 12 months and then talking to the treasurers or finance heads of the business units to understand their priorities and where there are overlaps.

- “We all understand we don’t have unlimited resources, so we need to try to prioritize what the next set of initiatives will look like,” he said.