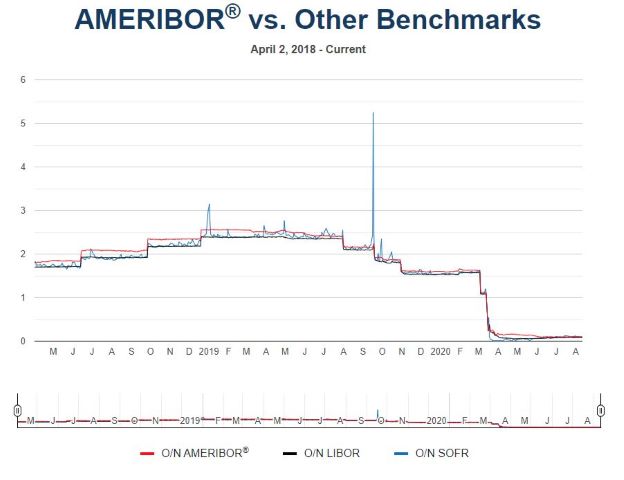

Banks could price corporate loans using SOFR sooner than ARRC best practices suggest.

The Alternative Reference Rate Committee (ARRC) guiding the US transition for cash products is pushing for Libor pricing to cease for certain types of debt by the end of this year, and other types of debt may soon follow.

- Floating-rate notes, for example, should be priced by year-end using an alternative benchmark, according to best practices published in late May by the ARRC, which comprises mostly large banks and federal regulatory agencies.

- Revolving credit, term loans and securitizations have until June 30, 2021, but may be priced much sooner over a replacement benchmark—presumably the secured overnight financing rate (SOFR) whose development the ARRC has guided.

Banks could price corporate loans using SOFR sooner than ARRC best practices suggest.

The Alternative Reference Rates Committee (ARRC) guiding the US transition for cash products is pushing for Libor pricing to cease for certain types of debt by the end of this year, and other types of debt may soon follow.

- Floating-rate notes, for example, should be priced by year-end using an alternative benchmark, according to best practices published in late May by the ARRC, which comprises mostly large banks and federal regulatory agencies.

- Revolving credit, term loans and securitizations have until June 30, 2021, but may be priced much sooner over a replacement benchmark—presumably the secured overnight financing rate (SOFR) whose development the ARRC has guided.

Catalysts for change. Libor is a forward-looking term rate enabling corporates to forecast cash flows accurately, and so far there’s no such version of SOFR. In late June, the ARRC published a method to calculate the “in arrears” SOFR rate for syndicated loans, and on July 22 it published conventions for how and when to do it.

- The in arrears approach averages the rate over the past 30 and 90 days to provide a “good” estimate of what averaging SOFR over the next 30 or 90 days will be, according to Ian Walker, head of US middle-market research at Covenant Review, a Fitch Solutions service that analyzes debt contracts determining creditor rights.

- Mr. Walker said these moves make it easier to adopt SOFR. He added that the ARRC’s “early opt-in” option enabling conversion to SOFR before Libor ceases is likely to prompt lenders to push for transitioning revolvers and term loans to the new rate sooner rather than later, to reduce Libor-exposure risk.

- Mr. Walker called the conventions and vendor systems’ ability to handle SOFR—the ARRC recommends by Sept. 30 on the latter—the “last two dependencies” before we see the syndicated loan market doing loans over SOFR instead of Libor. “I would not be surprised if we start seeing that phenomenon before the end of 2020,” he said.

Fallbacks sooner. Floating-rate notes and securitizations priced over Libor before year-end 2020 should have incorporated “hardwired” contractual fallbacks to an alternative rate as of June 30, the ARRC says, and corporate loans by Sept. 30.

- “Any company refinancing today should spend significant time considering the Libor fallback language in their debt, and ensure that they can operationalize it should it become triggered,” said Amol Dhargalkar, managing partner and global head of corporates at Chatham Financial.

- While there’s more time to transition revolving and term credits to an alternative benchmark or adopt another benchmark for new borrowings, don’t procrastinate.

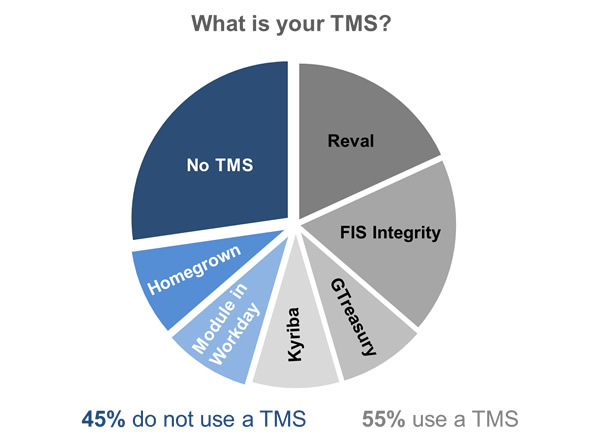

- The operational challenges are significant, especially for companies still using Excel instead of a treasury management system (TMS). “Can their systems even support different indices and how are calculations done using these indices?” Mr. Dhargalkar asked.

Corporates too passive? Despite the significance of the Libor transition, Mr. Dhargalkar said, corporates’ common response tends to be that “things are going to take care of themselves. It’ll be fine.” Many appear to be waiting for banks to make the first move, he said.

- Corporates “tend to view themselves as price takers rather than price makers on this Libor transition, so they’re waiting for banks to come to them with a proposal, rather than them approaching banks and saying, ‘I want to borrow off something other than Libor,’” Mr. Dhargalkar said.

- While financial institutions and governmental organizations have issued SOFR-priced debt, Toyota Motor Credit appears to be the only large, public corporate to have done so to date, said Yon Valtchev, a treasury credit specialist at Bloomberg who has followed the issue closely.