Willis Towers Watson weighs in on WACC, the efficient frontier and pension financing alternatives.

Pension fund managers evaluating alternative funding strategies should not necessarily use their companies’ weighted average cost of capital (WAAC) as a discount rate; the risks of the pension should be viewed differently than a normal project investment considered by the company.

- That was among the key takeaways from a recent NeuGroup Virtual Interactive Session sponsored by Willis Towers Watson, “Relative Value: Pension De-risking in a Post-Covid World.”

Example. Roger Heine, senior executive advisor at NeuGroup, illustrated the point: “The cost of paying an insurance company to accept risk transfer of low-balance participants above the participants’ strict annuity liability would be weighed against the present value of saved PBGC fees and other operating-type costs discounted at the company’s cost of debt.

- “This would be lower than its WACC, since saved fees and costs are essentially riskless.”

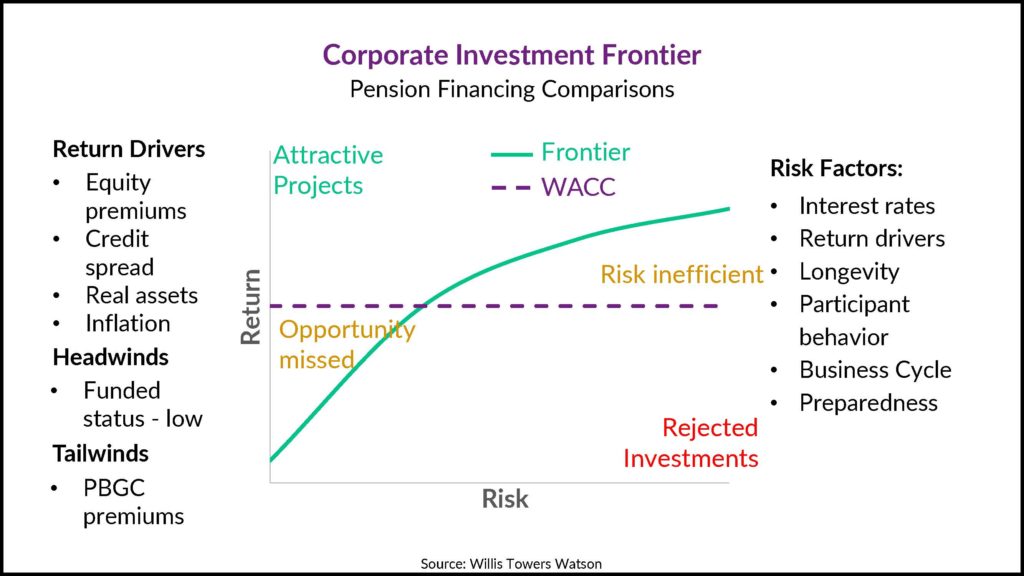

Risk and reward. Willis Towers Watson presented the graphic below to make the point that companies evaluating pension options strictly using the company’s WACC as the hurdle rate may reject investments and miss out on opportunities that are relatively low risk or may make investments that look attractive but are “risk inefficient.”

Speed matters. Companies should also be prepared to act quickly on different funding strategies because opportunities that arise can quickly disappear. Mr. Heine gave these two examples from 2020:

- The widening of corporate spreads in the spring meant that insurance companies would potentially reduce their cost to execute risk transfer of pension liabilities due to their ability to source corporate bonds at lower cost.

- The sudden decline in interest rates combined with a recovery in the corporate bond market meant that companies could offer lump sum buyouts discounted at higher average historical interest rates funded by corporate debt based upon current, lower rates.

- One member whose company considered this said the HR department opposed the move over concerns that recipients of the lump sum would spend it instead of investing.

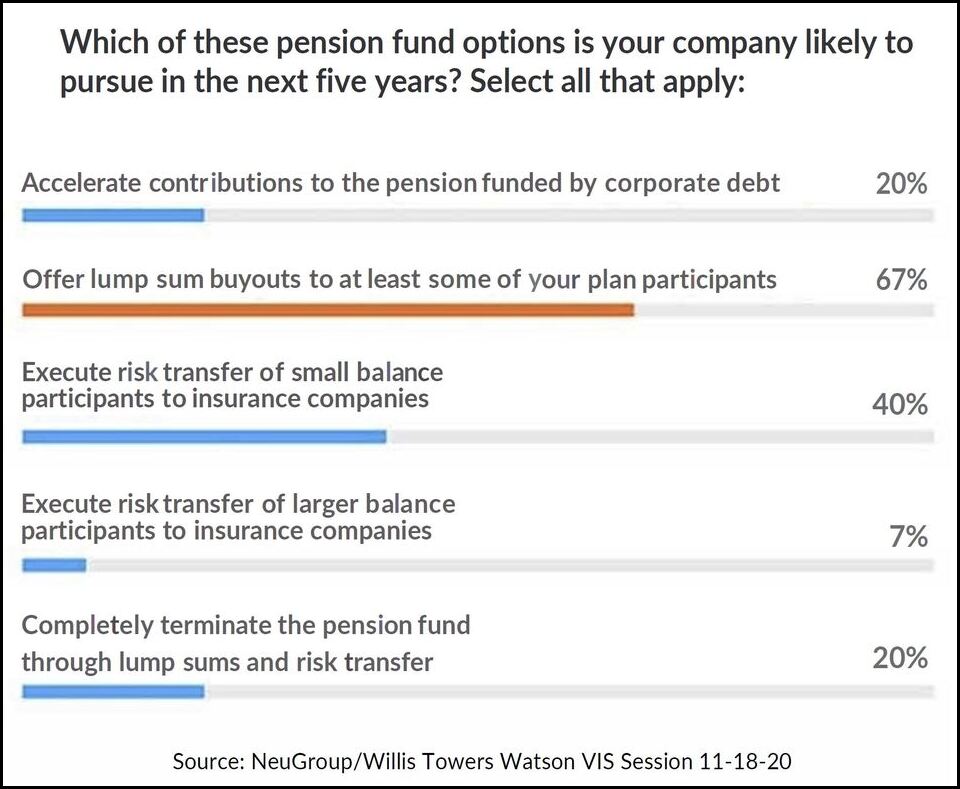

Debt and taxes. An in-session poll of members in attendance revealed that a large majority are not inclined to issue debt to fund the pension, with just 20% saying it’s likely in the next five years (see above). One participant did it right before tax rates went down under tax reform to capture the deduction from the contribution at the expiring higher corporate tax rate.

- “But right now, with 80% of participants thinking that corporate tax rates are going to increase in the next couple of years, it makes more sense to try to defer contributions until the tax rates rise,” Mr. Heine observed.

- “The possibility of further government funding relief also argues for deferring funding along with the fact that the recently rising stock market and tightening corporate spreads have returned many pension funds to the funding status where they began the year.”

- Participants in one breakout session agreed that creditors and the rating agencies view a pension deficit as less “debt-like” than straight corporate debt despite published metrics equating the two.

- Mr. Heine added that issuing corporate debt to fund the pension “secures pension creditors ahead of unsecured corporate creditors.”