One corporate uses data on firms’ racial and gender representation relative to the US Census and their peers.

A dearth of minority-owned firms that manage fixed-income assets—and a desire to hold all its asset managers accountable on diversity initiatives and metrics—led the treasury team at one NeuGroup member company with a large cash balance to develop a scorecard for diversity, equity and inclusion. The company’s treasurer shared it with peers at a recent meeting of NeuGroup for Mega-Cap Treasurers.

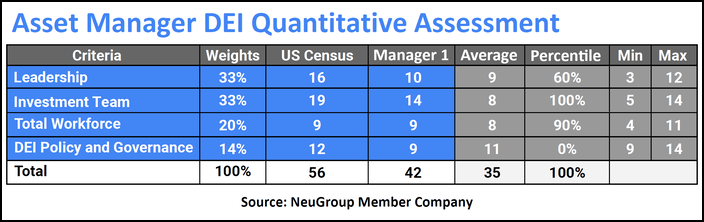

The treasury team’s asset manager DEI quantitative assessment shows the diversity performance of 11 investment firms relative to each other and in comparison to a score based on statistics from the US Census on the representation of women and people of color. Some of the data used to produce the scorecard is public; the corporate had to request the rest from its managers.

- The company is using the scorecard as part of a dialogue about DEI with its asset managers. The treasury team’s overarching goal is to share thought leadership on diversity with its partners, describe how the company is thinking about the issue, and discuss how the asset manager plans to make progress on its DEI strategy.

The scorecard has four categories, shown below with the weighting the corporate gives each category.

- Leadership (33%)

- Investment team (33%)

- Total workforce (20%)

- DEI policy and governance (14%)

Large disparity. The results showed—unsurprisingly—that none of the 11 firms have a DEI score equal to the representation of women and people of color as documented in the US Census. The combined average score of the managers totaled 35, versus 56 for the US Census-based score, according to the formula developed by the corporate (see figures in bold in the table below).

- The treasurer noted the relatively wide disparity among the firms, especially in some categories. The investment team score, for example, ranged from 5 to 14, with an average of 8. That compares with the US Census-based score for this category of 19—leaving plenty of room for improvement.

- The table compares managers against their peer group as well as the US Census across each category (and several unshown subcategories). The figures to the right of the “Weights ” column in the table show:

- The US Census-based score for a given category as calculated by the company.

- The manager’s score (Manager 1 as example in table).

- The peer group average.

- The manager’s percentile ranking within the group.

- The minimum and maximum scores of the peer group.

Discussing the data. The treasurer told peers at the NeuGroup meeting that he discussed the scorecard results with a few of the managers—including some of the company’s largest partners—and found them “incredibly receptive.” That’s not particularly surprising, in part because the corporate represents a very large account for the firms.

- Some asset managers asked about the corporate’s use of US Census data to calculate scores, given differences in demographics between cities and states, including talent pools and the population of college graduates.

- The corporate recognizes the limitations of the US Census data and makes clear to partners that it views the benchmark as more aspirational; it emphasizes using the scorecard to assess the managers relative to each other.

Move money? In response to peers’ questions, the treasurer said the company will not move assets under management based on the results of this initial analysis of the firms’ scores. The goal is for the firms to show progress over time. The corporate will consider moving assets from a firm if it shows no progress over a longer period.

- Companies that use DEI scorecards will need to figure out how to weigh the scores in the context of the return performance of a given manager, especially close partners that hold significant, sizable assets.