One corporate used IntraFi Network’s services to access FDIC insurance on a large deposit.

One of the obstacles encountered by NeuGroup members whose diversity and inclusion (D&I) initiatives include supporting banks that serve minority communities is connecting with the right people at those institutions and ensuring the safety of their deposits.

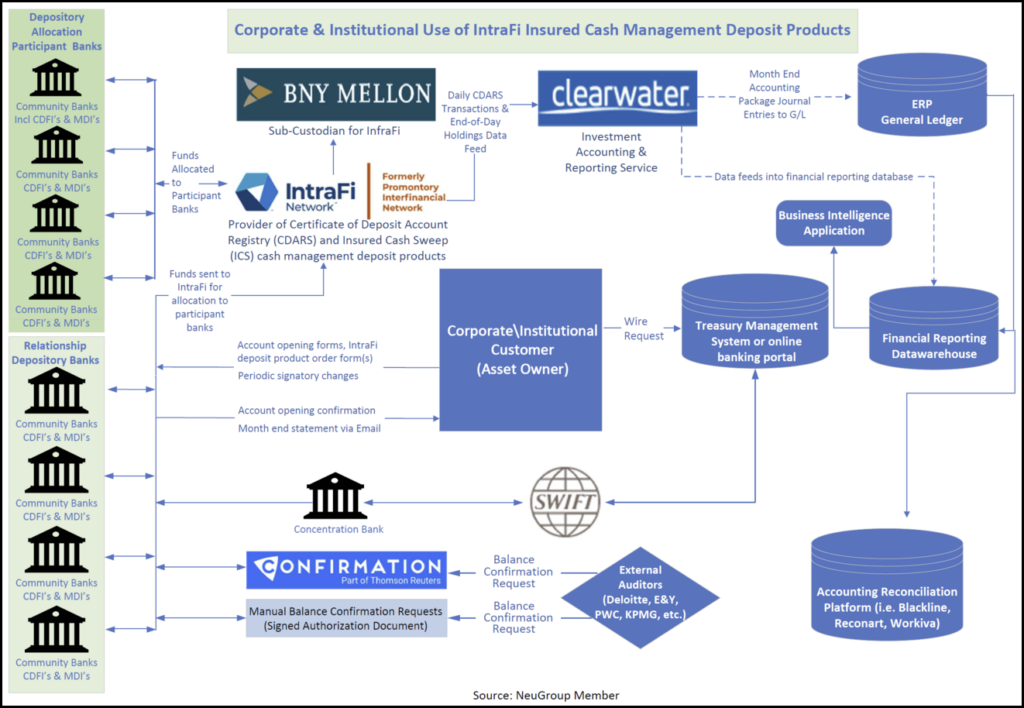

- To address that issue and others, NeuGroup in 2021 showcased how IntraFi Network—formerly Promontory Interfinancial Network—is making it easier and more efficient for corporates to place deposits with minority depository institutions (MDIs) and community development financial institutions (CDFIs), and simultaneously gain access to large-dollar FDIC insurance.

- NeuGroup D&I sessions included one member who asked IntraFi and Clearwater Analytics, the investment accounting and reporting service provider, to develop and integrate daily data feeds between their systems.

A clear goal, a less clear path. This member’s company found a way to support MDIs and satisfy the company’s goal of protecting its excess cash balances with access to FDIC insurance.

- The company worked with MDIs to place its large deposit using IntraFi Network’s Certificate of Deposit Account Registry Service; as a result of the placement, the MDIs received a matching amount of reciprocal deposits in return. Each MDI can use the reciprocal deposits to lend to individuals and businesses in its local community.

- The member said that although his treasury group had a list of MDIs and CDFIs, connecting with the appropriate staff at many banks proved difficult; calls to 800 numbers got routed to voicemail boxes and progress was also slowed by institutions’ internal fraud and security policies.

- In retrospect, the member said he wished the company’s treasury team had leveraged IntraFi earlier and better understood “where IntraFi sat in the equation.”

IntraFi and relationship banks. At a recent NeuGroup session, IntraFi executives explained that their service allows corporate depositors to “gain the diversification of thousands of banks and the convenience of dealing with only one relationship institution,” according to their presentation.

- Jane Gladstone, IntraFi’s president, told members that IntraFi’s network of about 3,000 financial institutions gives each depositor access to up to $150 million of FDIC insurance while working through a single relationship institution.

- That’s possible because the relationship bank places the large deposit, using the service, into other so-called participating destination banks and each one receives $250,000 or less.

- The member’s company had deposits placed by several relationship (MDI) banks using the service, and the funds were allocated among other destination banks (see chart).

Solving the reporting puzzle. The member company’s corporate requirements included daily electronic visibility to all IntraFi deposit product transactions and balances via investment reporting. Also:

- An automated month-end statement available via PDF on relationship bank letterhead (same as a paper statement).

- Deposit product holdings reported at the participating bank level.

- To accommodate the member, IntraFi and Clearwater developed the necessary data feeds and implemented them in less than six weeks in.

- This gave the company daily automated visibility for reporting transparency, accounting automation and risk oversight and management.

Other corporates may benefit. The data feeds not only allow the company to scale its MDI program to additional banking partners, but also can be leveraged by any organization that uses Clearwater and submits deposits for placement by MDIs using IntraFi’s CDARS and Insured Cash Sweep products. They will have a seamless process to “look through” to see deposits placed at each destination bank, the member said. Other benefits he listed include:

- Accounting interface from Clearwater to the general ledger.

- Improved reporting resulting in easier compliance with applicable treasury policies.

- Access to FDIC insurance eliminates potential credit risk on uninsured deposits placed with banks.

- The ability to scale up the program through increased deposits across multiple participant banks.