Low adoption rates in the US and issues such as routing rights and interchange fees may present challenges for some retailers as contactless payment grows.

It’s no big surprise that the pandemic has pushed more US shoppers to use contactless credit and debit cards as well as mobile wallets. Tapping or waving a card or phone is a cleaner, safer way to pay than swiping or inserting a card.

- But what stood out at a recent NeuGroup for Retail Treasury meeting was the frustration voiced by members about aspects of the shift to contactless payments—each aspect related in some way to costs.

One-sided investment? “This frustrates me,” said one member, adding that companies like hers were “forced to step up and invest” in technology enabling chips and contactless payments or risk being liable for fraudulent charges. The problem? Card issuers, she said, did not include contactless technology when they introduced chip cards—meaning retailers had to make “a one-sided investment” with respect to contactless payments.

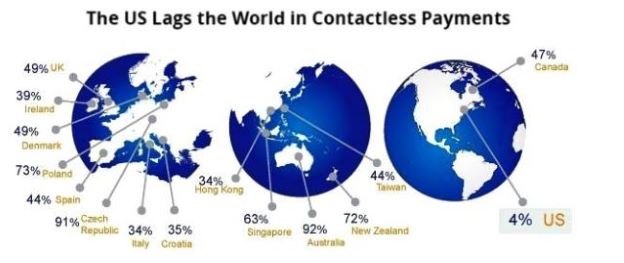

The US as laggard. One reason that investment hasn’t paid off for many retailers is that very few US consumers are making contactless payments, even though about 75% of merchant locations can accept them and card issuers are now providing them. As the chart shows, only 4% of face-to-face transactions in the US are contactless, far below the global average of 50%.

- This discrepancy meant merchants have not benefitted significantly from faster transaction processing times or throughputs available with contactless payments, the member said. And employees of quick service restaurants with drive-through service had to keep passing cards back and forth with customers.

- But the times are changing fast: More than half (51%) of Americans are now using some form of contactless payment, which includes tap-to-go credit cards and mobile wallets like Apple Pay, according to Mastercard.

Pinless debit in peril? Another member pointed out that companies like his that process pinless debit transactions—which by law allow merchants to route transactions away from the big global card networks and pay lower interchange fees—may lose that ability if they opt for contactless payments.

- “This is the networks’ way of eliminating pinless debit because of lost revenue,” he said.

Upside down. The last area of frustration discussed concerns the interchange fees merchants pay for contactless transactions over the internet using biometric technology in digital wallets, making them among the most secure transactions, one treasuer said.

- He argued that this superior level of security should mean interchange fees for mobile transactions online are the lowest paid by retailers. They’re not.

- They’re among the highest, he said, because they are treated in most cases as any internet transaction, which is less secure than when a customer is presenting a card in a physical store or restaurant.

- That there is no correlation between the fees charged and the relative level of security doesn’t make sense to this treasurer.