How finance teams can prepare for the departures of members with valuable knowledge in a tight labor market.

The question of how to mitigate so-called key person risk as treasury teams grapple with high turnover and difficulty filling open positions surfaced among members at a fall meeting of NeuGroup for Mid-Cap Treasurers sponsored by Chatham Financial.

- The broader context of the conversation was a session where Chatham advisors reviewed the key components of risk management—strategy, operating model and technology—and discussed case studies of companies rethinking those areas to build resilience in corporate finance in the wake of the pandemic.

How finance teams can prepare for the departures of members with valuable knowledge in a tight labor market.

The question of how to mitigate so-called key person risk as treasury teams grapple with high turnover and difficulty filling open positions surfaced among members at a fall meeting of NeuGroup for Mid-Cap Treasurers sponsored by Chatham Financial.

- The broader context of the conversation was a session where Chatham advisors reviewed the key components of risk management—strategy, operating model and technology—and discussed case studies of companies rethinking those areas to build resilience in corporate finance in the wake of the pandemic.

- Among the questions Chatham suggested corporates ask in addressing operating model resiliency is, “Do I have key person risk?” The answer for some members is clearly yes.

Relentless turnover. One Chatham client saw a string of key FX personnel depart, leaving no playbook for FX balance sheet exposure gathering or hedge execution, and a system relying on multiple platforms through the hedging life cycle. The company used the experience to take a proactive stance and rethink its treasury program and avoid a Band-Aid approach in the future.

- By using Chatham to fill in temporarily the gaps left behind, it gained a fresh set of eyes to review the program workflows and trading thresholds.

- It established steady FX daily trading and reporting coverage, documenting key activities and recommending process improvements. Documentation of processes and controls reduced the time to onboard new team members.

- The company established a long-term staffing plan by aligning activities with expertise and employees’ capacity, conducting interviews to vet treasury candidates and support existing staff.

Backups. Providing further insight into the turnover issue, a treasurer recalled taking over the treasury team of his current employer and ensuring that each member has backups. This means there’s never reliance on one individual, but it also means that companies need to proactively invest in cross-training and documentation efforts.

- Before going on vacation, staff members must identify assigned backups; perhaps someone focused on the pension side who has expressed interest in treasury operations or banking.

- “It provides good growth opportunities for individuals to be able to cover other roles when somebody goes for a two-week trip to Europe,” he said.

- An extension of the backup plan is providing very detailed manuals on how to do daily cash flow, FX trades and other key functions. The treasurer recalled the departure early in 2021 of his senior manager of capital markets who was instrumental in investor relations communications and a recent convertible debt offering.

- A junior person from the operations group had been assigned as his backup and was trained in those functions, and the instructions—with screenshots from Bloomberg—bolstered his ability to take on those responsibilities.

Reconsidering strategy. In another Chatham case study, the treasurer and the FX risk director of a fast-growing company with a significant international footprint resigned in the same week. Management tapped Chatham to “keep the lights on in the risk management program” while it found the “right replacements” and strategically thought through treasury’s resiliency. Then the pandemic hit, accelerating strategic changes aimed at ramping up the staff’s capabilities. Those included:

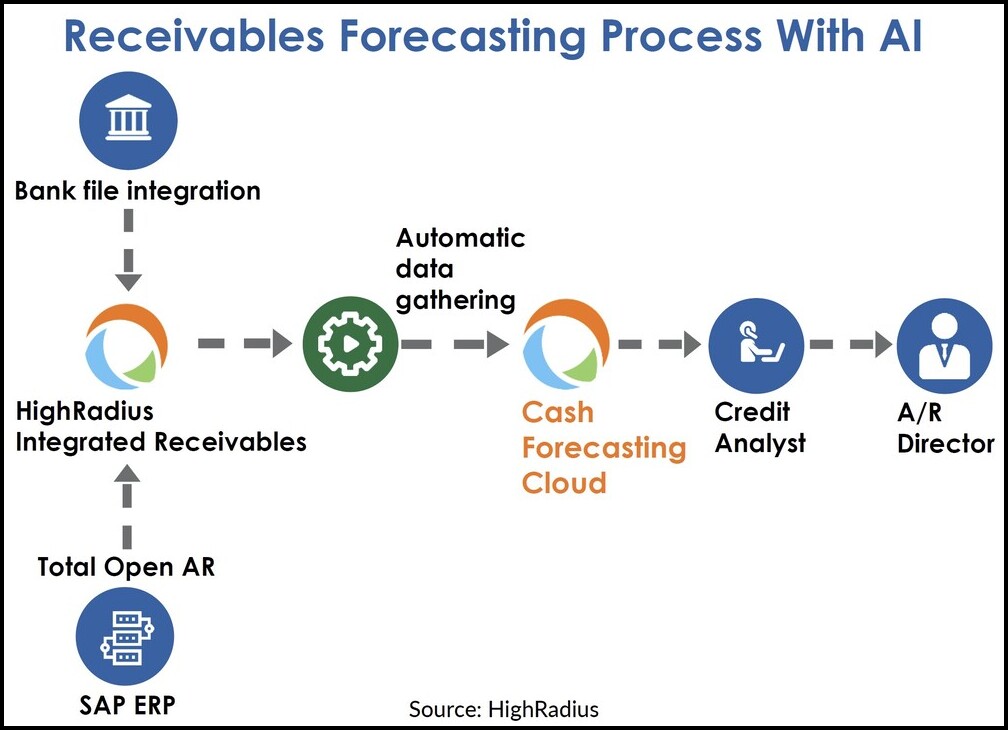

- Moving off Excel and implementing a new ERP and treasury-risk platform were critical to leverage data to review the real-time impact to global sales and forecasts.

- Trend analyses across business units determined areas of likely forecasting deficiencies and challenges and prompted enhanced visibility and analytics, enabling the ability to modify execution tactics and strategy on the fly.

- Moving away from the critical-terms-match to a long-haul-regression accounting strategy provided a much longer window in which to achieve forecasts and obtain hedge accounting.