What corporates are saying about the Fed’s instant payment system and what it may mean for them.

Blockchain proponents may be promising a bright future of limitless payments made in seconds, but traditional payments infrastructures are providing real-time alternatives today. Next month, the US Federal Reserve will launch FedNow, a payments system that enables USD payments of up to $500,000.

- The service will join the RTP network, a real-time payment platform owned by The Clearing House and launched in 2017, as an instant payments option. At its inception, RTP had a limit of $25,000 per payment, which has gradually increased to $1 million now.

What corporates are saying about the Fed’s instant payment system and what it may mean for them.

Blockchain proponents may be promising a bright future of limitless payments made in seconds, but traditional payments infrastructures are providing real-time alternatives today. Next month, the US Federal Reserve will launch FedNow, a payments system that enables USD payments of up to $500,000.

- The service will join the RTP network, a real-time payment platform owned by The Clearing House and launched in 2017, as an instant payments option. At its inception, RTP had a limit of $25,000 per payment, which has gradually increased to $1 million now.

- The two systems also offer a number of expanded capabilities compared to payments made via wire or ACH, including 24/7 access, immediate settlement and fund availability, a notification of confirmation once a payment goes through and no ability to revoke a payment after sending.

- At a recent meeting of NeuGroup for Payments Strategy sponsored by Citi, FedNow SVP and head of payments products Dan Baum and The Clearing House SVP of product development and strategy James Colassano answered questions and discussed the systems’ use cases—which may be limited by low values relative to wire transfers.

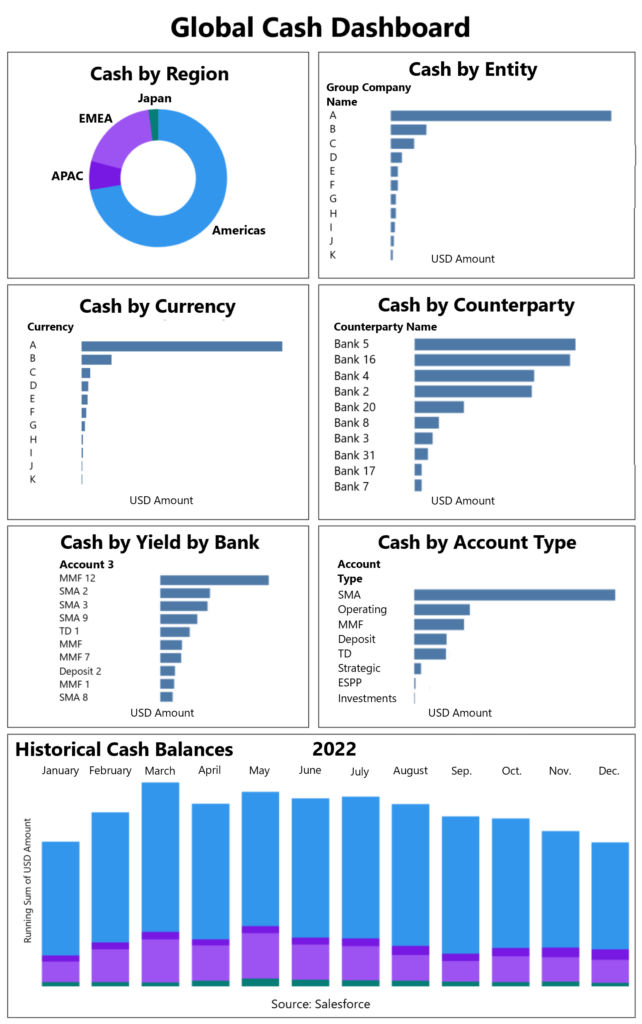

Early innings. NeuGroup’s Jerry Olivo, who heads the payments group, said instant payments are going to be big business, with 400 million payments at a total value of $430 billion already processed through RTP. “There are many use cases already identified, but this is by no means a mature market,” he said. “There will be many, many more changes to come, and it’s important to get ahead of the curve, because we’re still in early innings.”

- RTP’s network covers 330 banks, including all in the bulge-bracket tier, reaching a total of 60% of demand deposit accounts in the US. FedNow is launching with 120 pilot banks and will expand over time.

- In the session, Mr. Baum said FedNow’s research shows there is already market demand for more accessible instant payments, so the team’s primary focus was on launching with full credit capabilities—the ability to make a payment. “First, we have to create the reach, then we’ll be in the business of use cases and value creation.”

Expanding use cases. RTP’s traffic in the business-to-business space jumped after the company raised the limit to $1 million. Mr. Colassano notes an uptick in vendor payments to suppliers made after wires close, as well as cash concentration payments from subsidiaries to a central corporate account. The fastest-growing use case, he said, is for employee payroll, especially payments to gig workers.

- Another evolving use case, from a product perspective, employs the systems’ “request for payment” functionality, in which one user can send a payment request to another account. This could work for regular bill payments to a utility company, sparking the interest of one member who works at an app-based service provider.

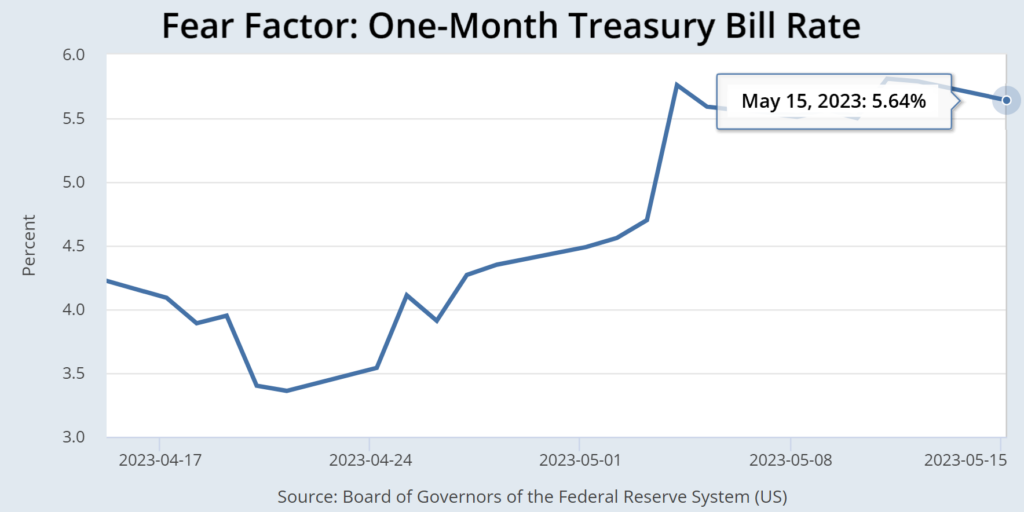

Corporates’ concerns. With current transaction value limits, some potential uses of instant payments aren’t quite ready for prime time. The first use case mentioned by a NeuGroup member at the session was for opportunistic M&A deals, which could be made quickly to capitalize on favorable conditions for an acquisition. One problem: $1 million isn’t enough to acquire a company, let alone $500,000.

- Both RTP and FedNow representatives indicated that transaction value limits are likely to increase, but could not provide details on the timing or amount, saying they will evaluate system limits as use cases expand.

- Another member shared that the irrevocability of real-time payments would be something of a challenge for his company, citing a strict central controllership as an obstacle to adopting the tools. “It puts a lot of pressure on setting up that payment, because once it’s gone, it’s gone,” he said.

Looking ahead: beyond payments. In addition to raising volumes, another update corporates should anticipate is if—or when—the instant nature of settlement technology is applied in the securities space, Mr. Olivo said.

- “It’s over a longer time horizon, but it will be massive,” he said. “Right now, if you go buy bonds or equities, you have to wait two days for settlement in most instances. If real-time securities and cash settlement is applied to that environment, settlement will eventually occur in two seconds rather than two days.”