Management is putting greater focus on cash forecasting accuracy. Some in treasury wonder whether the extra work is worth it.

After a decade of cheap money, liquidity is once again at a premium. Because it costs more to borrow, and pays more to invest, treasuries are under pressure to improve cash forecasting accuracy. In this environment, “treasury has three important mandates: don’t run out of cash, don’t run out of cash and don’t run out of cash,” one member said.

- “From a treasury perspective, this is the time when the rubber hits the road,” another treasurer said. “The organization looks to treasury for guidance. Whereas FP&A’s cash flow forecast becomes completely irrelevant.”

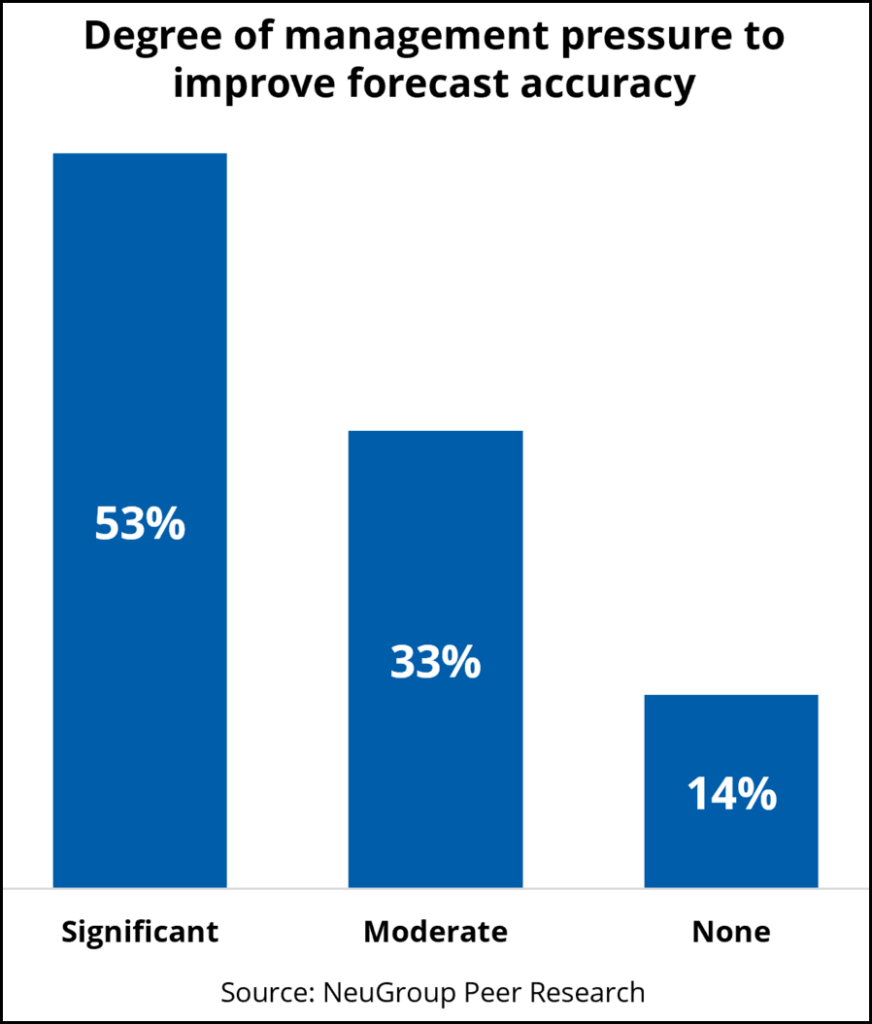

Treasuries are feeling the pressure. At a recent NeuGroup meeting, 86% of participants said they are experiencing significant or moderate pressure to get it right (see chart).

- Especially in this environment, the forecast must provide meaningful insight that can lead to action, e.g., tightening working capital management to reduce external borrowing and minimize idle cash and take advantage of higher yields.

- One treasurer, recalling the 2008 liquidity squeeze and the early days of the pandemic said, “Some treasury staff have not lived through a real liquidity crisis.”

Getting over short-term volatility. The problem treasuries face is that producing the cash forecast remains a tall challenge. NeuGroup’s May 2022 Cash Forecasting Survey found that the primary hurdles to producing the forecast are lack of visibility into cash (88%) and access to data about cash (50%). Absent accurate and up-to-date information, treasury is hamstrung in fine-tuning forecast accuracy.

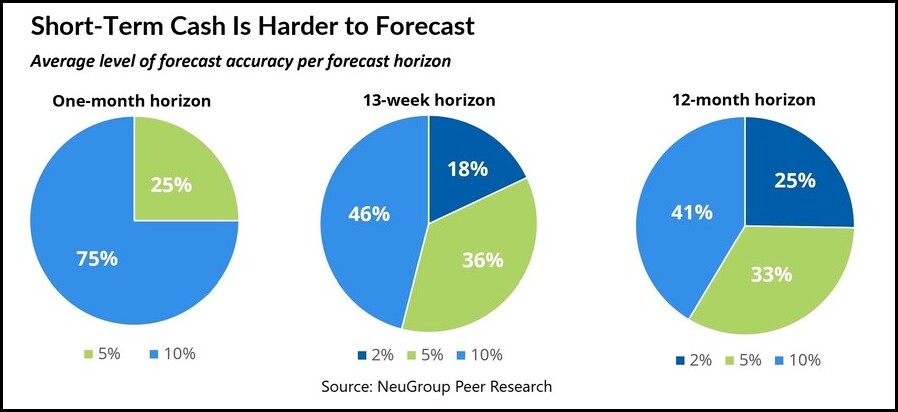

- As the chart below shows, the forecast-to-actual variance gets smaller as the horizon gets longer. That reflects greater volatility in shorter-term forecasts because of uncertainty about the timing of incoming and outgoing cash. While treasury may expect $500 million in receivables in Q1, some of the revenue may come at the end of the quarter (which is why for quarterly forecasts, some teams forecast monthly for months one and two and weekly for the last month of the quarter).

Does accuracy matter? Given these obstacles, some treasurers wonder whether trying to shrink the variance is worth the effort. “The ROI just does not make sense,” one member said.

- “This is a case where the 80/20 rule applies: As long as we are directionally correct, I am OK with that.” His company reported a variance between forecast and actuals exceeding 10%.

- Another company sets a minimum liquidity threshold for its subsidiaries, so forecast precision does not really matter.

Driving action. But several treasurers argued that accuracy is essential to driving funding and investment decisions, especially in this environment.

- “If you can’t make a decision based on the forecast, then why are you even forecasting?” one member asked.

- At another company, cash forecasting accuracy and discipline are a big focus. Because cash has been plentiful, some organizations have loosened their grip, according to this member. “But cash forecasting is like a muscle: You have to exercise it to stay fit.”