RBC’s customized investments help corporates reach specific groups and areas.

Increased attention on persistent racial disparities in wealth, income and home ownership in minority communities is motivating many corporates to look for new ways to make a difference through investments and deposits.

- At a recent Visual Interactive Session, one NeuGroup member described the benefits of impact investing using a tailored and targeted approach offered by RBC Access Capital, part of RBC Global Asset Management.

- “With the RBC team, we were able to develop a program that uses the money we have allocated to fund loans made by community development financial institutions and other lenders in traditionally underserved areas in support of affordable housing,” the treasurer of the member company said.

- RBC’s strategy—which involves mortgage-backed securities—allows the company to “support the communities in which our employees live and work, but do it in a way that gives us confidence to ensure that we’re going to have preservation of capital consistent with our needs,” the member said.

How it works. At the core of RBC’s offering are separately managed accounts (SMAs) and mutual funds that primarily invest in pools of loans in the form of mortgage-backed securities (MBS) or other government guaranteed securities.

- Ronald Homer, RBC’s chief strategist of US impact investing, said the firm incentivizes originators to make loans in communities targeted and specified by the investors. Those loans are then bundled into securities.

- “Not only have we found that these securities perform as well as securities made of the same type of loans in broader communities,” Mr. Homer said, “In many instances they perform better than the generic securities because of the idiosyncratic nature of the performance of the borrowers.”

- The minimum investment for an SMA, which the NeuGroup member is using, is $25 million. Lesser amounts are invested in mutual funds that also allow investors to target specific communities and geographies as well as those the fund already supports.

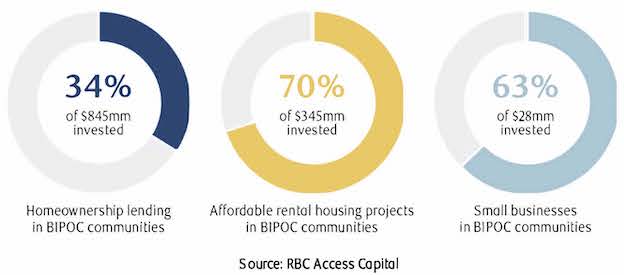

- RBC’s strategies support low- and moderate-income individuals and communities, but can also be targeted specifically to Black, Indigenous and people of color (BIPOC) communities.

Customization. RBC Access Capital can customize for criteria including businesses owned by women, minorities and veterans. And the securities can reflect a company’s investment criteria in terms of liquidity, duration and credit quality.

- “The client chooses the risk benchmarks and parameters,” Mr Homer said. “And we find the securities to match up to that benchmark and perform well.”

- In the case of the NeuGroup member, RBC designed a strategy to maximize liquidity and minimize volatility. The focus of the SMA investments are affordable housing in the San Francisco Bay Area. The member’s investments also support small businesses.

- Whatever the focus, Mr. Homer said that to affect change, a program must have scale and sustainability. That is achieved with home loans and MBS, he said, because of the access to a liquid secondary market.