Banks already price commercial loans over Ameribor and a term version is in the works.

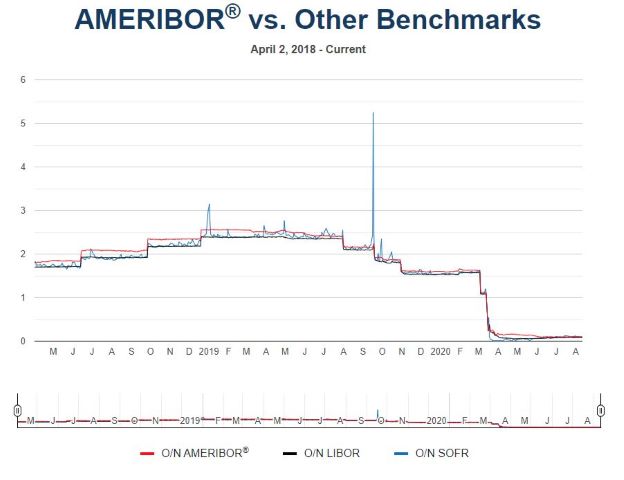

Ameribor, the benchmark alternative interest rate to Libor devised by the American Financial Exchange (AFX), is managing to stay in the conversation despite the endorsement by the Federal Reserve of the secured overnight financing rate (SOFR). Ameribor reflects the unsecured borrowing costs of more than 1,100 American lenders.

- This week, Citizens Financial Group, one of the nation’s 20 biggest banks, with assets of $177 billion, joined the exchange.

- In late June, the AFX announced volume of $1 trillion transacted since its inception in 2015.

- In late May, Fed Chair Jerome Powell—in response to a question by Senator Tom Cotton—wrote that Ameribor is “based on a cohesive and well-defined market” and is “a fully appropriate rate for the banks that fund themselves through [AFX] or for other similar institutions for whom Ameribor may reflect their cost of funding.”

Pricing debt over Ameribor. With a few exceptions, corporates have yet to price floating-rate debt over SOFR, although that may start soon. Ameribor is already used for that purpose.

- ServisFirst Bank, catering primarily to commercial clients, has priced all new and renewing corporate loans over Ameribor since the start of the year.

- “Customers really haven’t resisted moving to Ameribor, after we show them the chart and why it’s better for them,” said Tom Broughton, chairman and CEO of the full-service, Birmingham-headquartered bank.

- Richard Sandor, AFX CEO, said other banks—generally smaller regionals—are also pricing clients’ debt over Ameribor.

- John Deere and American Electronic Power (AEP) have joined the AFX. How they are using AFX and Ameribor is unclear, but AEP said in May that the company wants to help “advance Ameribor as a benchmark rate.”

Forward-looking terms. Both SOFR and Ameribor have listed futures contracts, and both are aiming to develop swap markets that will enable the generation of the type of forward-looking term rate corporates prize to forecast cash flows.

- “We continue to do research on a forward-looking term Ameribor,” Dr. Sandor said, “In March and April we had record volume and the lowest volatility of any rate, including fed funds and Libor.”

- Until a term Ameribor arrives, rates calculated in arrears are available for both SOFR and Ameribor that may differ from the current rate averaged over the specific time period, but not by much.

- Amol Dhargalkar, managing partner and global head of corporates at Chatham Financial, said cutting off the period several days early or delaying payment so treasury can accommodate the difference are potential solutions.

Have to hedge. Corporates and their lenders alike need to hedge floating-rate exposures. The Financial Accounting Standards Board (FASB) has already approved SOFR as a hedging benchmark rate, making it viable for hedge accounting.

- AFX has asked FASB to add Ameribor to its list of approved benchmark interest-rate indices, so it qualifies for fair value hedge accounting treatment.

- In the interim, Ameribor’s high correlation to the effective fed funds rate (EFFR) enables the latter to be used as a hedging index for Ameribor-linked assets and liabilities. That’s according to a recent note from Derivative Path, an electronic platform aimed at commercial and financial end users to manage interest-rate and FX over-the-counter derivatives.

- Any difference between the contractually specified Ameribor borrowing rate and the EFFR would be recorded “through interest income/expense, but that basis would not be recorded as hedge ineffectiveness from an accounting perspective,” the note said.