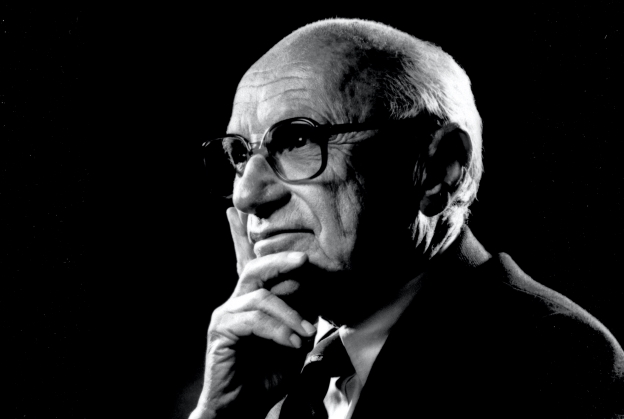

50 years after Milton Friedman’s landmark essay on profits, treasurers are trying to embrace stakeholder capitalism responsibly.

By Joseph Neu

Milton Friedman’s essay, “The Social Responsibility of Business Is to Increase Its Profits,” turned 50 this past Sunday. Many commentators are seeking to mark the occasion with efforts to either square stakeholder capitalism with Friedman’s view—helping stakeholders is good for long-term profitability—or call him out as myopic to the more equal, inclusive and sustainable future that young people—and others—now want.

Today’s reality. The timing is telling. We see more and more of our members seeking to find a way to support corporate social responsibility, the S in ESG (environmental, social, governance), along with addressing racial inequality in favor of inclusiveness, helping the communities in which they operate and supporting a more sustainable future.

- A repeating theme, however, is that members want to use capital, if not capitalism, to accomplish these good goals.

- They also want to support stakeholders and communities in need in a manner that rewards authentic efforts to build their capabilities. And in ways that justify capital contributions (investments) with success measured in real key performance indicators (KPIs)—dare I say profits—as they might be more broadly defined.

Fiduciary duty. It is hard for treasury professionals to give up their fiduciary duty, be it to shareholders or some larger cohort of beneficiaries. So their first instinct is to do something to help disadvantaged stakeholders without doing anything they would not otherwise do—business as usual (BAU). For example:

- Treasury needs to deposit excess cash in a bank, so why not a minority-owned bank lending to disadvantaged communities?

- Treasury needs to retain broker-dealers to assist with buying back shares or to issue bonds or commercial paper; why not use some that are minority owned?

- Treasury is being asked to invest corporate funds in a manner consistent with a risk-adjusted return mandate. Might investments in disadvantaged stakeholders mitigate risk (through diversification and supporting political-economic stability) to the extent that they meet that risk-return profile?

A goal for government. More prominent than 50 years ago, today’s backdrop to all this is the concern that the political process and government are too slow, ineffective or no longer capable of socially responsible actions sufficient to help stakeholders.

- This would be less true if politicians took seriously their fiduciary obligation to act in their stakeholders’ best interests in the same way that treasury professionals do.

- That is, if they sought to do good via BAU and to measure success with real KPIs, if not profits.