Healthcare is one of the most dominant issues of our time and ripe for disruption, so what are treasurers in the sector doing about it?

The NeuGroup for Healthcare Services Treasury is looking for treasury and finance leaders at established healthcare services companies, as well as new entrants looking to change the space, who are seeking to finance and support their businesses through the coming transformation of the sector.

Ultimately, we want to help you share and learn for mutual success so that your firms can help everyone access better, more cost-effective healthcare; healthcare that harnesses digital transformation and data to allow us all to experience a higher quality of life for a longer period of time.

The pilot meeting for this group, complementing our Life Sciences sister group, is scheduled for June 18 in New York and is being sponsored by Wells Fargo.

Some of the challenges we hope to help you and your firms navigate successfully, include:

- Political scrutiny and regulation. In the

US, the healthcare industry is front and center this election year, as almost

every presidential candidate is proposing a plan to impose radical change on

how healthcare is paid for, including wider imposition of pricing restrictions.

- Is your firm prepared financially for broader politically driven change to your revenue model?

- ESG.

Scrutiny is coming as well from environmental, social and governance (ESG) advocates,

investors and risk specialists who are incorporating ESG scores into their

evaluation of healthcare companies’ value and their assessments of risk as

investors, lenders and commercial counterparties.

- As treasurers, are you prepared to transition your role as risk rating guardians and risk managers to fully incorporate ESG?

- Becoming more consumer driven. The

competing idea to single-payer, government-supported healthcare is a more consumer-driven

approach, allowing patient choice, price transparency to improve pricing efficiency

and service along with market competition. Healthcare services would then much

more resemble retail and hospitality businesses, with more emphasis on point of

sale payments, merchant services and customer experience. But also resembling businesses

offering big-ticket purchases, with different ways to finance the purchase. And,

of course, these businesses are already further along in being affected by

digital disruptors. What separates healthcare providers from these firms is

that they will be at the vanguard of so-called value-based payments, where what

you pay is determined by the value received in terms of health outcome.

- What are some of the treasury and financial services responses in these other businesses that can help transform them in healthcare? How might they be adapted to a value-based payment model?

- Digital transformation and data as an asset.

Digital technology from wearables to remote diagnosis and delivery (virtual

healthcare) to data-driven and AI-empowered diagnosis and treatment plans, on

to provider finder and assessment, are all factors radically disrupting

healthcare. Yet, the biggest change on the agenda may be data, as the data that

can be sourced from healthcare providers is infinitely valuable to transforming

health care. Indeed, data is probably by far the most valuable asset in the

sector, and increasingly the most regulated as it pertains to personal and

vital information about your customers.

- How can finance leaders use data to help create more efficient care delivery, monetize data assets (or use them to secure cheaper funding), and pay patients for use of their data as a means to finance/pay for healthcare services?

- Changing workforce. The future of work in

healthcare is changing exponentially as support staff are scaled with supporting

digital technology and automated processes, robotic execution of procedures and

smart-machine diagnosis. All the above may favor the human interaction skills

in people roles over time. Plus, the potential for matching those in need of

care with caregivers via apps may subject more of healthcare to a gig economy.

- How should the funding and financial profile of a healthcare provider adjust to this sort of human resource change?

With all this, treasuries of health providers must also cope with funding and integrating roll-up acquisitions and consolidation to achieve scale, acquire new technology, talent and business processes. They must also allocate capital to invest in R&D and innovation to prepare for the ramping up of the digital disruption that is only now beginning.

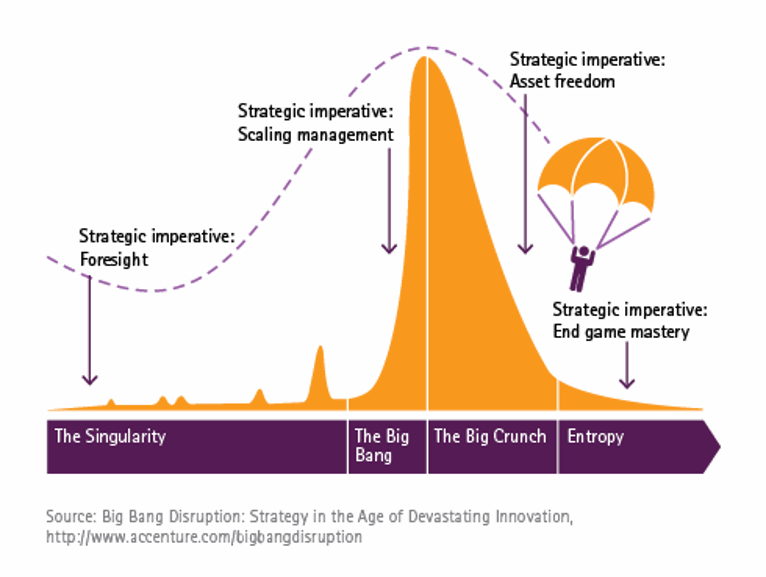

Healthcare services is about to enter the Big Bang phase of the Shark Fin model of industry transformation (see below)—it’s just a matter of how high the fin is allowed to go by government and regulatory control in every major global market, most especially in the US. These same forces will determine how much free cash flow these businesses will be able to generate in the future.

There’s no disputing that these are exciting, challenging and changing times for healthcare services companies and their treasury functions. If connecting with peers to share and learn about how to support successful transformation of this industry from a finance standpoint is valuable to you, then please contact us to inquire about the NeuGroup for Healthcare Services Treasury today!