How one member uses Cashforce to save time and money on FX trades—and helped create an automated hedging process.

One assistant treasurer at a recent NeuGroup virtual interactive session said that her primary project for 2021 is “to make treasury as no-touch as possible.” This is a common theme for treasurers recently, though it’s not always clear where to start. Her first step was to seek potential connections in existing processes and platforms—which led to an overhauled and streamlined process for foreign exchange hedging.

- The member already was using Cashforce, a fintech that allows deeper analysis of cash flow, to assist in cash flow forecasting, and saw potential in connecting it to Citibank’s CitiFX Pulse platform through the company’s TMS.

- Through collaboration with Cashforce, Citi and her TMS, she was essentially able to turn the company’s hedging policy into an algorithm that reads the forecast and will potentially execute or propose trades all on its own.

From forecasts to forex. The member said this is only possible because Cashforce can forecast at a high level of granularity. The AT said she was “really lucky” that the tools work together so well.

- “The forecast at that level of detail is a forecast in document currency,” she said. “And because I can have forecasting at nearly an invoice level, I know what that currency is going to be.”

- Through the forecast, she said, the company is able to see what its FX position is going to be. “Then if I layer over what hedge I might already have in place, it will be able to tell me what are my gaps,” she said.

- “The idea is to send it out so that we could auto-trade to fill the gaps below a certain threshold, let’s say 100 grand or less, and review above that just to check the data before we trade.”

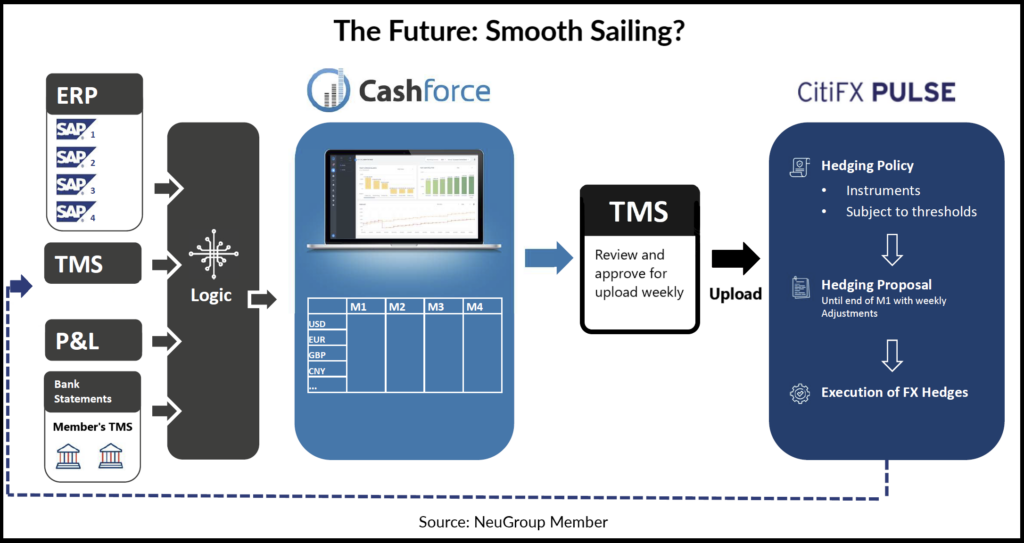

A closed loop. Nicolas Christiaen, Cashforce’s CEO, said that, before this project, the member’s process was “very disconnected,” but all it took was connecting the dots.

- “On the data input side, the ERP, TMS, P&L and bank statements are now put through [Cashforce’s] transformation layer, which results in a cash flow forecast,” he said. “As is very specific in this case, it’s a forecast by currency, by month.”

- Currently, the company then uploads this forecast back into its TMS for review, and manually executes FX trades based on the company’s hedging policy.

- “When these hedges are executed, the hedge amounts will pass back into Cashforce via the TMS, closing the loop,” Mr. Christiaen said.

A step further. With the proposed system that the member has designed with Citi, the company could include its hedging policies as a rules-based program in CitiFX Pulse that can read this forecast.

- It would then “put in place the instruments used for the hedges for the thresholds that need to be taken into account,” Mr. Christiaen said. “Which ultimately results in a proposal.”

- The chart below demonstrates the vision: As the data feeds into Cashforce, which outputs a forecast, that forecast is reviewed by the member and uploaded to CitiFX Pulse, which can automatically execute or propose FX hedges.

Constant change. Automation is “an awful lot to bite off,” the member said, and recommends starting slow on this kind of process:

- The first step is to test what systems you already have. “A lot of us have pockets in the organization of different systems that can be leveraged. Some of them can’t do what they say they can or aren’t quite what you need—but sometimes you get lucky, as we did.”

- She said it is also an opportunity for treasury to work with fintech partners to build exactly what it needs.

- Collaboration and clear communication with IT is “super important,” which she learned the hard way. “Despite really clear instructions from Cashforce on the size of server we would need, [IT] gave us a quarter of that size and we now need a bigger size,” the AT said.

- She warns that, although automation opportunities are promising, it’s not always smooth sailing. “Be aware of the opportunities, but also be aware of the work: automation is doable but takes an awful lot of time.”

- “As the business changes, the structure changes as well,” she said. “The only constant within treasury is change.”