Google’s co-innovation of treasury solutions that work with SAP S/4HANA could benefit other corporates.

Google’s frustrations with building its own customized treasury tools to enhance its ERP ultimately pushed the company to abandon that strategy. Today, it’s using standardized solutions it co-created with SAP that are now built into its cloud-based S/4HANA platform. Among the beneficiaries: other corporates that use S/4HANA that can make use of tools Google helped innovate.

- Over a two-year implementation of SAP that Google called Project Emerald, the company used its resources—time, people and money — to develop solutions for hedge management and liquidity and payments—improvements now offered to all SAP clients.

- In a meeting of NeuGroup for Foreign Exchange 2 and a conversation with NeuGroup Insights, Shaun Hazen, Google’s head of financial risk strategy, and Kathy Makowski, a business systems analyst, discussed the co-innovation process and its advantages.

- “We knew that we had to co-innovate with SAP to make it standard,” Mr. Hazen said. “And now everything we’re using today is standard in SAP, it’s not any unique customization.”

Building the right team. For the entirety of the project, treasury members and engineers within Google were re-prioritized, laser-focused on implementing and co-innovating with SAP.

- “We deprioritized other projects to create bandwidth,” Mr. Hazen said. “The people that were put on the project were more senior, so we weren’t pulling off the operational team members—it was people that had done the operational work and now had moved into more senior roles.”

- To ensure the project ran smoothly, the company hired project managers to oversee operations across the company’s different divisions.

- Google’s treasury team worked with internal engineers and SAP to make multiple enhancements to the software’s hedge management capabilities and exposure management trading interface.

The spirit of co-innovation. It’s worth noting that Google, like all SAP customers, could have requested that the vendor provide enhancements or additional modules. But such requests are pulled into a queue and prioritized based on factors chosen by SAP.

- “One of the great benefits of co-innovation is you’re putting your resources where that request is,” Ms. Makowski said. “’Hey, we’re willing to also invest our time in this in order to bump it to the top of the list.’

- “So it’s not just up to them to build, develop and test it. We want to be involved and we’re willing to give resource time in order to do that.”

- “SAP also had a lot to benefit from,” Mr. Hazen said. “The spirit of co-innovation is in each team bringing a similar amount of resources and expertise.”

Key goals. To start, Google treasury laid out initial, attainable goals focused on creating an integrated treasury platform that is scalable, using automated processes and real-time data to support and create value.

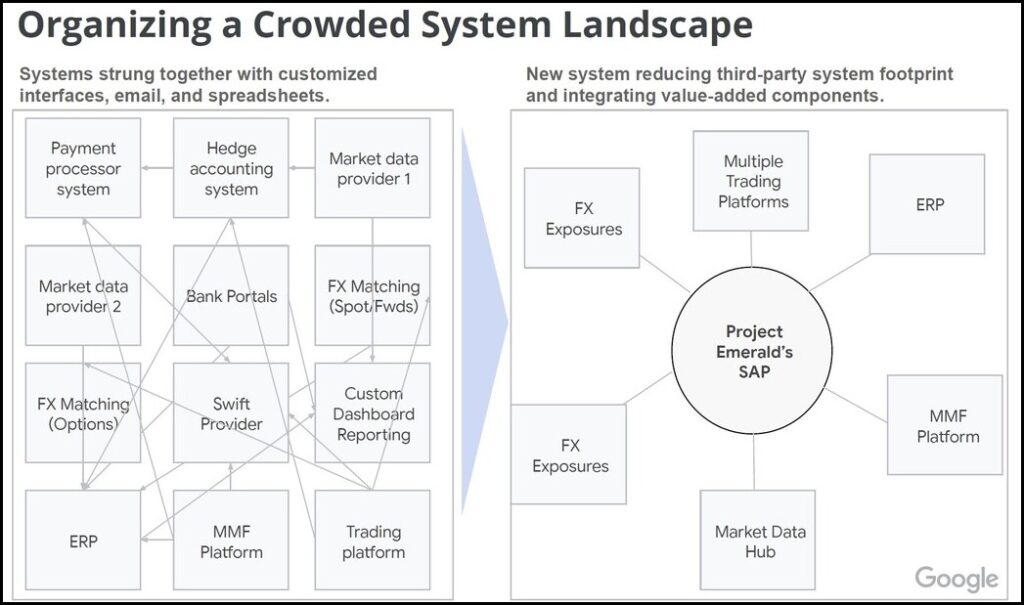

- A key objective was connecting the team’s separate systems to a central SAP platform without any need for add-ons. As the chart below shows, a spiderweb of connections and systems was streamlined and simplified. Other benefits included:

- Centralization of banking information into one source through access to electronic bank statements and reporting.

- Reducing operating cash balances.

- Enabling in-house banks, including intercompany loan management, netting, settlements and accounting and better liquidity forecasting.

- Increasing control and standardization of transaction and reporting.

- Integrating transactions to provide yield automated cash forecasting and liquidity management.

Closing gaps, avoiding customization. From the beginning of the implementation project, one of Google’s primary tenets was minimal customization given the difficulties encountered with its previous ERP.

- Those customized additions required constant effort to integrate with third-party data providers and systems. “Maintaining that over time as these systems and infrastructures change takes resourcing,” Mr. Hazen said.

- “Any time you go to customize a pre-delivered tool, you end up with a lot of issues during upgrades,” Ms. Makowski said. “So SAP helped us identify gaps and helped us close those gaps.”

- One of them: S/4HANA lacked some foreign exchange capabilities that Google desired. “We went back to [SAP] and asked [about] their capacity to have standard solutions for our high priority items,” Ms. Makowski said. “We worked directly with them [while] gathering requirements, and then again in the build.”

- “Google has put a lot of thought into how we do our hedging and risk management programs,” Mr. Hazen said. “We brought our hedging policies, our analytics, how we make decisions” to meetings with SAP to decipher what a system component would look like.

A new standard. “This became a standard for other companies, a pre-delivery service SAP can offer,” Ms. Makowski said. “It was advantageous on both sides, because SAP can then improve their product.”

- Though Google’s business team identified the necessary features and improvements, they left the design to SAP. This allowed SAP to design it in a way that leveraged Google’s inputs but wasn’t Google-specific.

- “For example, when our traders are preparing to execute trades, they will sometimes net several smaller trades together and/or vice versa, split out one large trade to several smaller ones,” she continued. “Google’s input was on the requirements, but SAP designed where, when and how that functionality would work best to accommodate as many companies as possible.”

The now-standard improvements include:

- Hedge management and trading:

- Multi-platform support for trading, confirmation, and settlements.

- Integration with upstream modules to generate FX trade requests.

- Dedicated trading application for structuring, assignment and routing of requests.

- Fulfillment process to validate that executed trades conform to what was approved.

- Alignment with U.S. GAAP requirements.

- Liquidity and payments:

- Forecast hub that enables the full use of SAP cash forecasting capabilities through direct integrations with non-SAP inputs (payroll, collections, etc.).

- Automated intraday cash reconciliation against forecasted items.

- Ability to raise FX trade requests directly in the cash position, supporting onshore and intercompany FX settlements.