After completing finance transformation initiatives at two companies, one NeuGroup member shares keys to success.

Accelerating the finance function’s digital transformation is one of the leading priorities for NeuGroup members heading into 2023, as many corporates seek to overhaul outdated, tactical finance organizations and embrace a more strategic, forward-thinking mindset. But where do you start? For Aaron Bloomer, vice president of global FP&A at Baxter International, the answer was simple: FP&A.

- “I’m a huge advocate of outside-in thinking,” Mr. Bloomer said in an interview with NeuGroup Insights after presenting at a session of NeuGroup for Heads of FP&A. “Corporates can be insular. To be transformative, you need to see where you’re coming from and where you’re going,” which he said starts with FP&A taking the lay of the land.

- After previously implementing a finance transformation initiative at 3M, he was tasked with leading a large-scale transformation to modernize FP&A at Baxter in 12 months.

Straightening out priorities. After setting goals, Mr. Bloomer says the next step is to establish the priorities that will enable the company to achieve them. For FP&A, the five key transformation initiatives included:

- Planning and forecasting

- Reporting and analytics

- Standardization and operational rhythm

- Systems

- Master data management

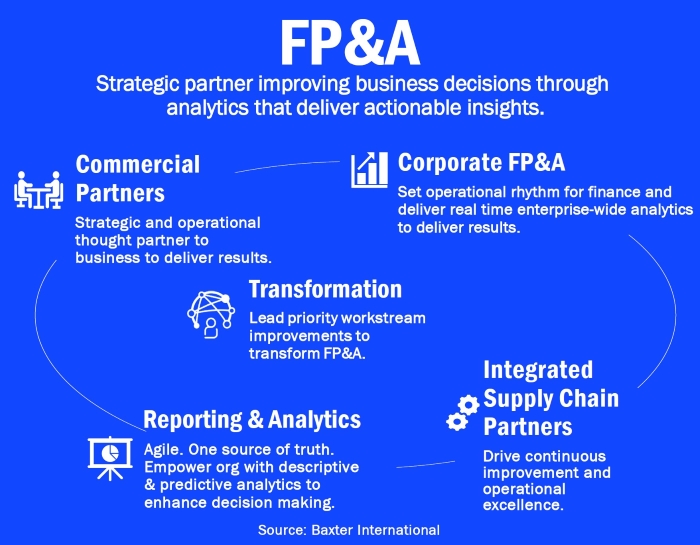

What is FP&A? The next task, Mr. Bloomer says, is to take a step back and think broadly about what FP&A is and can be across the enterprise, and how the company will rely on it as transformation continues (see chart).

- At the start, he said FP&A “was thought of as only the people who sit in corporate FP&A, so it wasn’t holistic; they had these positions like ‘plant controller’ or ‘local country finance’ in different regions that did FP&A tasks that were not actually thought of as FP&A.”

- “There are many groups that are part of our global FP&A community, and it’s important we’re all aligned to the same vision on how we deliver value and work together to unite everyone across the ecosystem,” Mr. Bloomer said. He set this vision as: strategic business partners improving business decisions through analytics that deliver actionable insights.

- He says FP&A is all about getting analytics at the fingertips of all employees within the company, not just reporting the numbers. Instead of leadership simply waiting on a report from FP&A, his team built constantly updating dashboards that function as a single source of truth, readily accessible by all employees.

- He’s also established a dedicated reporting and analytics team based out of India as an end-to-end digital reporting factory, driving adoption of digital tools across the enterprise.

- “A lot of times, FP&A teams are great at insights, but if you’re not influencing actions, you’re wasting time,” he said.

Splitting out, saving time. A key to supporting business partners, Mr. Bloomer said, is to remain agile and able to focus on the big picture, in part by pushing out time-consuming daily duties. “It’s important that each group works together but remains focused on where they can best add value to the company,” Mr. Bloomer said. “A lot of times, companies stick reporting or cash operations into FP&A or treasury, which is unreasonable.”

- Mr. Bloomer opted for a hybrid approach to cash, splitting out cash FP&A as an independent team that collaborates closely with treasury and corporate FP&A. “Now I have to make sure my FP&A person, my cash person and treasury are all synced up, but that creates an alignment, a bond,” he said.

- “A lot of organizations have forecasting in treasury or in corporate FP&A, and things just get lobbed over the fence and put into a black box, while 15 assumptions could change at any point; this better ensures the teams are synced up in real time and creates more focus on cash optimization.”

- He’s also separated out a dedicated strategic FP&A team from corporate FP&A that partners very closely with corporate strategy and business development on capital allocation, portfolio management, external markets, inorganic opportunities and analyzing long-term scenarios. This allows the corporate FP&A team to focus more on day-to-day operations.

- Even the company’s supply chain finance team ended up pushing out a number of tasks, standardizing the company’s process across all plants. He said the department was still doing all day-to-day transactional accounting activities “inside their four walls,” so is shifting activities into service centers and centers of excellence, leaving behind only value-adding business partners at the plants.

Three keys to transformation. During his experience heading transformation initiatives at Baxter and 3M, Mr. Bloomer has conceived three key tips to successfully bring finance teams into the future.

- Standardization. “People get excited about analytics, they get excited about automation, but if you don’t standardize your work, you will fail,” Mr. Bloomer said. “Get data in a usable spot—which doesn’t necessarily mean a single ERP for the entire globe, but a unified data integration layer, extracting data from multiple sources and dropping them into a data lake.”

- Speed. By starting the project with a 12-month target time, Mr. Bloomer was forced to make a strategic plan, which he said was key to its success. “It has taken about a year, and it’s been aggressive by design; we had to go fast,” he said. “Have things gone wrong along the way? Absolutely, but I’m a fan of ripping the Band-Aid off.”

- Lean structure. Baxter now collaborates with strategically placed centers of excellence in Poland, Costa Rica and India. “We’ve gotten our COEs to take on a lot more business partnering,” he said. “We’re setting up a one-to-one partnership, so the business team can go directly to the COE team, who is actually engaged. The structure directly relates to the five priorities.”