More companies are moving to streamline their payments and collections with on-behalf-of structures. Here are some lessons from the field.

(Editor’s Note—Original publication date: May 5, 2015)

Being a trailblazer is always nice but sometimes it pays to be the one who comes along next and learns from the trailblazer’s mistakes. And certainly, the more multifaceted the effort, the bigger the lessons learned. Such is the case with corporate payment and collections, part of the growing importance of supply-chain management and global cash management in general.

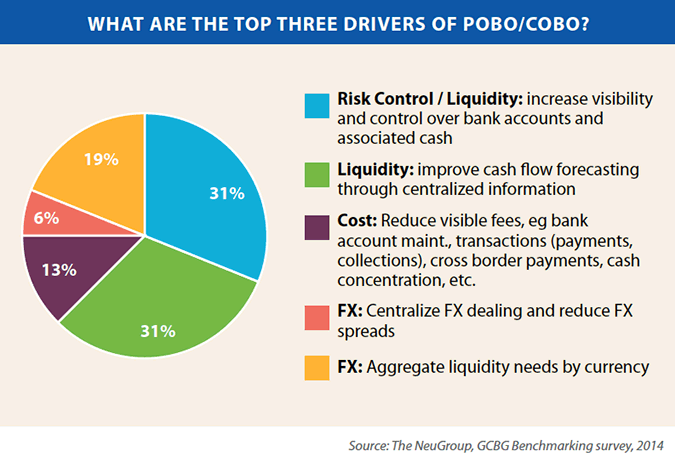

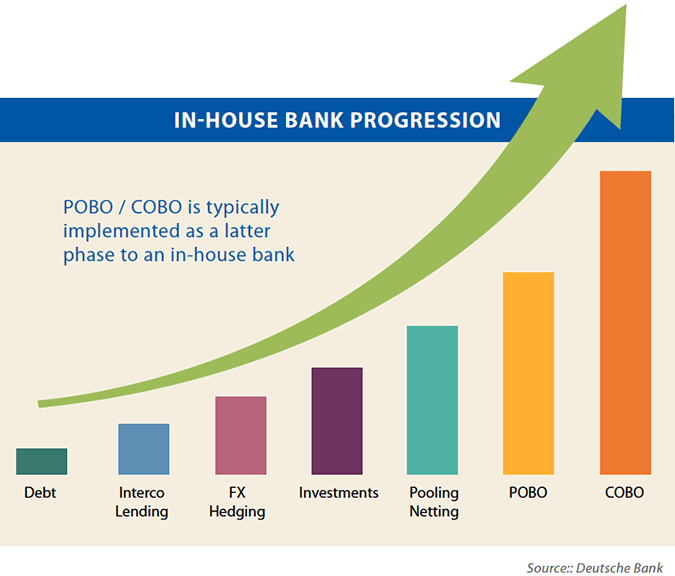

Corporates have long recognized the benefits of channeling payments and collections through a single legal entity via an on-behalf-of set up (POBO/COBO). They see reduced bank fees, simplified banking relationships, better operational efficiency and more control and visibility. Deutsche Bank has been one bank at the forefront of implementing on-behalf-of structures and has strengthened its product and advisory offerings in this area. iTreasurer asked Drew Arnold, Director, Trade Finance and Cash Management Corporates – Global Solutions Americas, Deutsche Bank, to explain some of the lessons learned in his experience implementing POBO/COBO structures. Mr. Arnold said that while all companies are different, there are some lessons that just about all companies can learn.

More Complex, More Benefit

One lesson that Mr. Arnold has drawn from years of helping corporations navigate the path to both POBO and COBO structures is that companies often shy away from them because they think their organizations are too complex.

Very often, Mr. Arnold said, he hears from companies that say, “We’re too complex” or “We have too many operating companies.” But what’s ironic, he said, is that “the more complex [a company is] the greater benefit they can get from an on-behalf-of model; that complexity shouldn’t be a hurdle to doing an on-behalf-of model.”

It will mean performing more due diligence, however, Mr. Arnold acknowledged. But for doing that extra legwork companies can get “much greater benefit than someone who has a more simplified organization. In fact, he said, if a company has a very simplified legal entity structure, “there might not be any benefit to doing an on-behalf-of model, or the benefits are so low they don’t justify the costs of doing it.”

On the other hand, if it does seem too daunting or perhaps the resources aren’t available for a full-blown POBO/COBO campaign, another route is to take it one country or one subsidiary at a time. If one country has a lot of legal hoops to jump through, Mr. Arnold said, then companies should consider moving on to a different country that’s easier to navigate. As for subsidiaries, they can also be added piecemeal.

“You don’t have to include one hundred percent of your legal entities in a structure to be able to get the cost-benefit equation that makes sense for you,” Mr. Arnold said. “If a company can include 50 percent [of its subs] in a structure, and they’re going to see great cost savings and efficiencies by including that 50 percent, that alone may justify putting in an on-behalf-of model.”

And then over time if it makes sense to include other entities or if regulations or market practice change in the previously bypassed countries, they can be added as they make sense. “So one hundred percent inclusion of countries or legal entities is not a requirement to be able to build a business case that justifies going ahead with an on-behalf-of model,” Mr. Arnold said.

Worth the Effort

Similarly, Mr. Arnold observed that many companies finish the POBO/COBO process and say that it was the toughest implementation they’ve ever been through. But, he added, no one who has gone through the set up ever regrets it.

“Many people say they were not aware of how long it would take,” Mr. Arnold added. They go on at length about all the difficulties, the challenges “not realizing how long it would take to put in service level agreements (SLA) between businesses or to define services or get the IT to work.” The challenges and work is definitely more than they expect, which is usually the case on any big project, Mr. Arnold said. “But then I always ask the question, ‘Knowing what you know now of what you had to go through to get where you are today, would you make the same decision?’ And they always say, ‘Absolutely.’”

This is certainly not something that one hears after many other large implementations, Mr. Arnold pointed out.

Welcome to Documentation

One of the more cumbersome areas in the work load—and one that Mr. Arnold said companies underestimate—is documentation. When companies use banks for payments and collections or they open an account, the bank provides the documentation that the client reads, signs and sends back to the bank. In other words it lays out all the terms and conditions and other relevant items.

“But when you go to an on-behalf-of model [now], that legal entity no longer signs all of its bank documentation, so instead of getting documents from the bank you now get them from the in-house bank,” Mr. Arnold said. “And the complexity is that there is no documentation that exists; it has to be done from scratch—SLAs, fee schedules (i.e. transfer pricing) and whatever it may be, because there is this arm’s-length relationship between the in-house and the legal entity. It’s sort of out-insourcing.”

Companies now have to do all this documentation on their own and between themselves, which can take time for a company to create. On the bright side, however, once the documentation is established the work is much less, but at the beginning it can be very complicated and time-consuming.

And again, Mr. Arnold said, it can vary by country which is one of the reasons bank documentation is so complex in the first place. “It’s not because we love complex documentation it’s just because of regulatory challenges in countries, and so now with an on-behalf-of model, companies have to take care of this themselves.”

Laying the groundwork

Like most big corporate projects, success depends a lot on the effort put in at the beginning. As Abe Lincoln famously said, “Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” And so it should be in setting up a POBO/COBO structure. Getting the right team together and including all the parties from the outset will make the job easier to do and lessen the headaches along the way.

POBO/COBO “is highly complex and touches on many different parts of an organization,” Mr. Arnold said, “from treasury, to payables and collections teams, service centers, tax, legal, and both at the global and regional levels as well.”

Of those parts of the company, Mr. Arnold stresses it is the tax department that often can prove most critical. That’s because much of a corporate’s global strategy includes tax—if not actually built around tax issues. “All global corporates have developed their legal entity structure with a lot of input from tax,” he said, “So when moving to an on-behalf-of model you have to make sure that whatever you do will not in any way endanger or call into question the tax and legal-entity structure of the corporation.”

Mr. Arnold added that he’s seen several instances where treasury gets excited about doing a POBO/COBO project and after spending a considerable amount of time on it, brings it to the tax department where it gets shot down. “Tax takes the position that it has things set up in a certain way and you can’t go changing things,” he noted. “But if tax is involved early on in the discussion and it hears from a third party about what other companies have done… it becomes a lot easier.”

Mr. Arnold also stressed that POBO/COBO should not be sold as anything more than “an efficiency play.”

“The on-behalf-of model is not set up for any legal entity or tax optimization strategy,” Mr. Arnold said. “It’s purely an efficiency play: efficiency of making payments, collecting payments, managing the company’s liquidity, reporting at the entity level for the correct legal and tax reporting. So it’s efficiency; it’s cost savings.”

It is also a risk mitigation tool because you have greater visibility and greater centralized control, Mr. Arnold added, so you have reduced risk and a greater view into counterparty risk. “Once tax sees that, they’re more receptive to it.” Another consideration of laying the groundwork is to consider making it a long-range goal. “If you think you’re going to go to an on-behalf-of model anywhere in the near future, or within 5 years, you have to put in the building blocks.”

When opportunity knocks

When is the best time to start the project? Mr. Arnold said it’s often best to embark on a POBO/ROBO project when there is another big project coming up or when there’s a bank change coming.

“If you’re going to go through some major bank changes due to acquisition or divestiture or because you’re moving businesses between relationship banks” then it can be good idea,” Mr. Arnold said. In an acquisition, for instance, treasury will have to open up new accounts, set up all new payment flows using the current set up in any case, so why not start up that new acquisition right away with an on-behalf-of model? “Why go through all the set up and then a year later… go to an on-behalf-of model? Why not combine them?”

Overall, what a company should do is clearly lay out the as-is structures and processes and then lay out the perfect-world scenario, or what Mr. Arnold calls “the blue sky to be.” And then break down that journey into phases. “Define the objectives very clearly in how they’re going to get there and put in that plan,” he said. “That plan might take multiple years to get to where they’re going.”

Strategic opportunity

POBO/COBO structures are increasingly recognized as an efficient way to manage global cash. Although the initial set up of such a structure requires close coordination with tax and other partners, the ongoing benefits thereafter are well worth the initial legwork. That’s because it allows to treasurers to stop spending time on some of the mundane tactical responsibilities, allowing them to focus on the strategic, which ultimately adds more value to the company.

Sponsored by Deutsche Bank