Oil and gas sector analysts are scrambling to explain to energy companies the link between ESG scores and credit risk.

The momentum behind ESG mandates and the conviction that companies committed to sustainability represent better investment risks have put pressure on ratings agencies to reconcile traditional credit ratings with ESG scores.

- This reconciliation has become more challenging as the agencies themselves begin to offer ESG scores or ratings as well as sustainability assessments. One approach is to explain in more detail how ESG factors, which agencies say have always been part of their risk assessments, are incorporated into credit ratings.

- This effort is underway with rated firms in all sectors. However, it has been a major point of discussion over the last few months with members of NeuGroup for Oil & Gas Treasury at meetings sponsored by Societe Generale, including during sessions with sector analysts from Moody’s and S&P.

Factoring in ESG. S&P says it has factored in environmental, social and governance issues into credit ratings as part of its industry risk assessments, business risk profiles, profitability analyses and management/governance scores.

- Often, the risk is linked to jurisdictions where the companies face greater regulatory risk. Or where they have greater exposure to physical risks including hurricanes. These factors are generally reflected in their business risk profiles.

- In addition, environmental incidents, such as oil spills, might also impact liquidity and show up in a company’s financial risk profile, S&P says.

- Moody’s, meanwhile, will assign issuer profile scores for each of the three areas—environmental, social and governance—based on factors deemed most material to credit. It also has introduced a carbon transition assessment scorecard for certain sectors to assess the current, medium and long-term exposure of the issuer to the transition to low carbon business activities.

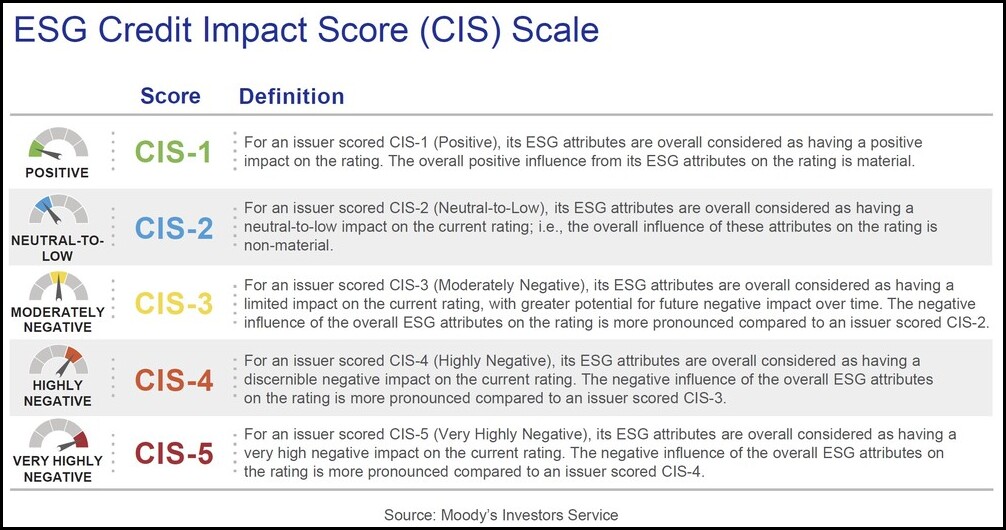

- True to the analytical rigor that Moody’s is known for, it will also layer on an ESG credit impact score that has a five-point scale (see table below), which is significantly influenced by the company’s industry sector. Most of the oil and gas sector will get a score of three, meaning the issuer’s ESG attributes are overall considered as having a limited impact on its current rating, with greater potential for future negative impact over time.

Impact skewing bigger. It should come as no surprise, given the increasing attention paid to climate change and the growing likelihood of a government response in the US and globally, that the potential for ESG factors to negatively affect credit ratings is increasing.

- S&P, for instance, in January revised its “industry risk assessment for the oil and gas E&P industry to ‘moderately high’ from ‘intermediate’ due to the potential for stricter regulations, substitutions and secular shifts in industry supply/demand fundamentals the energy transition entails.” This initiated a lower rating for most of the oil majors and a “recalibration” of business risk profiles for other entities in the sector.

- S&P has also noted “early evidence of a funding gap between entities viewed as having lower vs. higher carbon footprints,” which will impact the cost and availability of capital.

Issuers want to shine on merit. As the impact of ESG risk factors looms larger, issuers want their rating analysts to shine a light by merit. One of the key complaints NeuGroup members across all sectors make is that the ESG risk factors seem to be applied more on a sector basis than an individual issuer basis.

- Issuers in carbon sensitive sectors in particular want to get credit for their carbon transition story, along with other ESG initiatives, to help them stand out among peers.

- Without the ability to raise their credit outlook on individual merit, issuers in carbon-transitioning sectors must bring their peers along to mitigate the adverse impact of ESG risk factors on their credit rating.

- Until ESG raters adopt an approach like that for credit ratings, with issuer dialogue and information sharing, including some disclosure of inside information, it is very challenging for issuers to manage their external ESG assessments.

Issuer funding at risk? Unless and until rating agencies explain effectively how issuers can individually impact ESG risk factors on their credit rating, and do the same on the ESG scores, they will be encouraging treasurers to ignore the ratings, and go directly to debt investors with their meritorious carbon transition and ESG reporting and contextual stories. Eventually, they will need a new funding model for credit ratings.