The pandemic is taking a toll on working capital, leading to more rationing of cash, an FEI survey says.

Far fewer finance teams planned on cutting headcount in the second quarter of 2020 than in the first, according to a survey released this week by Financial Executives International in collaboration with Deloitte. Meanwhile, the percentage of companies reporting a drop in working capital balances in Q2 rose by a third as the pandemic took hold.

- The survey of 170 of FEI’s members—CFOs and other senior finance executives—found that in Q2, 55.7% of respondents expected to maintain their headcount, while 24.5% indicated planned workforce reductions. In Q1, 46% of respondents expected to reduce headcount.

- Among myriad reasons for retaining staff, said Dillon Papenfuss, manager of research and analysis at FEI, the most commonly cited one was uncertainty. “These are complex, volatile times and companies need ample supplies of human capital to not only survive but also find new avenues of long-term growth,” he said.

- The survey found half of staff across all organizations will work remotely for the remainder of 2020, with 51.5% in the Northeast saying that, and 64.7% on the West Coast.

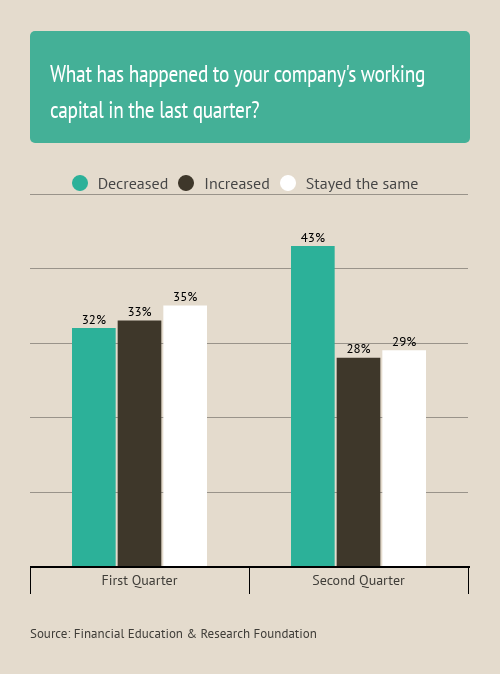

Working capital blues. Nearly half of respondents, 43%, said their companies’ working capital balances decreased in Q2, compared to 33% in Q1.

- The increase “illustrates a profound erosion of corporate cash flow,” FEI’s survey report says.

- One Chief Financial Officer remarked that his organization is focused on conserving cash and that cash-related financial metrics have become the KPIs his team scrutinizes the most.

- FEI said that if not for CARES Act funding the proportion of respondents reporting decreasing working capital would likely have been higher.

- Financial executives expressed a preference for pausing various business actions instead of canceling or cutting them.

Forecasting challenges. Complicating decision-making, however, is difficulty forecasting in the current environment, cited by 66% of respondents. That difficulty is heightened by the uncertainty of COVID-19’s impact and the timing of a vaccine, the report says, noting that one senior-level executive said his team is planning for 2021 based on whether a vaccine is ready by the end of Q4.

- Companies are often using different scenarios as part of their forecasting process, and in the current environment the inputs and outputs of the various scenarios have a high degree of variability,” Andy Elcik, national managing partner of accounting, reporting and advisory services, Deloitte & Touche, said in a statement. “To manage through this some companies are using rolling 12-month forecasts to help assess the evolving economic landscape.