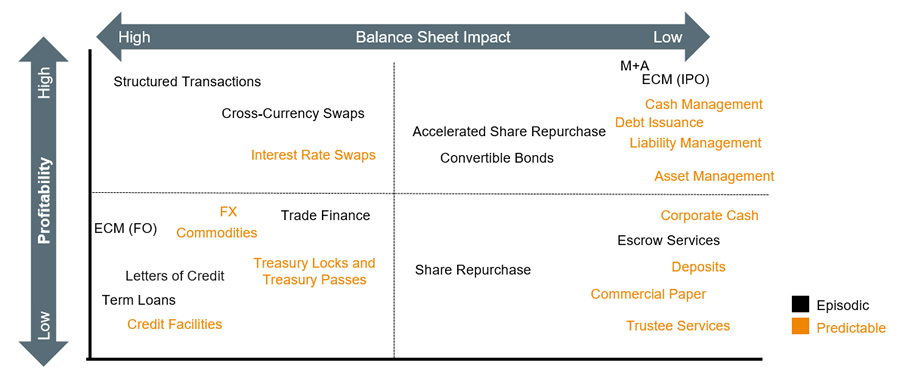

In good times and bad, treasury teams benefit from knowing how their banks look at the world. That’s one reason this chart, created by NeuGroup’s Scott Flieger, is compelling. It shows which products are especially important to banks by measuring both their relative profitability and how much balance sheet impact they have. A third dimension shows which products result in predictable revenue and which are more episodic in nature. Most members found the slide “directionally accurate” and helpful in explaining why banks have been more aggressive on some products versus others.

- Mr. Fleiger explained that FX revenue is important to banks because of its high level of predictability. And while “flow” FX business such as spot FX transactions may not be terribly profitable, it allows banks to demonstrate their competitive strengths and commitment to corporates. It may also increase their chances of being selected when more lucrative opportunities presents themselves, including FX transactions associated with cross-border strategic M&A.