Two debt issues show the benefits of both planning and flexibility when tapping capital markets.

Investors clamoring for highly rated corporate bonds before the financial-market meltdown began in late February and again in early May provided opportunities for issuers to do debt deals at very attractive terms under different circumstances. Two members of NeuGroup’s Assistant Treasurers’ Leadership Group discussed with peers the key factors and market dynamics driving their companies’ deals.

The similarities. Each company’s offering, one at the start of 2020 and the other in early May, was oversubscribed by several multiples.

- Each deal saw spreads inked well below initial price talk.

- Both companies are in the technology sector and their deals may have benefited from investor demand following a dearth of tech offers in 2019.

Thinking ahead pays. With existing bonds maturing over the summer and volatility likely as November elections neared, the first issuer decided that refinancing early was prudent. Had it waited a few months, the combination of blackout periods and the market impact of the coronavirus could have derailed its efforts.

So does flexibility. The second issuer had planned to refinance at year-end 2020 an existing deal maturing in summer 2021. Then it drew down its revolver in March, prompting a rethink. A lesson learned, the issuer’s AT said, was “be quick and flexible enough to react to market changes.”

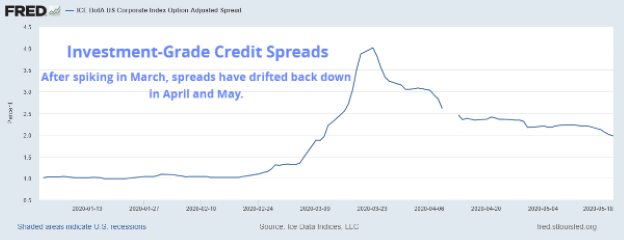

- Equities rallied and credit spreads tightened in April in response to the Federal Reserve’s aggressive efforts to stabilize markets and fiscal stimulus.The company filed its 10-Q at month’s end, a week after its earnings, to give investors time to read disclosures, especially regarding COVID-19.

- The offering prospectus noted explicitly that proceeds were to pay down the revolver and refinance existing bonds, reassuring investors.

ESG talk helps. The first issuer’s bond wasn’t a sustainability bond, but slides in its NetRoadshow presentation discussed the company’s ESG footprint, and the CFO and treasurer explained its ESG initiatives during investor calls.

- “That allowed us to draw a more diversified group of investors,” the AT said.

Rewarding book runners. When assigning active book-runner positions, the first issuer prioritized help it had received on capital structure and allocation issues—beyond the banks’ normal treasury-operations services.

- The second issuer chose active book runners from the first tier of its bank group and appeased a tier-one member that didn’t get that lucrative position by giving it the swap-manager role. “We typically would have unwound [the forward-starting swaps] ourselves, but we gave them that business,” the AT said.

Saving money. The second issuer informed banks that it planned to pay down the revolver and asked them to waive the “breakage fee” for drawing on the bank facility. “Since we were dangling the bond economics, it gave them incentive to waive those fees,” the AT said.

- The first issuer saved interest expense by stating the transaction size of its deal would not exceed what was initially announced, allowing the bookrunners to tighten pricing and get the best terms possible for the company.