Using annuities to make 401(k) plans resemble pensions is compelling—but so far, most corporates aren’t doing it.

The vast majority of members of NeuGroup for Pensions and Benefits who also oversee defined benefit (DC) plans say their companies should consider solutions that help employees receive lifetime income after they retire. But few corporates are actually implementing so-called retirement income solutions. At least not yet.

- That key takeaway emerged at a recent meeting sponsored by Insight Investment and BNY Mellon that featured a presentation by Raytheon Technologies on its “Lifetime Income Strategy.”

Beyond target date funds. Many corporates have embraced target date funds as the default option for DC plans. These funds automatically and gradually shift the participant’s allocation from equity investments to fixed-income as participants approach retirement age.

- Retirement income solutions go a step further by gradually layering in annuity contracts provided by insurance companies with life and beneficiary features.

- The end result: As participants approach retirement age, their DC plan looks more like a defined benefit (DB) pension plan, but with liquidity benefits not generally available under DB plans.

- As NeuGroup Insights has reported, The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 cleared some legal impediments to offering more retirement income products, particularly annuities.

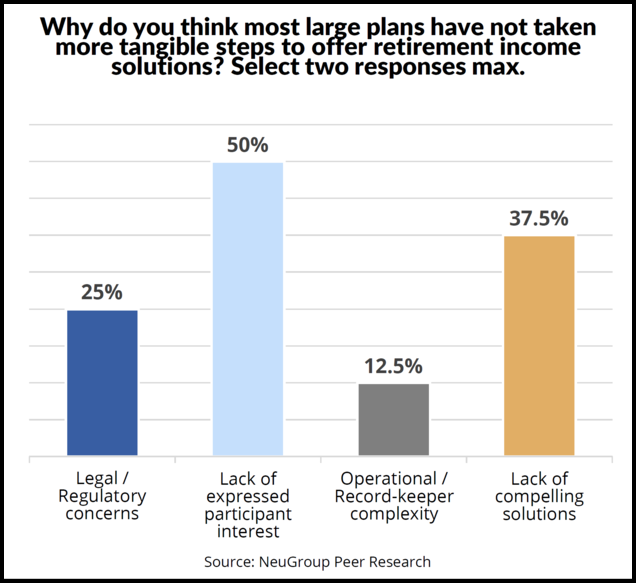

Slow to act. But while 85% of respondents at the meeting said in a poll that it made sense for them to consider offering retirement income solutions, responses to another question (see chart above) indicated that “lack of expressed participant interest” and “lack of compelling solutions” are reasons why most companies have not actually pursued this solution.

- One member of the group said that while the safe harbor provisions of the SECURE Act have made offering more choices feasible, the company’s legal counsel remains reluctant to give the green light.

- Bruce Wolfe, head of individual retirement strategy at Insight Investment, noted that United Technologies (now Raytheon) remains the only major DC plan “with a systematic retirement income solution embedded in the process.” A future NeuGroup Insights post will explain the details of the company’s Lifetime Income Strategy.

- He suggested that some companies see their role as limited to helping employees accumulate wealth while they work, and that going beyond that is not considered part of the corporate’s responsibility.

Benefits of better benefits. Among the reasons that more companies may adopt investment-annuity combinations in their DC plans going forward are financial benefits.

- The Raytheon presenter said, “What we’re doing for employees is going to raise the bottom line, noting the savings to the company for “everyone who retires on time.”

- He cited research by Prudential and the University of Connecticut in a 2019 study showing a one-year increase in average retirement age results in over $50,000 in additional costs for employers.

- This represents the cost differential between the retiring employee and a newly hired employee, largely because of higher healthcare costs for older employees.

- And NeuGroup’s Roger Heine, who helped moderate the meeting, said that “it’s clear that providing better DC plans will promote the hiring and retaining of talented employees.”