Asia Treasury members discuss how advanced technology may boost satisfaction with forecasting tools.

A quick poll at a fall meeting of the Asia Treasury Peer Group sponsored by Standard Chartered underscored both the dissatisfaction of members with their cash forecasting tools and the intensifying scrutiny of cash positions by senior management since the beginning of the pandemic.

- None of the treasurers polled are highly satisfied with their current set of tools: 60% have low satisfaction and 40% said medium. All of the treasurers said they’re fielding more questions about cash from the C-Suite.

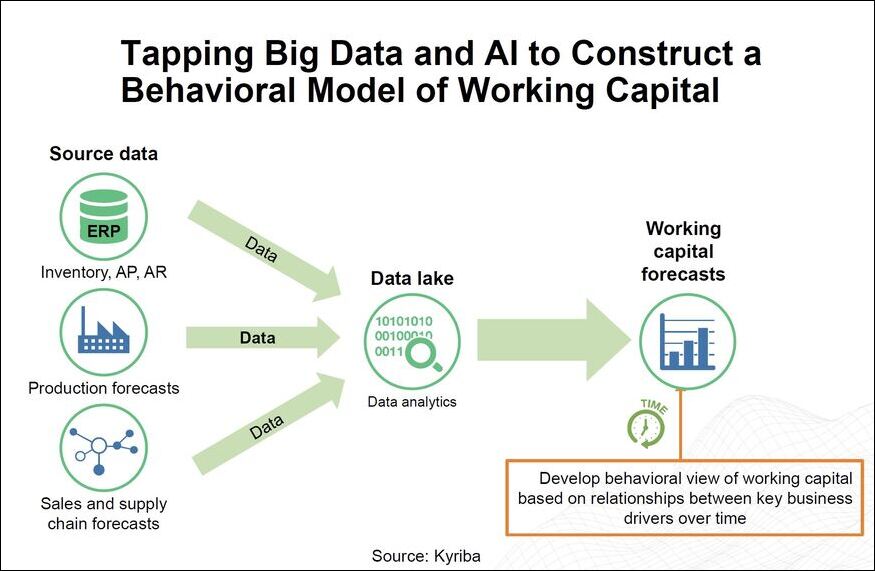

Building better tools. In a presentation by Kyriba arranged by Standard Chartered, members heard about the potential for big data, artificial intelligence (AI) and machine learning (ML) to “move treasury into true management of working capital” and improve the accuracy of cash forecasts.

- As the chart below shows, this vision for building a so-called behavioral model of working capital depends heavily on extracting huge amounts of data from a multitude of sources and collecting it in a data lake.

- ML allows the model to learn patterns based on innumerable variables—and the effects of one upon another—and then predict future flows with more precision.

- In breakout discussions, members discussed their data management challenges, including the need to standardize exogenous data before it is fed into a model.

Addressing the AR problem. The presentation included discussion of pain points experienced when forecasting invoice payment dates. “We do not know when our customers are going to finally pay their invoices,” read one example.

- Another said cash collection “is very blurry,” resulting in a “manual and time-consuming process” to build a cash position for future days, weeks and months.

- The presentation identified the value proposition as creating an automated process to forecast the payment date of each invoice.

- Using AI in pilot programs with two corporates, Kyriba said, helped reduce payment forecast variances from 25 days to five days.

Other use cases. In addition to forecasting invoice payment dates, the presentation identified these use cases for companies that use systems built with AI and ML:

- Assign budget codes to bank movements.

- Reduce manual cash reconciliations made by users.

- Detect payment anomalies compared to history.

- Detect abnormal FX transactions.

- Suggest financing request to suppliers.

- Forecast investment and debt.