Standard Chartered explains the potential value of “use of proceeds” and performance-linked ESG derivatives.

The flood of money pouring into ESG finance—everything from green bonds to sustainability-linked revolving credit facilities—has washed up on the shores of derivatives markets. At a recent NeuGroup meeting of European treasurers, sponsor Standard Chartered dove beneath the surface to reveal what value ESG derivatives may offer. The bank described two types:

- “Use of proceeds” ESG derivatives that hedge FX or interest rate risks arising from ESG financing and are ring-fenced as hedges referencing a specific loan or bond.

- ESG performance-linked derivatives that link a payoff with ESG metrics or key performance indicators (KPIs).

- The sustainability metrics are determined by a third party’s score or index or by the corporate itself.

Case studies. Standard Chartered’s presentation included several examples of how ESG derivatives can be used.

- A company using an FX forward to hedge export pricing in Asia that will receive a discounted FX rate if it meets ESG targets which support the United Nations Sustainable Development Goals.

- A company enters into an interest rate swap where the credit spread is linked to the corporate’s sustainability performance as measured annually by Sustainalytics.

- A company enters into a cross-currency basis swap with a bank where either party’s interest rate payments can rise if they don’t meet their sustainability targets.

Any takers? While NeuGroup members expressed interest in the topic, it’s unclear if treasury teams are ready to embrace ESG derivatives since many companies are still figuring out where green bonds or sustainability-linked loans or revolvers fit in their sustainability plans.

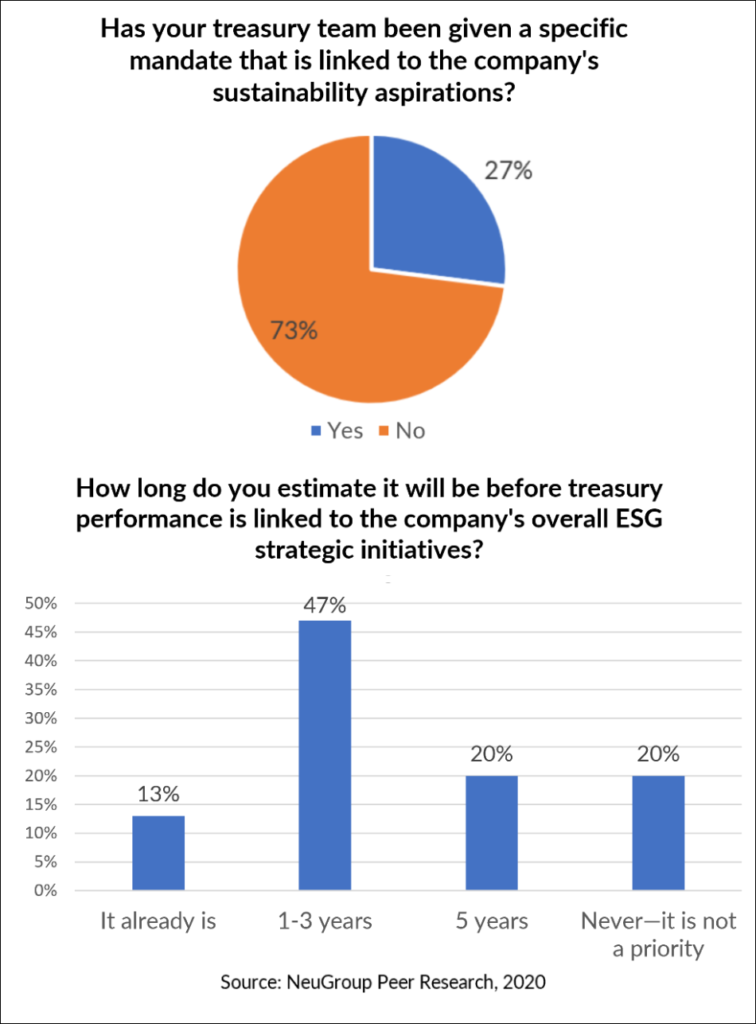

A poll at the meeting revealed the low percentage of companies that have given treasury a specific sustainability mandate or have linked ESG to performance (see below).

One of the Standard Chartered bankers said the fact that almost half of those polled expect performance to be tied to ESG initiatives within one to three years was better than he expected and was “encouraging.”

- An outside risk management consultant asked by NeuGroup Insights about the firm’s clients said, “It’s actually a new enough market development that we haven’t seen a lot of corporates exploring the use of ESG derivatives just yet.” Stay tuned.