Many FX risk managers are working to get out of Excel and automate more processes.

“When it comes to treasury and finance upscaling, aside from the big TMS systems, who is using what?” That question from an FX risk manager sparked discussion at the second-half meeting of NeuGroup for Foreign Exchange 2, sponsored by Societe Generale, as members shared a variety of approaches ranging from tapping a team of dedicated treasury engineers to using less sophisticated, more user-friendly tools. And the trend was clear—everyone wants to be less reliant on Excel.

- “You can have IT focus on the big stuff, but what about everything that starts in Excel?” the risk manager said. “Excel macros are powerful, but they’ve been there for 20 years and almost no one’s using them because they’re pretty technical. So we’re trying to experiment with other platforms that are essentially macros on steroids to see if something else will click with people.”

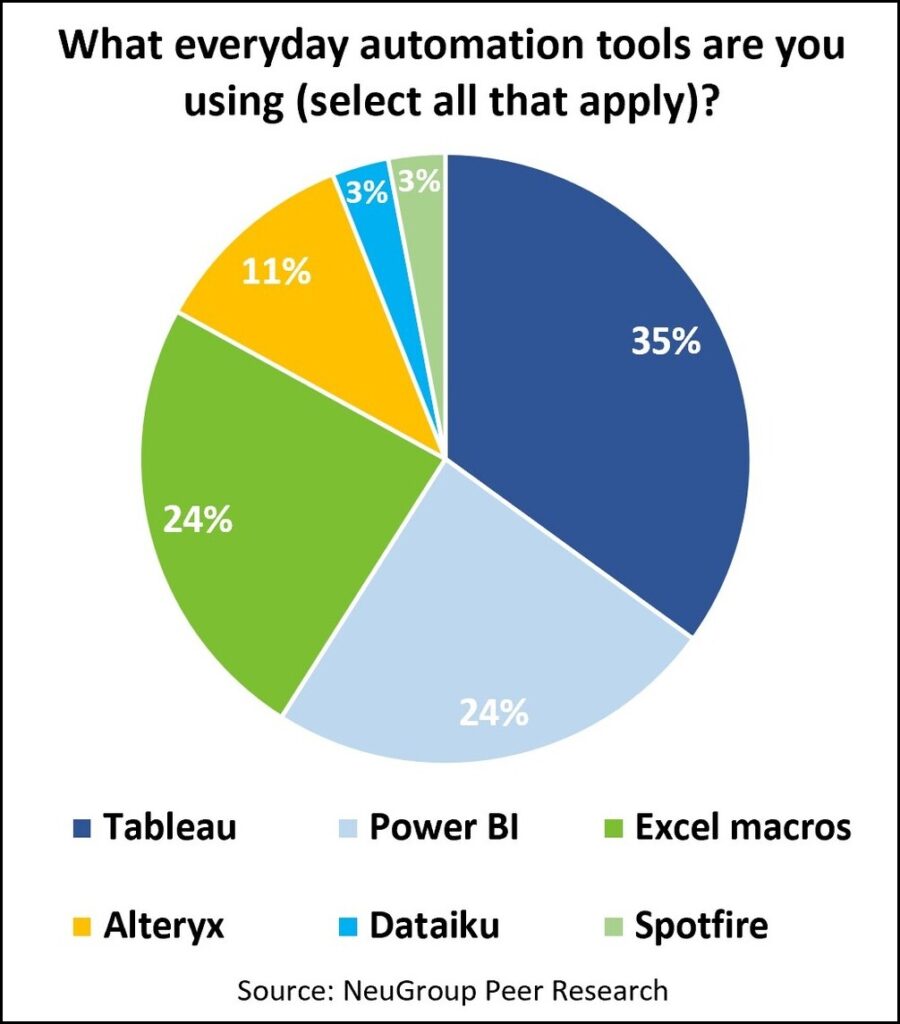

- An in-meeting poll (below) showed that Tableau and Power BI lead the field. “We’re able to automate things like exposure uploads and forecast uploads, which save up to 10 hours a month of upload time,” said one member who uses both tools.

Future state. The global currency director at one multinational who presented at the meeting said his goal for treasury automation is to eliminate manual data input processes and move exposure data directly into the TMS from the ERP. He aims to consolidate to a single source of truth and move away from the current process of collecting various Excel files from different regions.

- “We’ve been asking, ‘Is this the European Excel file or the Mexican Excel file?’,” he said. “Depending on which one you get, it might cause some challenges.”

- The presenter said he believes Excel can be great but can also be a crutch, which is why he’s aiming to automate everything out of the system.

- “I think Excel is a step, it’s treasury version 2.0; version 3.0 will have no place where a person has to go and click a mouse just to make sure something got copied over correctly,” he said. “I’d like to have one place, one source of truth based on actuals.”

Making it on your own. Some corporates have already begun the journey, but IT time constraints and a high skill level needed to use some tools means it’s not a short path to a single source of truth.

- “As far as a dedicated IT resource goes, I can raise tickets with the service desk, but who knows how long that will take,” the presenter said. “Fully integrating new systems takes a lot of money and a long time, but I think smaller tools, including even fintechs, can come in, go out and change quickly.”

- One member said his treasury team is “mostly an Excel and PowerPoint shop.” He is experimenting with different tools that require little or no coding experience, including Power BI, Alteryx, Dataiku and Microsoft’s Power Query.

- There is a moderate learning curve for each of those tools, but he said they’ve all been fairly easy for treasury team members to learn the basics, opening the door to develop more expertise and create more automations.

The tech company benefit. Members from two technology companies have already begun large-scale implementations of automations, benefitting from more resources within the companies.

- The FX risk manager at a software company said treasury has access to a dedicated engineering team that aids in building what he calls small robots, used mostly for pulling, gathering, verifying, uploading and distributing FX rates.

- “It saves my team a lot of time,” he said. “And we’re on monthly rates; I can’t imagine [using] daily rates—that would be a huge resource to look into automating.”

- The treasury team at another large tech company recently started an internal finance training program to teach the basics of programming simple automations.

- The member said his treasury team has since designed, coded and implemented robots designed in SQL that take care of internal processes like reporting, inputting or updating data in certain systems, which saved thousands of hours for the whole treasury organization.

- “We are not mandating, it’s an optional training, but people see the value in it,” he said. “Instead of spending the whole day doing repetitive processes, have a robot do it in a few minutes.”