Corporates seeking better returns on cash by lending crypto weigh falling rates and regulatory uncertainty.

News this week that the SEC is investigating Coinbase Global over a lending program and may sue the company could have a chilling effect on corporates that were considering buying and then lending cryptocurrency to pick up yield.

- But the fact remains that corporate treasuries have been challenged for years to find investments in which to park cash that provide attractive, positive returns.

- And a small but increasing number of companies has been finding respite by providing loans collateralized by digital assets such as bitcoin.

- One treasurer whose company owns bitcoin and has lent small amounts said, “Given our small size in this area and our counterparties, I don’t think this [Coinbase news] brings any undue risk for us. Clearly there’s a path here where the lending products get shut down, but I wouldn’t lose any sleep over that.”

The Genesis window. Practically nonexistent two years ago, such lending has grown rapidly. Genesis Global Trading, a top digital asset trading firm and custodian, publishes a quarterly report that provides a look into the still nascent market.

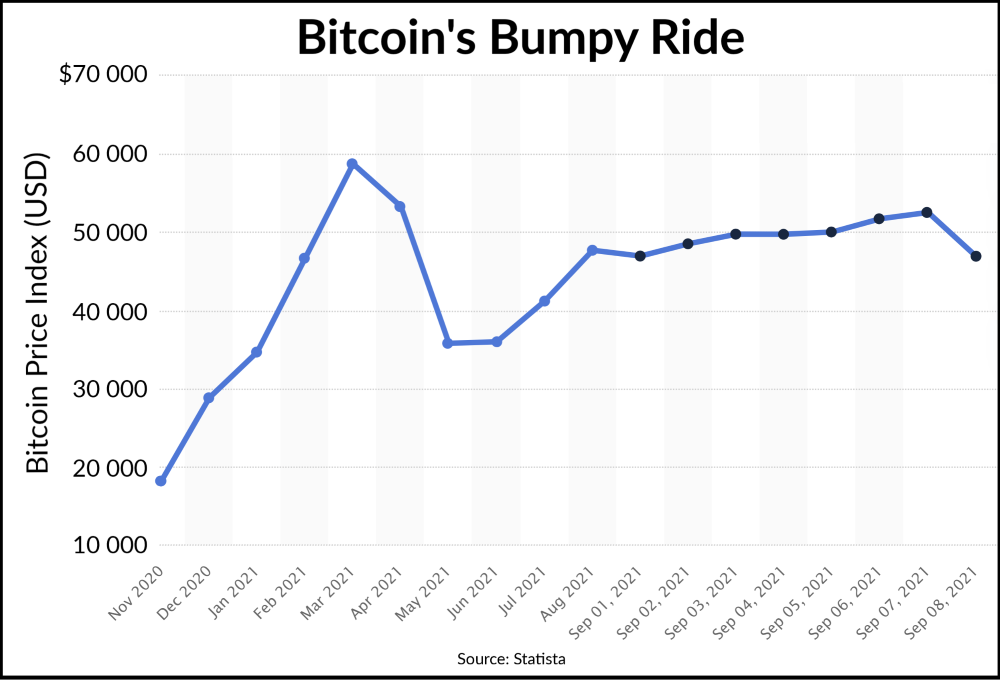

- Despite bitcoin plummeting 41% in Q2, Genesis’ total active loans outstanding fell just 8.1%, to $8.3 billion, as interest in the market continued to grow. “Mark-to-market depreciation in book value was offset by organic loan portfolio growth,” the report says.

- It doesn’t say who those lenders were, but the firm’s Q1 report said corporates jumped to first place in terms of trading, making up 27% of total activity.

- “The entrance of companies like Tesla, MicroStrategy and Square led to a wave of interest from corporates looking to work together with Genesis Treasury for their own treasury allocation efforts,” the report says.

- The firm’s originations by the end of Q2 had risen by more than eight times year over year, and by more than 60% since Q1.

Regulatory risk. Uncertainty about regulation is just one reason many companies are steering clear of buying cryptocurrency, let alone lending it. That said, many in the crypto industry welcome more clarity from regulators.

- “At Genesis, we see emerging regulatory clarity as a plus for institutional investors,” the Q2 report says. “However, in the short term, uncertainty around the details of eventual crypto regulatory moves adds risk and was likely one of the factors behind Q2’s lackluster crypto market performance.”

- A spokesman for Genesis declined to comment on the possible implications of the SEC’s investigation of Coinbase.

Cash vs. crypto lending. Genesis notes cash loans collateralized by crypto dominated in Q1, but demand fell following the collapse in spot/futures spreads since May.

- Digital asset lending took the lead in Q2, matching the needs of corporates that have purchased crypto currencies over the last year, whether to diversify investments or support their own businesses’ forays into digital payments.

- “We’re only looking at crypto lending, the key benefit being that we have idle bitcoin and can earn a return,” said one treasurer, adding the company has “committed some small amounts.”

Returns fall. Steve Swain, CEO of Gibraltar-headquartered Lendingblock, a digital asset lending platform, said that more lenders than borrowers has pushed down rates by more than half compared to 18 months ago, to between 2% and 4%, depending on the borrower and type of digital currency.

- Those returns are still attractive compared to more traditional cash investment alternatives, and lending crypto instead of cash offers a premium.

- Genesis acknowledged the pressure on rates, but said borrowing demand typically increases in a bearish market, and in the Q2 “crypto lending rates have moved a bit higher.”

More risk. Mr. Swain, whose firm recently licensed its software to Singapore-based exchange operator and Nasdaq-listed EQONEX Group, said the borrowers’ market has pushed down loan collateral levels significantly from the 150% common previously, in some cases close to par.

- Collateral levels depend on the type of borrower and crypto currency, said Jennifer Liu, head of lending at Anchorage Digital. Specializing in digital asset lending, the digital asset platform’s bank subsidiary was conditionally granted the first national trust charter by the OCC earlier this year.

- The treasurer cited collateral levels at close 125%, although he did not provide information on lender rates.

- Ms. Liu added that most of the loans Anchorage facilitates are collateralized by bitcoin or Ethereum, the largest digital assets by volume. She added the firm models each loan that is approved by its risk-management committee, and its bank holds the collateral so it can be quickly liquidated in the event of margin calls.