D&I financing and investing activities at many companies are governed by informal guidelines.

New NeuGroup research reveals that 86% of treasuries do not have a formal policy to govern engagement with diversity firms, but a majority (54%) work within informal guidelines.

NeuGroup conducted the November 2022 survey in partnership with the National Association of Securities Professionals (NASP), Fitch Ratings and Sustainable Fitch. The responses came from members of NeuGroup for Cash Investment Managers, Pension Managers, Capital Markets and our extensive D&I working group.

Doing more, elsewhere. In interviews with respondents, the most commonly cited reason for not having a treasury-specific D&I policy is that the company believes it can make a more meaningful impact through other means, for example through direct community investment and hiring policies.

- “I am not surprised that many companies do not have a formal policy for treasury,” said one treasury executive. “We believe we can make a bigger impact through other areas of the organization, like HR and sustainability.”

- For example, after considering whether to invest cash in CDs at minority-owned banks, treasury decided investing directly in community projects will be more impactful, the member said.

Aligning with a corporate policy. Another reason for the absence of a treasury D&I policy is that many companies already have strong, enterprise-level policies that are cascaded down to different functions.

- “We don’t have a formal policy, mostly because there is an overarching corporate strategy, and treasury has to do its part,” said one respondent. “We do a lot in the treasury space,” he added, “but this is not the organization’s focus.”

- “We have a formal policy at the corporate level to promote D&I objectives,” another respondent said. “And our treasury team (capital markets, cash and pension investment) has done a great job being able to participate.”

A pragmatic constraint. Finally, particularly in the pension space, the selection of financial partners can be highly regulated.

- “We cannot set hard targets because of ERISA’s fiduciary requirements, which determine asset allocation and the qualifications of external managers,” one pension manager said. For example, firms need to have a certain number of years in performance track record, which prevents some of the smaller or newer ones from getting a share of the market.

- “It’s a chicken-and-egg situation,” added another member. “Managers cannot gain the track record because we cannot allocate them the business.” Yet, “despite ERISA, we ended up the year with 5% of our pension assets invested through minority-owned firms; we hope to see that share increase in 2023.”

A new phenomenon. While a formal policy is not a prerequisite for success, a documented approach has benefits. For example, absent a policy, “the risk is that when things change, for example during a recession, the initiative will fall down the list of priorities,” said NASP’s president and CEO Ron Parker. To this end, follow-up conversations with respondents revealed some are considering making their practices formal.

- “Our investment policy governs duration and asset classes, but not engagement with diverse firms. It would be good to incorporate it, but we struggle with how to do that,” said one cash investment manager at a company that does extensive business with minority-owned firms. For example, she said, “because our cash is growing so fast, it would be hard to put in place specific targets. They will get out of date very quickly.”

- A good way to build a policy is by connecting with peer companies that already have one in place. “We do have a policy that formalizes how we engage with diverse firms as part of processes and procedures,” one respondent said. “We have made some broad changes to it recently, and it now includes diverse firms as part of the evaluation of any new product or service; it has to be in the RFP. We also have a pre-vetted list of firms we can work with.”

- “We don’t have a quota, but it’s a formal part of our process of consideration in the cash and asset management space,” another member said. His company has recently looked to expand its mandate. “We interviewed diverse firms in the debt capital markets space, but we are at an early part of our journey. There’s a lot at stake, and we want to get comfortable with minority-owned firms before we make significant changes.”

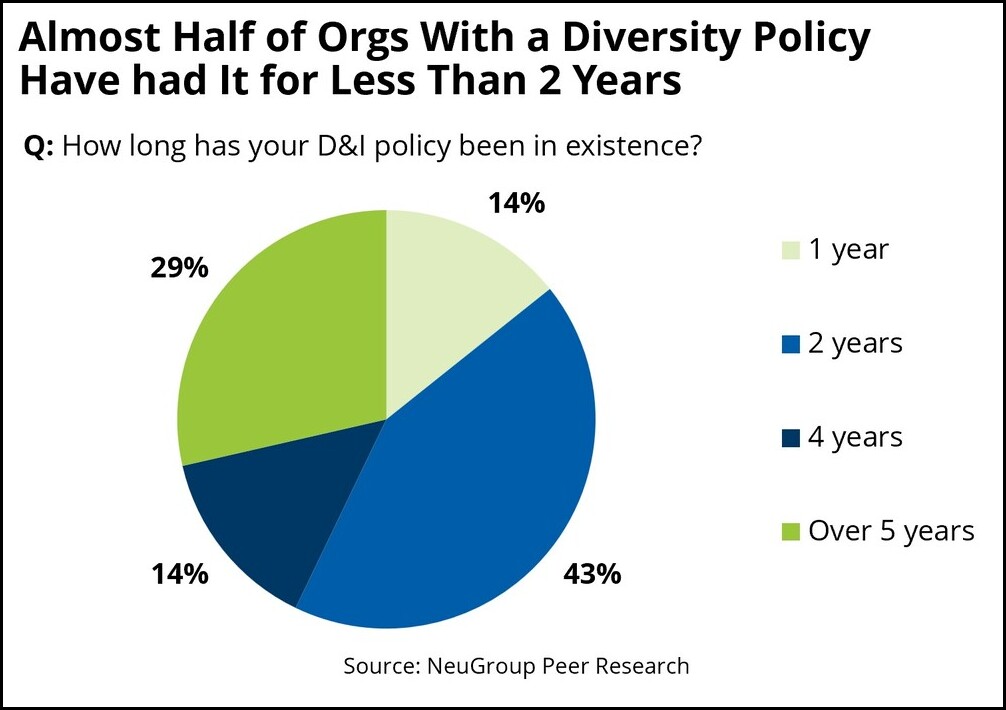

Early days. The scarcity of formal policies reflects the still-early stages in the evolution of treasury’s engagement with diversity firms. NeuGroup’s survey revealed that in over half the cases, when treasury has a documented policy, it has been in place for less than two years (see chart above).

- “I started working to expand our initiative four-to-five years ago,” one participant said. “But we only formalized the policy two years ago.”

- In another case, a policy was put in place three years ago, sparked by rising focus on ESG in general. “We wrote the policy to help clarify our thinking,” the member said. “The ESG and the D&I policies are one and the same.”

The right thing. “While treasuries may not have a policy for tracking engagement with minority-owned firms, they are doing it because it’s the right thing to do,” said Marshay Hall, head of communications and programs at NASP.

- That said, NeuGroup data shows treasuries use the same performance metrics to evaluate diverse-owned firms as they do with other underwriters and managers. “There is no special treatment,” a respondent said.