Standard Chartered guides a client to hedging that requires more analytics but aligns more with risk management goals.

The increased frequency of so-called black swan (or gray rhino) events roiling currency markets recently has more corporates establishing or revamping FX hedging programs designed to minimize earnings volatility. They face a host of decisions involving which exposures to hedge, timing, instruments and overall approach—static, dynamic or somewhere in the middle.

- At a recent meeting of FX risk managers, sponsor Standard Chartered, along with a NeuGroup member that is a client of the bank, explained how and why the corporate shifted from a static hedging program to one that is dynamic—as well as the pros and cons of the company’s move and those of other approaches.

Static scorecard. Standard Chartered’s presentation described a static hedge execution style as one where a corporate hedges all its exposures at the beginning of the year, a simple approach with minimal execution costs.

- The major downside of static strategies, though, is the year-over-year volatility they create, the bank said.

- The NeuGroup member said the rigidity of the static approach also left the company “fully at the mercy” of markets and bank counterparties because hedging needed to be completed by a certain time each year.

Defining dynamism. To reduce volatility, better manage FX risk and allow treasury to take advantage of favorable markets, in the last year Standard Chartered has helped guide the corporate to a more dynamic approach.

- The policy for forecasted cash flows prescribes hedge coverage levels for up to one year out. Now, though, the company is transitioning to a quarterly, layered hedging strategy, which also extends to forecasts beyond the one-year horizon.

- In its presentation, Standard Chartered illustrated how a layered approach reduces quarter-over-quarter gains and losses from FX volatility.

- The disadvantage of a dynamic approach is that it is more time consuming to track exposure changes and execute the resulting more frequent hedges. And the more flexibility you build into the program, the more time-consuming it becomes—which is why a decision framework is important.

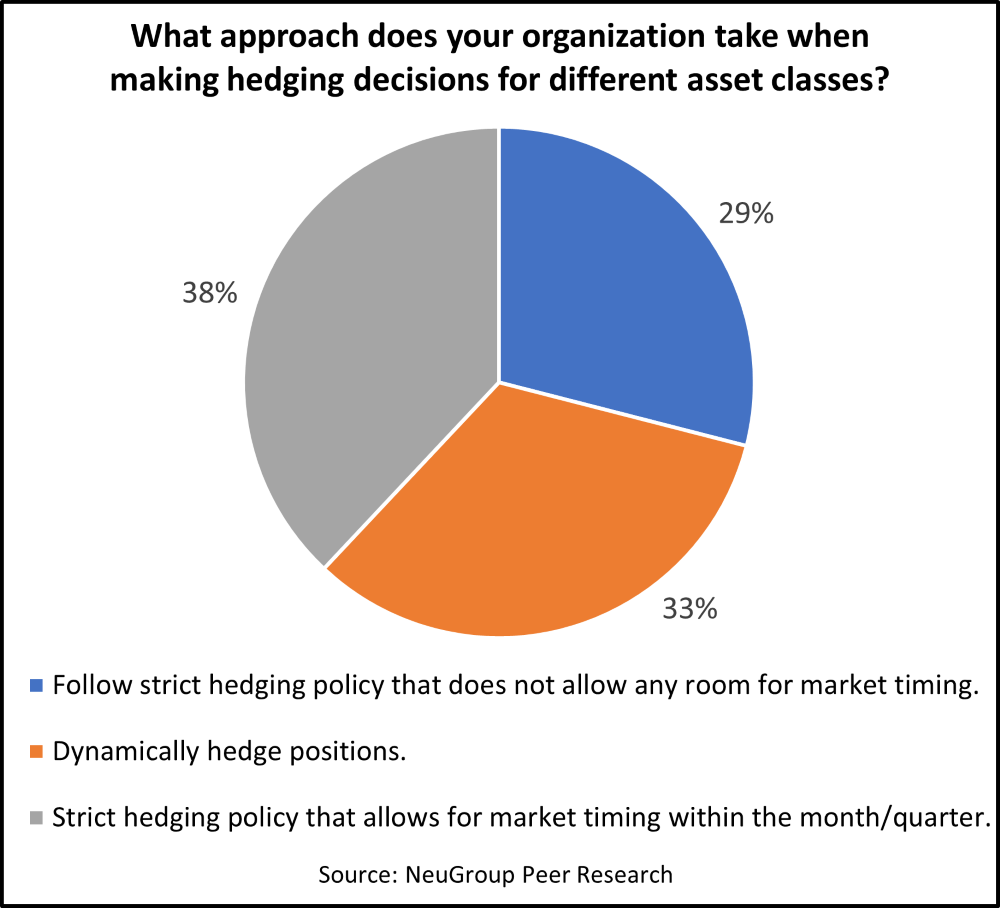

Exception, not the rule. Today, the member is able to take several factors into account when deciding what to hedge, how much and when to meet established risk tolerance levels. That puts him among the one-third of members who said in an in-meeting poll that they can dynamically hedge their exposures; two-thirds of respondents have either no flexibility on timing hedge execution or some flexibility, but only within a month or quarter (see chart).

Exposure and confidence. The most important factor is confidence in the exposure forecast. For risk managers, higher confidence in exposure data allows a higher hedge ratio without risking over-hedging (important to avoid for hedge accounting reasons).

- The company’s hedge ratios take into account the degree of certainty of forecasted exposures, while contractual exposures by their nature are more certain but may instead have some timing variances.

- Balance sheet exposures should be “majority hedged,” according to the company’s presentation.

- Its instrument tool kit includes outright forwards, swaps and NDFs, as well as options (calls, puts and collars).

A decision framework. Under the member’s new program, a decision framework helps determine which instrument or combination of instruments will be chosen to hedge at any given time.

- Treasury has built a spreadsheet “monitor” that looks at market spot and forward rates, forward points (carry), at-the-money options premium and the 25-delta skew (call-vs.-put volatility differential), which can be compared to their three-year historical levels.

- Backtesting shows how instruments have performed under different circumstances and can be used to support the instrument decision.

- The team is allowed to take in-house views on currencies, supported by purchasing-power-parity (the long-term fair value of currencies) and other factors, tempered by bank forecasts. A caveat on research is to pay extra attention to very divergent views to see if the publishing date of the bank’s forecast might explain it.

- Depending on the strength of the in-house view, collar strikes may be set to incur some premium cost (vs. a zero-cost collar) to capture potential for upside participation.

- The performance or success of instrument choices is benchmarked against a strategy using only forwards.