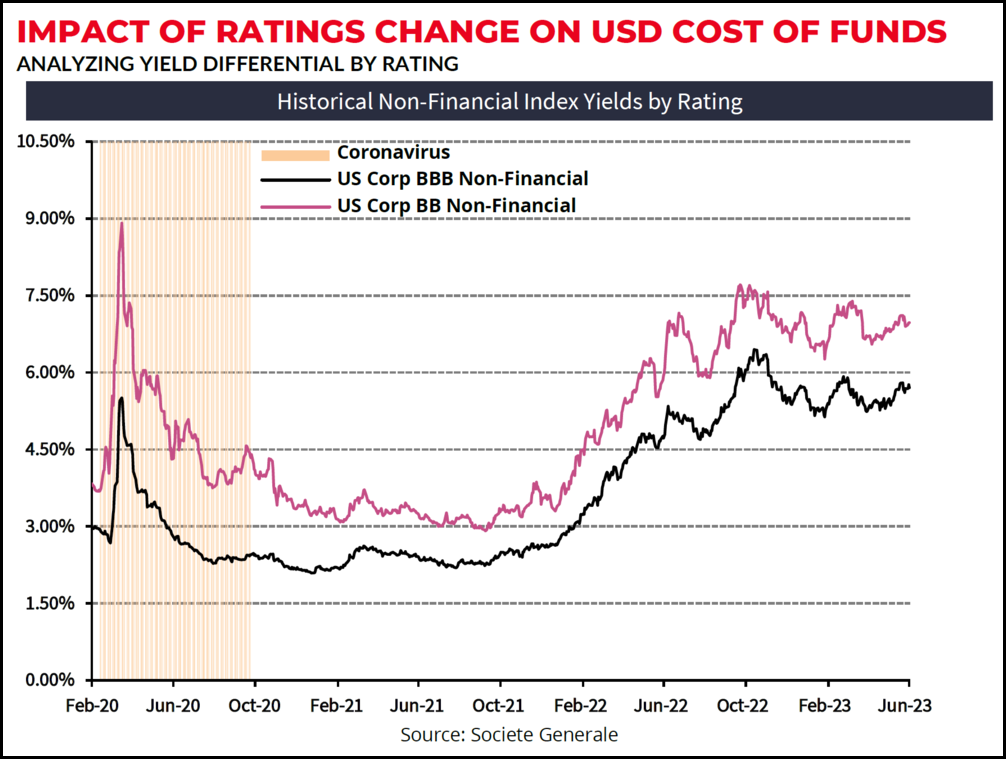

With the end of Fed rate hikes in view, some managers are now talking about extending investment duration.

When 2023 began, corporate cash investment teams were battening down the hatches, keeping maturities very short in anticipation of more interest rate hikes. Almost eight months later, the discussion has shifted to when the Fed might start cutting rates, leading to a flatter and eventually steeper yield curve, opening the door to extending duration.

- “Short-term rates may exceed or be more optimal than investing in one-year securities, but at some point, that’s going to turn,” said one cash investment manager at a recent session of NeuGroup for Cash Investments requested by members. “When it turns, the short-term’s going to get hit a lot harder than longer-term.”

With the end of Fed rate hikes in view, some managers are now talking about extending investment duration.

When 2023 began, corporate cash investment teams were battening down the hatches, keeping maturities very short in anticipation of more interest rate hikes. Almost eight months later, the discussion has shifted to when the Fed might start cutting rates, leading to a flatter and eventually steeper yield curve, opening the door to extending duration.

- “Short-term rates may exceed or be more optimal than investing in one-year securities, but at some point, that’s going to turn,” said one cash investment manager at a recent session of NeuGroup for Cash Investments requested by members. “When it turns, the short-term’s going to get hit a lot harder than longer-term.”

- For that reason and others, several members said they are starting a gradual process to lengthen the average maturity of their cash investment portfolios as inflationary pressures cool.

- Other managers, though, are either waiting until the yield curve steepens or say they’ll stay short in keeping with their mandate to preserve capital, not aim for high yields.

Timing a move. On one end of the spectrum are cash investment managers convinced this is the right moment to start making changes. “This is historically the time to extend duration, where you time the Fed hiking cycle,” said one member. “This is where my mind will be for the next couple of years.”

- Treasury at this company, which has kept investments “very short,” plans to increase duration over a two-year horizon. The goal is to return to pre-pandemic levels of 60% cash allocated to one- to three-year investments and keep 40% in short-term instruments, the member said.

- This strategy in part reflects the views of an experienced investor on the company’s board who is pushing treasury to take more risk in the portfolio “if the timing is right.” The rest of the board, the member noted, is more risk averse. “If the three-year is even just a bit lower yield, they will ask us why we invested in that tender.”

Keeping your balance. This member commented that when a corporate puts all its money in cash, it is betting that rates will be higher for longer. Even if you agree with that bet, they said, “you should take a more balanced approach.”

- Multiple members agreed, with one saying that a barbell-shaped portfolio—with investments in very short-term assets and very long-term assets—is the best way to balance that risk. “We take advantage of very high cash rates, and at the same time can extend the duration of the portfolio,” he said.

- Another member, who believes the end of the Fed’s tightening cycle is in sight, is being cautious about the pace of policy change. “We have begun extending portfolio duration relative to our underweight positioning that was in place over the last 18-24 months,” he said. “But we are skeptical about the 100 basis points of cuts priced into the market in 2024, and we’re picking our spots on the curve accordingly.”

No time for timing. On the other end of the spectrum at the NeuGroup session were cash investment managers who will not be extending duration because it’s at odds with treasury’s mandate to protect principal and ensure liquidity—not to chase higher yields.

- “We’ve been using that same policy for close to two decades,” one said. “The curve won’t change our strategy; we’re not a hedge fund.”

- Another member equated trying to figure out how many more rate hikes there may be before the Fed starts cutting to a game he’s not willing to play. “It’s a magic eight ball issue,” he said. “I’m not good at those.”