Bank of the West/BNP Paribas sees inviting conditions for young companies raising capital in 2021.

Capital markets bounced back strongly in the second half of 2020, with soaring levels of convertible bond deals and a healthy climate for IPOs and high-yield bonds. Favorable conditions will continue to benefit emerging technology companies this year, according to Bank of the West/BNP Paribas, sponsor of the fall meeting of the Tech20 High-Growth Treasurers’ Peer Group. Highlights:

Low high-yields. Volatility due to political tensions and a second wave of Covid cases worldwide put a damper on the high-yield market at the start of the fourth quarter, but the market quickly strengthened following the November election.

- High-yield deals had reached a record $453 billion through mid-December, nearly twice the levels of 2019.

- Yields are in record low territory, around 4.3% vs. 2019-2020 average of 6.41%, Bank of the West/BNP Paribas said, a favorable environment for high-growth companies.

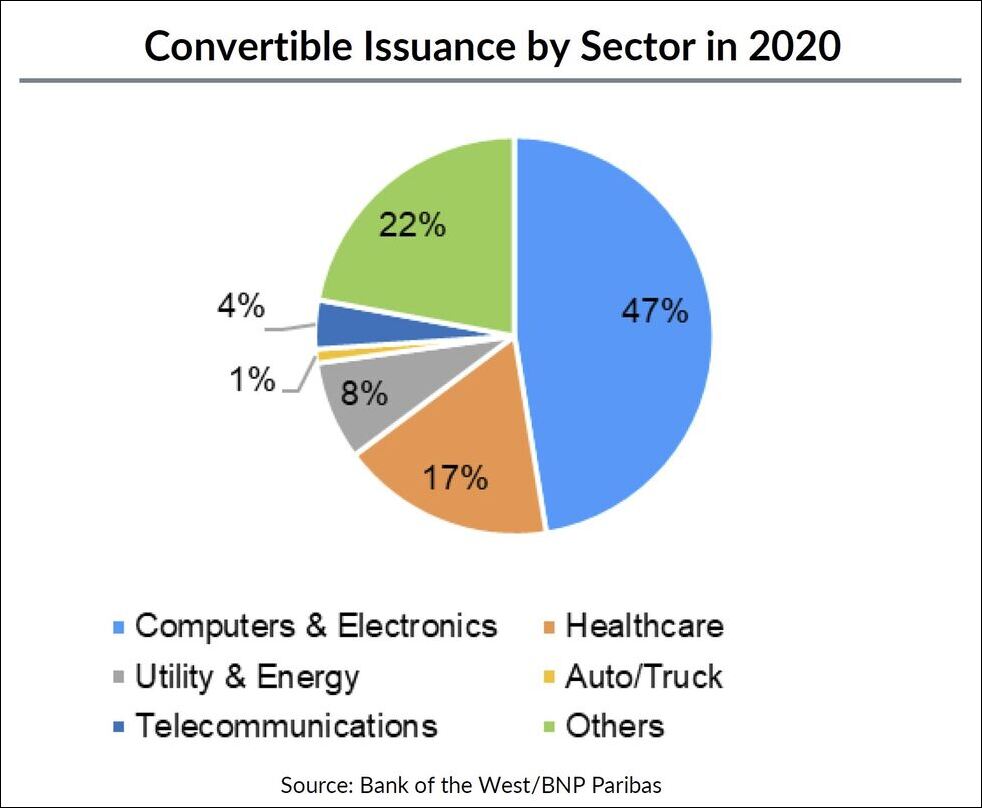

Cool convertibles. The US convertible bond market hit near-record issuance levels in 2020, reaching over $100 billion, with tech companies issuing nearly half of all convertible debt (see below).

- Even with investor-friendly deals made at the onset of the pandemic, last year had the highest conversion premium and the lowest average coupon in the last decade, creating an ideal environment for issuers.

- The bankers said market confidence has sparked the return of 24-hour marketing periods, as opposed to pre-market launches for same day pricings.

IPOs made easier. Constructive market conditions and a faster, easier process have made initial public offerings increasingly attractive for developing companies.

- Many members shared their positive experiences with virtual roadshows, which can take under an hour and require no travel expenses. They also give growth companies access to a broad range of US and international investors.

- “It’s hard to see a world post-Covid where investors fly to Europe to attend investor meetings,” one member said. “I think it’s here to stay.”

- The lag between public filing and pricing an IPO rose to a month or more, a growing pipeline that the bankers described as “a sign that issuers have more confidence in the stability of markets.”

SPACs surge. Special-purpose acquisition companies (SPACs), an alternative to IPOs, surged last year, a trend that some analysts say is likely to continue in 2021.

- Hedge funds looking for money market alternatives in a low-yield environment boosted demand for SPACs, a positive for growing tech companies.

- Between the high-profile success story of Virgin Galactic and a willingness of target companies to go public via a “de-SPACing” acquisition rather than a traditional IPO, SPAC issuance in 2020 alone exceeded the previous decade combined.