Wells Fargo explains an alternative to layering for corporates hedging cash flow exposures.

Who doesn’t want to get more for less? As in less work, more efficiency and fewer transactions, all while still meeting risk management goals. To take advantage, though, you have to be willing to look closer at the shortcomings of the very common cash flow hedging approach known as layering.

- During a recent interim meeting of NeuGroup’s two FX managers’ peer groups, the quantitative solutions team at Wells Fargo laid out an alternative to layering called laddering.

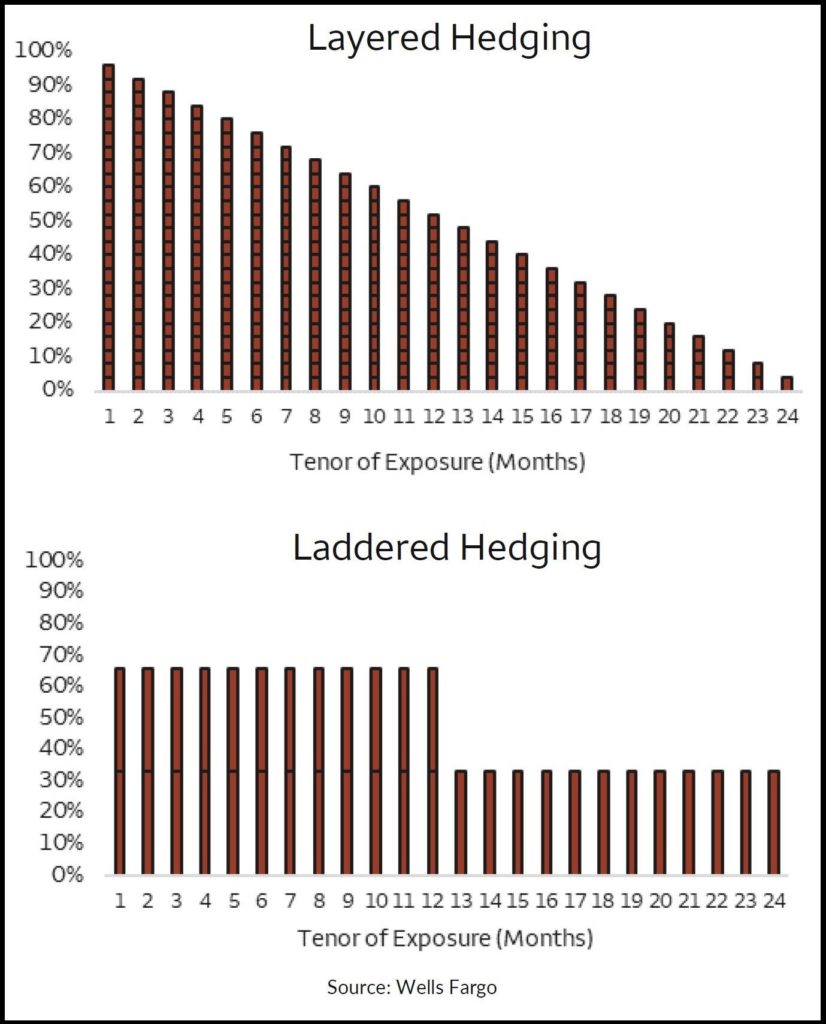

Layering rationale. A Wells Fargo survey in 2018 found 63% of the public companies that responded use layering in their cash flow hedge programs.

- By adding in hedges over time to achieve a higher hedge ratio as the exposure gets closer and exposure forecasts get more accurate, the rationale is that the resulting dollar-cost averaging smooths out gains and losses from FX volatility. This achieves a more stable outcome year-over-year or quarter-over-quarter.

The downside. The disadvantage of this approach is that it requires the ongoing execution of a large number of hedges, with all the accompanying process work from trade initiation, confirmation and accounting through reconciliation and settlement, not to mention the transaction costs.

- Wells Fargo’s analysis demonstrates that for a monthly layered cash flow program with a 12-month hedge horizon, a company would have 78 outstanding hedges at any given time per currency, or 300 for a two-year hedge horizon.

- Many companies choose quarterly layering programs, but that’s still a big number to keep track of, especially when also considering the hedge accounting documentation requirements. Automation helps, but not all companies have achieved that level of automation yet.

Another way. Laddering, by contrast, means hedging a higher percentage of the exposure earlier and for longer per hedge, i.e., “more notional but less frequently” or “sort of an infrequent layering program,” as Wells Fargo’s presenter put it.

- The example uses a third of the exposure hedged from two years out with an added third starting a year out. This cuts down significantly on the number of hedge executions required and outstanding hedges per currency at any given time, especially as compared to a monthly layering program, of course.

Volatility. But does this increase volatility? Intuitively, if the rationale for frequent layering to increase the hedge ratio over time is to reduce volatility, less frequent would increase volatility. But Wells Fargo’s backtesting analysis for EUR, GBP, CAD and MXN, for example, shows that volatility reduction is better with this tenor extension than with more frequent execution, and lower still for a two-year program.

- Why is that? Laddered hedging “maximizes the overlap of the rates you are picking up” for the currencies involved as compared to the classical smoothing of layering, the presenter explained.

Converts. So laddering, anyone? One member noted that by conducting similar analysis, her company has indeed transitioned to a laddering (sometimes called staggering) approach to reduce the operational burden of frequent layering while still achieving similar levels of volatility reduction.

- Another member, however, has a dual mandate of volatility reduction and opportunism to do better than a fully systematic program. So her team needs flexibility to increase (or not) their hedge ratios (above a required minimum prescribed in the policy), and the layered program provides that.