Founder’s Edition, by Joseph Neu

NeuGroup member calls with corporate treasury leaders reveal preparation gaps.

Some NeuGroup corporate members—nonfinancial institutions—are well on track with planning to transition off Libor before the end of 2021. One company, Ford Motor, has even joined the Alternative Reference Rates Committee (ARRC), a group of private-sector participants convened by the Federal Reserve Board and the New York Fed to help identify alternatives to Libor and develop strategies to promote their use.

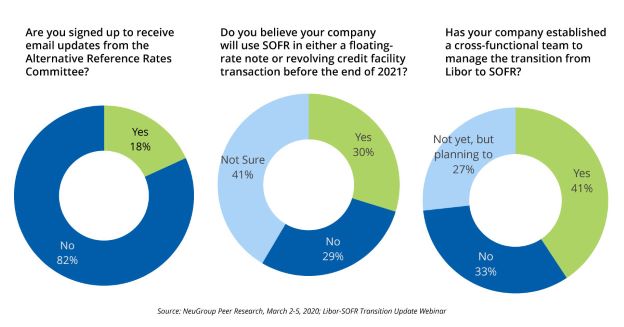

However, the majority of members have work to do, as revealed by polling on two conference calls last week with David Bowman, the Fed’s senior staff liaison to the ARRC. Altogether, we had 184 member participants from 91 companies on these calls.

- Teamwork. 41% of members have not yet established a cross-functional team to manage the transition from Libor to SOFR, the Secured Overnight Financing Rate the ARRC and the Fed are promoting to replace Libor. A cross-functional team to include participants from treasury, accounting, tax, legal and procurement, credit and collections and other business finance leads is seen as the first big step in taking the transition seriously. An additional 27% have realized this and are planning to put a team together.

- Information. By far the easiest preparation step is to sign up for the ARRC’s email updates. Just 18% of our members had signed up (before last week’s calls). Every week, the ARRC publishes a free email update with important information on the Libor transition. You can sign up on the ARRC home page: https://www.newyorkfed.org/arrc.

- A recent edition highlights an ARRC proposal for New York State legislation, as New York law governs most USD financial transactions, to deal with the permanent cessation of Libor that many contracts did not envision, which may also be difficult or impossible to amend.

- Timing. Although the phaseout of Libor is mandated for the end of 2021, liquidity is likely to shift away from Libor-referenced contracts sooner than that with a tipping point possible for many by the end of this year. As an example, Fannie Mae and Freddie Mac have said they will stop accepting adjustable-rate mortgages tied to Libor by the end of 2020. As soon as ISDA finalizes its fallback language protocol, expected for implementation in H2, liquidity in the markets for swaps and other rate derivatives markets will likely also tip away from Libor.

Time to get busy.